Thanks to the Internet, many people can now work where they want to live, as opposed to being forced to live where they work.

Many factors come into play in selecting that special place, and one of them is state taxes. Kiplinger compared income, sales, property, estate, gift and other taxes to find the states that are the most tax friendly.

The following are the 10 states that came out best in that comparison, listed in reverse order.

No. 10. Delaware

The First State is a standout among its East Coast neighbors with no sales tax and low property taxes.

No. 9. Mississippi

Mississippi is home to some of the cheapest property taxes in the nation.

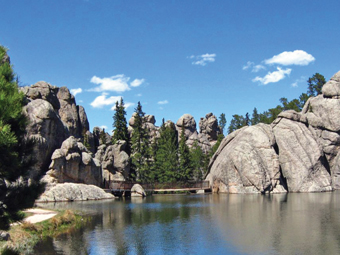

No. 8. South Dakota

South Dakota has no income tax and combined state and local sales taxes are below average for the U.S.

No. 7. Alabama

Property taxes in Alabama are the second lowest in the country.

No. 6. Louisiana

The Pelican State is homeowner-friendly, with property taxes the third lowest in the country and an average tax bill of less than $1,000.

No. 5. Arizona

While the Grand Canyon State does have an income tax, the rates are notably low: If you're a joint filer, you won't hit the top bracket until your income is over $300,000.

No. 4. Nevada

Nevada is another no-income-tax haven.

No. 3. Florida

The Sunshine State is well known for its absence of a state income tax and its property taxes are below the midpoint for the U.S.

No. 2. Alaska

In Alaska, not only is there no state income tax, but also the state pays residents an annual stipend, which more than outweighs the state's modest real estate and sales tax levies.

No. 1. Wyoming

The Equality State is the winner thanks to abundant revenues the state collects from oil and mineral rights.