After the revenue challenges that advisors faced in 2009 and 2010, coming off low asset levels from the financial crisis, the 2011 market offered advisors mostly mania: nosebleed highs and Prozac-worthy lows. The S&P 500 fell 20% from the end of April to the end of October, then rose another vertiginous 17% before falling again and ending the year flat.

Several trends emerged in this year's survey. For several decades, the flow of brokers breaking away from wirehouses has populated the independent broker-dealer universe, but following the financial crisis more of these people are opting to enter the RIA space and some are growing fast. In short, their presence in the RIA business continues to expand.

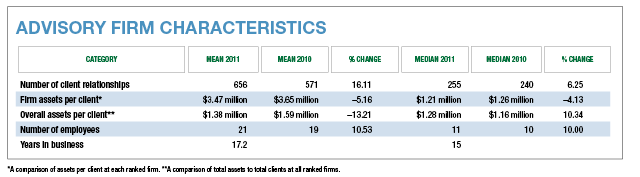

Another noticeable trend was the modest decline in assets per clients. With markets taking a wild ride but ending the year flat, more and more clients entering the decumulation and some firms seeking to grow partially by lowering account minimums, this shouldn't come as a major surprise.

All small businesses like consistency. But who would want to negotiate a hiring budget, schedule IT purchases or plan bonuses in a year like 2011, when trying to draw a picture of revenue is like trying to design Venice on a mud flat?

Still, some people welcomed the challenge. "Volatility creates opportunity," says Shannon Eusey, the CEO of Beacon Pointe Advisors, which saw its client roster grow by almost 40% last year. "We're big believers that if you wait patiently for opportunity, the market will give it to you."

"I think from a market perspective it really was a matter of managing client expectations," says William Cafero, a partner at RCL Advisors in New York, which saw 42% asset growth in 2011 to $1.245 billion. "I mean, last year wasn't dismal, but it was a pretty mediocre year in terms of capital market performance whether you look at equities or international equities relative to bonds. We get through periods like that because we spend a tremendous amount of time educating clients."

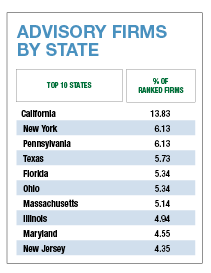

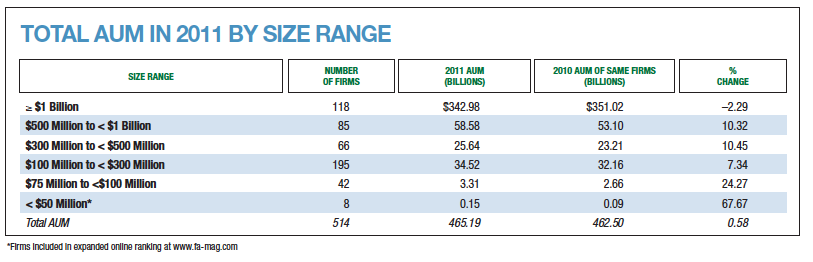

Some 400 firms in Financial Advisor's 2012 RIA survey saw their assets grow in 2011. Twelve of the 514 firms that participated in the survey saw growth of more than 100%. Among the fastest growing firms were Investmark in Stratford, Conn.; LeafHouse Financial Advisors in Austin, Texas; Greenspring Wealth Management in Towson, Md.; Corbin & Company in Fort Worth, Texas; Latitude Advisors in Vero Beach, Fla.; and Hartland & Co. in Cleveland. About 118 firms had a billion or more.

Sacramento, Calif., firm Hanson McClain saw asset growth of almost 70% last year, with asset per client growth of almost 45%. Much of the growth has come from shifting monies over from the shrinking broker-dealer side of its business, but lately the growth has become more organic, president Steve Burnett says. (The RIA side of the business reached $1.03 billion in assets as of May of 2012). That includes new business the firm is attracting from former wirehouse clients in Sacramento, Burnett says. A local radio show featuring company principals has helped prime the pump.

"This year is a unique year. We're actually on pace [in 2012] to do $160 million," he says, "and we saw this same type of phenomenon in 2003 after the three bad years of the market, 2000, 2001 and 2000. It seemed like there was a consumer freeze for a point in time, and I don't know if it was the 'deer in the headlights' shock-'I just want things to get better.'-And then 2004, 2005, 2006 were some of our biggest years because people went out and started challenging their relationships [with their existing advisors]."

A lot of those investors are questioning their overall allocations because of the poor performance in the markets, Burnett says. Many clients have been burned by structured products, he says-illiquid real estate and oil and gas exploration products, for instance. "If you have a $500,000 portfolio and somebody put $50,000 in some illiquid product that blew up, what was the incentive there?"

John Buoymaster, chairman and managing director of portfolio management at Hall Capital Partners, an investment company in San Francisco that works with high-net-worth individuals (as well as endowments and foundations), says his firm's assets under management rose by about $200 million to $23 billion for 2011. The firm has 130 clients.

"If we break that down," he says, "there was net new client assets of roughly half a billion and some market loss that offset some of the new client acquisition assets."

Katie Hall started the firm in 1994 after running a small hedge fund and working in mergers and acquisitions. She was approached by two high-profile wealthy families who needed help with investment and wealth management. The firm now manages money for the very wealthy-the same way the big college endowments do, Buoymaster says, which is best when the asset levels are $100 million or so. The firm also works with young executives still accumulating assets.

Robert Balentine, chairman and CEO of his own namesake firm in Atlanta, started taking clients in March 2010 and had reached $1.047 billion in assets by the end of 2011. His team started out in an RIA that was sold to Wilmington Trust in 2002 (Balentine was the chairman of Wilmington Trust Investment Management, overseeing $36 billion in assets). But the team decided to part ways with the mother ship again in 2009 to avoid the pressures they felt in a public company to meet earnings estimates, sell manufactured products and work commission. Clients told the team flatly they wanted advisors' own money in the kitty, mingling with their own.

"One of the lessons of the great recession is that people don't trust anybody anymore," Balentine says. "They don't trust the banks, they don't trust the large brokerage firms and I think they're seeking independent models. I think at the end of the day, if you listen to your clients, they'll tell you how to run your business."

The firm has 25 employees, and seven members on its investment strategy team. Balentine says the firm's strategy now is to act as an "outsourced CIO" to endowments and foundations. But the firm has also seen a windfall from entrepreneurs selling their operating businesses and liberating their liquidity.

"I think, given the headwinds facing the economy in this deleveraging cycle," Balentine says, "a lot of larger public companies that can't achieve topline growth are looking for acquisitions. So there's been a big pickup in the M&A cycle." That means liquidity events. And anticipated tax changes make it imperative to start thinking about taking capital gains now, he says.

Still, no matter how shipshape and Bristol fashion an RIA is run, 2011 was a challenging year for the markets, especially for firms depending on higher asset levels for their income.

"Your revenues go down," says Balentine. "You hope that you're able to bring in enough money to offset that. But quite frankly we've had pretty good investment performance. Our clients aren't coming to us to get rich. They already are. Our goal is to catch 80% of the market upside and lose only 40% of the downside."

He says that in 2011, the firm's performance was basically flat. The firm went into the year with a cautious stance; it started at 15% cash going into the year and a 10% allocation to gold, which the firm sold off in February 2012. "We were underweight fixed income, which turned out to be a bad decision, because interest rates continued to go lower." He said the firm also had an allocation to hedge funds (funds of funds, mainly) as well as MLPs and natural resources and inflation-linked bonds. But he says the firm made up with outperformance in the beginning of 2012.

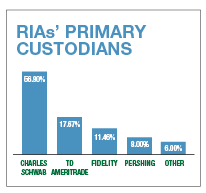

Meanwhile, Beacon Pointe Advisors in Newport Beach, Calif., a wealth management firm that also does financial planning, saw its assets rise by more than $500 million to over $4.5 billion by the end of 2011. The firm, says Shannon Eusey, was formed in 2002 by a group of broker-dealer reps and institutional asset managers who thought they could bring institutional investment advice to high-net-worth clients. Eusey says the recent growth is partly due to the momentum the firm has seen getting referrals and being discovered on the Internet. But Beacon Pointe has also spent hundreds of thousands of dollars on marketing, focusing on the referral networks of Schwab and TD Ameritrade advisors.

"We had never hired outside advisors to market our business to go out and sell our services," she says, "so over the last couple of years we've hired breakaway brokers to go out and market and to get our name out there within the community, and that's why you've seen a pretty big jump in the number of clients."

The company has also acquired two firms in the past year (one in San Jose, one in Scottsdale, Ariz.) and plans to make more in the future if the cultural fit is good. For its investment platform, the firm prides itself on finding diamond-in-the-rough asset managers.

"What we have found is that managers that aren't on the large wirehouse platforms and that can't be found in the databases tend to outperform over time," Eusey says, "so we're really looking for that undiscovered manager." She likes firms that are a little bit "quirky"-investment wonks who don't care about what goes on in the index and don't even necessarily like dealing with the clients (which would be Beacon Pointe's job).