Fed likely on hold this year

The Fed appeared itchy to raise rates until recently, following its initial move off the zero bound last December. However, the cortisone of an weak May jobs number and Brexit in our view is likely sufficient to scratch that itch for the remainder of this year.

Clearly, given that the Fed has only raised rates once so far—and further hikes could be off the table this year—this cycle appears to be setting up to be an extremely slow one (or perhaps even a “one-and-done” cycle in the near-term). As we highlighted in the beginning-of-year outlook, slower rate hike cycles were historically rewarded by stronger stock market returns relative to faster cycles.

There are risks associated with Fed policy: that the Fed gets behind the curve if economic growth and/or wage growth and inflation heat up, or it misreads a much slower economy and continues to signal rate hikes ahead. Ideally, we have a “Goldilocks” scenario with economic growth not too hot and not too cold, but that could be elusive longer term.

Awaiting earnings growth

Another stumbling block for U.S. equities is at least slightly elevated valuations (depending on the metric) alongside still-negative corporate earnings growth. Low interest rates and inflation continue to be supportive of higher-than-median valuation levels, but investor patience will likely wear thin if earnings growth doesn’t move into positive territory, which will be less likely if the dollar’s recent strength persists.

One other factor is the presidential election. Election years historically have generated solid average gains for U.S. stocks, but this is not a typical election year. Voters are choosing between two of the least-popular candidates in history and it is also an “open election.” President Obama is only the fifth president to make it to his eighth year since term limits went into effect in 1953. As such, there are no incumbent candidates in the race.

Interestingly, year eight has been the worst of the election cycle, with a median decline for the S&P 500 of 6.6% since 1953 (the worst year of the eight). “Presidents’ lack of incentive to stimulate the economy for re-election has dampened returns…stimulus has been much less in the back half of second terms,” notes Ned Davis Research, which compiles data on election cycles.

Hope on the horizon

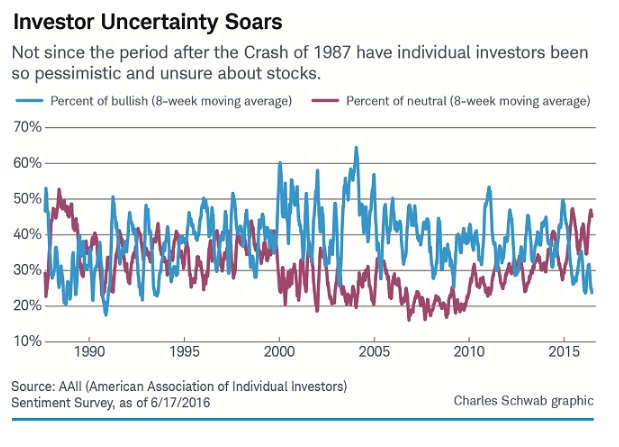

All is not lost. The dearth of investor confidence is one of the more positive indicators for the market looking into the second half of the year. As shown in the chart below, the American Association of Individual Investors (AAII) survey recently showed the lowest level of bullish sentiment in more than 10 years, and the highest level of neutral sentiment in more than 13 years.

Following occurrences like this in the past, the stock market generally had exceptionally strong returns a year later, with a consistent track record. The combination of very few bulls and very high neutrals is even rarer. In the post-1987 history of the AAII data, there were only five similar occurrences historically—all of which were within the 18 months following the crash of 1987. Here, too, the market was up more than 20% within the following year.

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Dazed And Confused: Brexit Contributes To Volatile Times

July 6, 2016

« Previous Article

| Next Article »

Login in order to post a comment