In the 1970s, the technology behind stereo cassette tapes had advanced so dramatically that a manufacturer asked listeners, “Is it live, or is it Memorex?” Forty years later, watchers of the stock market “tape” find themselves asking, “Is it real, or is it QE?”

In the 1970s, the technology behind stereo cassette tapes had advanced so dramatically that a manufacturer asked listeners, “Is it live, or is it Memorex?” Forty years later, watchers of the stock market “tape” find themselves asking, “Is it real, or is it QE?”

We don’t have any doubts the U.S. recovery is for real. Nor do we doubt the recovery would have taken place in the absence of any QE. But we can’t dismiss the notion that QE’s effect on the stock market is anything other than substantial. We’ll only know for certain when (or if) QE is finally and completely withdrawn, but for now the background hiss of “Memorex” is a bit more audible.

Let’s set aside valuations, money printing, deficits and the looming entitlement disaster for a moment. (Why not? Everyone else has.) From the perspective of pure price action, we find it more difficult today than at almost any time since March 2009 to find cracks in the bull market’s edifice. The only other period we can recall in the last four years, when the market appeared so uniformly strong, was in late April 2011, when the S&P 500 plummeted -19.4 percent over the next five months. Maybe when there’s little to worry about, then it’s time to worry.

During the last few months, we’ve pointed to a handful of technical divergences that historically have been the precursor to trouble. But today we’re almost at a loss, because October’s surge resolved almost all of these situations favorably.

Bear markets do not appear out of the blue. The crash of 1987 was not a one-day wonder; breadth and leadership began to collapse early that spring. Similarly, the March 2000 peak was preceded by an excruciating distribution period lasting almost two years. The topping process in 2007 was more compact, probably starting with the peak in the Financials in February—a full eight months before the Dow and S&P 500 peaked.

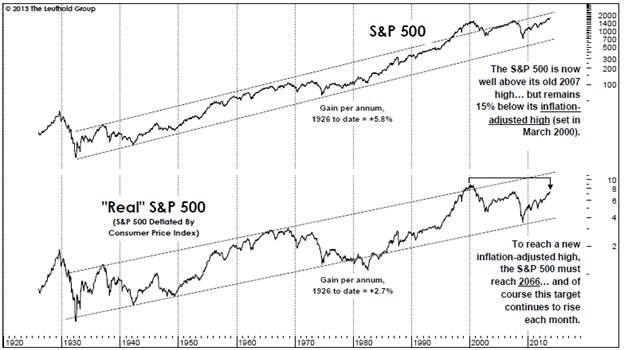

After October’s surge, we’re left wondering whether the topping phase of the post-2008 bull market has even begun. Whether a technical threshold or a valuation target, this bull market has met and then exceeded any rational objective. We’re probably pressing our luck, but there’s at least one longstanding fundamental threshold the S&P 500 market has yet to breach: the inflation-adjusted “real” all-time high of March 2000.

Today’s inflation-adjusted S&P high is 2066; assuming a rising CPI, this target rises a few index points each month. Four years ago (heck, just four months ago), we wouldn’t have envisioned a new high in the “real” S&P 500 was possible in the current cyclical bull market. We’re probably endangering the bull market’s life by even suggesting it, but the S&P is now so close (just 15 percent) that a late-cycle “overshoot” could easily get us there.

A new high in the inflation-adjusted Dow, on the other hand, is almost a done deal. This requires a month-end close above 15,995—only a few hundred points away. Again, this bull market has blown through nearly every logical objective we’ve established.

These “creative” central bank policies have challenged our own creativity.

Doug is the Chief Investment Officer of The Leuthold Group, LLC. He is a Co-Portfolio Manager of the Leuthold Core Investment Fund, and the Leuthold Global Fund. Prior to joining the Leuthold team in 2005, he was Chief Investment Officer of Treis Capital in Des Moines, Iowa, where he managed equity portfolios and published a quantitative equity research product, The Behavioral Strategist.

"Is It Live, Or Is It Memorex?

November 26, 2013

« Previous Article

| Next Article »

Login in order to post a comment