As the proprietary trading desks of large global banks are being shuttered to gratify public scrutiny, more pressure than ever is being put on the private wealth management groups of large banks to prop up falling revenue. Against that backdrop, the ultra-high-net-worth (UHNW) market has become the Holy Grail for private banks, multifamily offices and independent RIAs.

But creating strategic plans and market approaches is difficult because of the opaque nature and fierce competitiveness of the UHNW market. Having a good strategic plan that is tightly focused on wealth segmentation and geography is critical to survival and prosperity in this market.

The Global UHNW Market

Wealth-X estimates that there are around 185,780 individuals worth at least $30 million around the globe. North America has the highest concentration of UHNW individuals, followed by Europe, the Asia-Pacific region and Latin America. North America is populated by 62,950 individuals who account for 33% of the world's total UHNW wealth, which stands at about $25 trillion. Even though the Asia-Pacific region is the world's fastest growing UHNW market, it still has not topped Europe's 54,325 UHNW individuals, who account for $6.8 trillion in wealth.

The Asia-Pacific region is home to 42,525 UHNW individuals who possess $6.2 trillion of total wealth. The nearly 15,100 UHNW individuals in Latin America, with $2.3 trillion in assets, are a group that's only a third of the size of the Asian market, but Latin America's rising UHNW market has captured the attention of top global multifamily offices and private banks. The top four regions with the highest number of UHNW individuals offer the highest density and concentration for private wealth managers keen on establishing a global presence.

The Ultra Wealthy And Super Wealthy

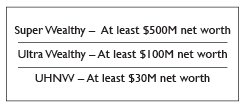

Moving beyond the UHNW market, Wealth-X defines those with $100 million in net worth as "ultra wealthy." Wealth-X estimates that there are about 52,800 individuals globally who can be categorized as ultra wealthy, collectively worth $17.2 trillion.

The top cohorts, or the super wealthy, have an individual net worth greater than $500 million. There are 4,680 super wealthy individuals around the world who together have more than $5.4 trillion in assets, according to Wealth-X.

The U.S. UHNW Market

The U.S. is the largest UHNW market, representing a little less than one third of the entire market. It is critical that private banks, multifamily offices and RIAs consider state UHNW populations when allocating resources and laying out strategic plans.

A total of 57,860 UHNW individuals reside in the U.S., each possessing an average net worth of more than $30 million. Their aggregate net worth surpasses $7.6 trillion. It is no surprise that California, with its size and robust wealth-generating clusters such as Silicon Valley, leads the North American charge with 10,390 UHNW individuals. New York follows close behind with 8,215 UHNW individuals. Both states combined represent a third of the overall UHNW market in the U.S. Texas comes in third with a UHNW population of 5,550, while Florida is fourth with a UHNW segment consisting of 3,615 individuals. Texas and Florida collectively represent close to 16% of the total UHNW market in North America. Illinois ranks fifth in the Wealth-X rankings with an estimated population of 2,680 UHNW individuals. When merged into a single quantity, the top five states represent more than 50% of the nation's UHNW wealth.

David Friedman is co-founder and executive vice president for strategic development for Wealth-X, a provider of qualified prospects and intelligence on ultra-high-net-worth individuals.