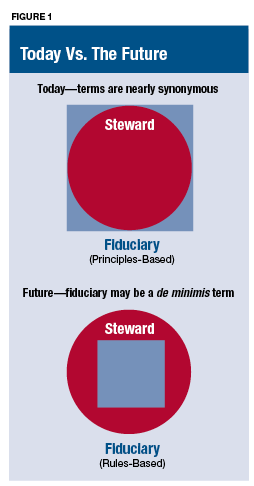

What's the difference between a fiduciary and a steward? Which defines a higher standard of care-a fiduciary standard or a stewardship standard? Will the answer to the last question change if or when the SEC imposes a uniform fiduciary standard of conduct?

I have always defined a fiduciary as a person who has the legal, moral or ethical responsibility for managing someone else's assets. I have defined a steward in a similar way, with the emphasis on morals and ethics. What both terms have in common is the concept of service to others above one's self-interest. The concept is based on principles.

Rarely have I used the term "steward" in my writings, though, because I viewed the two terms as synonymous. But that perspective is about to change.

I believe the SEC will soon define a uniform fiduciary standard of conduct; however, instead of a standard based on principles, we may have a standard defined by rules. A de minimis standard. A bare minimum in which morals and ethics-requiring a financial professional to have the quality of discernment-will be stripped out of the definition.

That means in order to obtain industry consensus, we will need to define the sharp edges and corners of what will become the fiduciary box.

In the mid-'80s the best practices associated with a fiduciary standard were just beginning to take shape. Practices we take for granted today-procedures for conducting asset allocation studies, the preparation and maintenance of investment policy statements, and due diligence and monitoring procedures for investment managers-were being incubated by a handful of investment consulting firms. Regulators, SROs and industry associations didn't pay much attention to the work we were doing, so we were pretty much left alone to "set the bar"-and we set it high!

But I'm afraid that SEC and Department of Labor efforts to subject more people to a fiduciary standard are going to lower the bar. Nobody agrees about how to offer a safe haven to wirehouses, broker-dealers and insurance companies that might find themselves engaging in prohibited transactions unintentionally. That uncertainty is the root of the problem. We will need to narrowly define procedures so that firms with complex capital markets products and services can fence off their fiduciary advisory services.

So instead of the "fiduciary" concept being the gold standard, it may represent the bronze. Instead of a standard based on the careful discernment of facts and circumstances, we may have only a series of checklists:

"Are you a fiduciary?"

"Yep."

"Check."

The concept of stewardship, on the other hand, is global and as old as the written and spoken language. Whether we are studying the ancient writings of the Greek or Roman philosophers, or the indigenous wisdom of American Indian tribal leaders, the concept remains the same. It could be said that stewardship is part of our genetic makeup-a DNA all people have in common.