Key Points

- Stock markets have recovered much of the initial loss following the U.K. (“Brexit”) vote. Attention will likely start to turn more toward economic data and the second quarter earnings reporting season, which is expected to show some improvement from a weak first quarter.

- The U.S. economy appears to be showing modest growth, and we believe for now that any hit from the British turmoil is likely to be minimal. Market expectations for a Fed hike plummeted following the vote, but with financial markets stabilizing and a solid U.S. economy, those expectations may have gone too far.

- Meanwhile, Brexit and its aftermath is likely to increase uncertainty and volatility for some time. Despite this uncertainty, we remind investors that an allocation to international investments may help to mitigate portfolio volatility.

Focus returning?

For the past couple of weeks the financial markets have been dominated by the results of a vote from a country that represents roughly 4% of world gross domestic product (GDP) according to the World Bank, and roughly 0.9% of the world population according to Trading Economics. It’s certainly not insignificant but does put some things in context. Financial markets, after a violent reaction to the shock of the vote for the U.K. to exit the European Union (EU), are putting a little context around Brexit’s aftermath as financial instruments have rebounded and shown stability in recent days. Uncertainty regarding economic growth in the U.K. and the rest of Europe will likely be with us for the foreseeable future, adding another reason for volatility to remain elevated, but that doesn’t mean investors should hide in a corner until things become more certain.

The impact on the U.S. economy from Brexit/EU-related uncertainty is likely to be via the confidence channels—both consumer and business. Although consumer confidence here in the United States has been slightly dented, we see continued supports for consumer spending, including low interest rates, higher wages, better housing data, and a healthy employment picture. From a stock market perspective we continue to hold a neutral view on U.S. equities and suggest investors use volatility to rebalance around longer-term strategic allocations. Volatility will continue to elevated but at this point we believe the U.S. economy should continue to show modest growth, helping to support similarly modest gains for equities.

U.S. economy ok, but will corporate earnings improve?

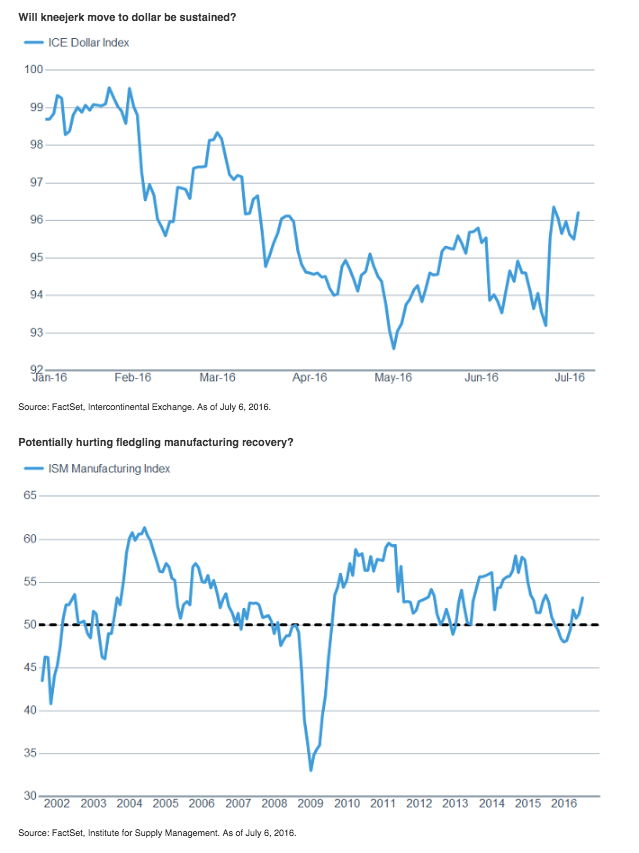

Will the uncertainty in Europe push companies to hold off on capital investments or hiring? Will the potentially stronger U.S. dollar have a negative impact on the fledgling recovery in the U.S. manufacturing sector? We’ll start to get an initial view on those questions in the next few weeks as second quarter earnings season ramps up. The results are expected to show some improvement from a weak first quarter, but those announcements may be taken with a grain of salt because they occurred “pre-Brexit.” More interesting will be any commentary we get from companies about plans that may have changed as a result of Brexit and what impact companies believe it may have in the United States.

As mentioned, manufacturing—representing about 12% of the U.S. economy—may be the most vulnerable. Hope had increased that the manufacturing recession was ending, illustrated by the Institute of Supply Managements (ISM) Manufacturing Index rising to 53.2 in June (well above expectations), from 51.3 in May. Manufacturing can be impacted negatively by a stronger dollar—possibly boosted by flight-to-safety flows—as it dents exports to other nations. Time will tell if that flight to safety we saw following the vote is extended, but for now it remains a threat to an already fragile sector of the U.S. economy.

Will kneejerk move to dollar be sustained?

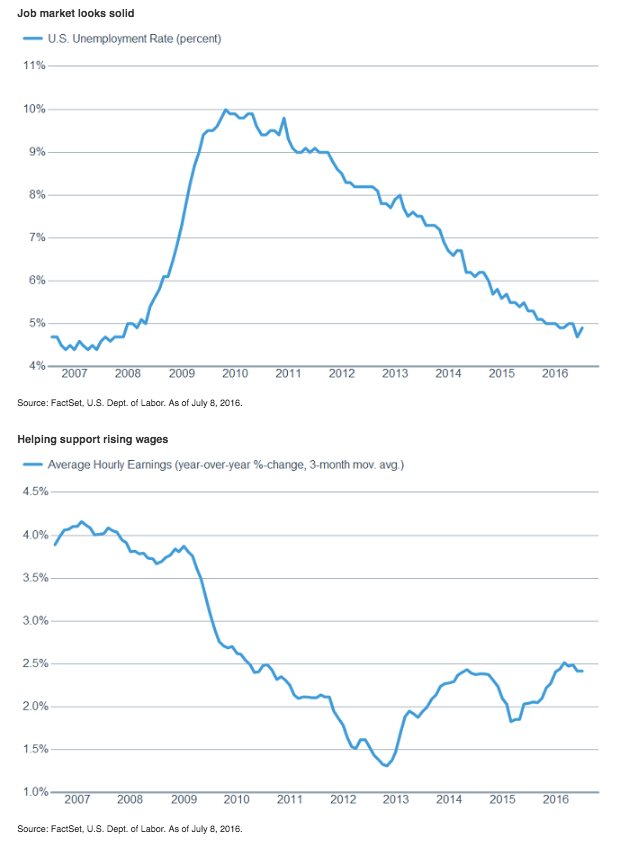

Positively, the much larger (88%) U.S. services sector continues to look solid as the ISM Non-Manufacturing Index rose to a strong 56.5 from 52.9, while the new orders component rose to a robust 59.9. Additionally, the U.S. consumer is in decent shape, with personal spending rising 0.4% in May on a month-over-month basis, after rising a robust 1.1% in April. These trends are likely to continue, supported by solid job growth and rising wages. After a disappointing May labor report, which was revised even lower, the June report showed a rebound by adding a solid 287,000 jobs, while the unemployment rate actually rose to 4.9% from 4.7% as the participation rate ticked slightly higher.

Additionally, average hourly earnings (AHE) showed continued firming of wages, rising 2.6% year-over-year. One additional note, an alternate measure of wage growth—notably the Atlanta Fed’s Wage Tracker, which eliminates the mix-shift problems embedded in AHE—has shown wage growth about a full percentage point higher than AHE.

Job market looks solid

Fed reversal and conventions ahead

Healthy job growth and the possible support to inflation from higher wages lead us to wonder if market expectations around Fed policy may have gone too far. The futures market indicates roughly no chance of a hike for the balance of the year; while rate cut expectations have come back in play. While we agree that the July Federal Open Market Committee (FOMC) meeting is likely off the table for a move on rates, we aren’t dismissing the possibility of a hike later in the year. A lot can happen in a few months and if financial markets stabilize, the job market remains healthy, and inflation pressures rise the Fed could look to move toward a more “normal” rate, while also giving it some room to act if/when the U.S. economy begins showing recession risks.

The political “fun” returns to the United States toward the latter half of July, with both major parties holding their nominating conventions—two of the more interesting in quite some time. Volatility related to the election could accelerate into the debate season as we all watch the two least-popular candidates in U.S. election history face off on policy (and personality).

Usually largely ignored by markets, the populist trend in the electorate is fueling more discussion and debate about global trade, currencies (and intervention), income divisions, and regulations; which could add to the volatility of markets as we ramp up the rhetoric to an even higher degree.