Still, fixed income remains critical to most investors as a potential source of steady income and a balance to the risks and opportunities elsewhere in a portfolio. But building your ideal bond exposure nowadays requires even greater skill and insight—and more tools—than in years past.

In the current environment of moderately rising (albeit still historically low) rates, we believe investors can do more to reach their fixed-income goals, while also better managing different kinds of risk, by using multiple sources of returns. A blend of bond strategies can and does make sense for delivering optimal results and targeting goals:

A flexible, or unconstrained, bond fund can seek out opportunity wherever it exists.

A total-return strategy is an ideal complement, providing an important offset to equity volatility and other market shocks and seeking to achieve optimized exposure to the leading fixed-income benchmark, the Barclays U.S. Aggregate Bond Index. A good total return strategy does this by seeking returns from as many different sources as allowed by its benchmark.

ETFs like iShares also play a role, allowing you to “own” the bond market affordably and tax-efficiently. ETFs also make good transition vehicles in that you can maintain exposure to the asset class and potential bond income while you consider what next to do with your money.

Using these and others funds (core bond, high yield, etc.) in tandem can help you pursue the returns and income you seek while potentially decreasing the market’s peaks and valleys through diversification.

At BlackRock, our goal is to find a little bit of income in a lot of places, thereby making a little bit of money a lot of times. Done consistently, we believe this offers fixed-income investors attractive risk-adjusted returns and steady income with fewer bumps along the way. Our suite of fixed-income offerings is designed to work together to achieve just that, and we believe we have the most integrated, durable and repeatable investment process, leveraging our entire global fixed-income platform.

What’s Changed?

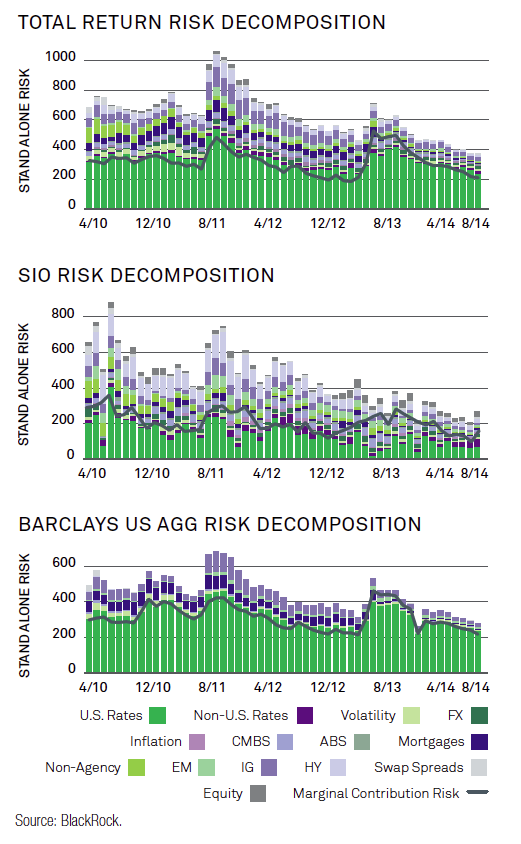

It also allows us a view of how that risk is evolving, and whether we are taking correlated risk and gaining diversification from our asset allocation.

Generating returns in fixed income is harder than ever. Interest rates are hovering at historic lows, and governments have pared back on issuing debt, therefore crimping the supply of new bonds.

Generating returns in fixed income is harder than ever. Interest rates are hovering at historic lows, and governments have pared back on issuing debt, therefore crimping the supply of new bonds.

The fixed-income market has indeed become more challenging. At a time when the income needs of investors have never been greater, yields have been sitting at historically low levels. That dynamic has led some investors to “overreach” for yield, and for that reason it’s necessary to understand the risks that may be embedded in your fixed-income allocation. Risk management is an integral part of the portfolio-running process at BlackRock, where we have highly sophisticated dashboards that give us an extremely high level of awareness surrounding the risks in our portfolios.

‘Total’ Solutions for Today’s Fixed Income Market

October 20, 2014

« Previous Article

| Next Article »

Login in order to post a comment