2016 is likely to be a difficult year for investors. Read that sentence carefully. We think 2016 might be a difficult year for investors ... not necessarily for investing.

Our core theme of the past six years, that the U.S. may be in one of the biggest bull markets of our careers, remains intact. 2016, though, may be a year during which investors need blinders and earplugs to successfully invest.

The Presidential Election -- Be Prepared For A Wave Of Negativism

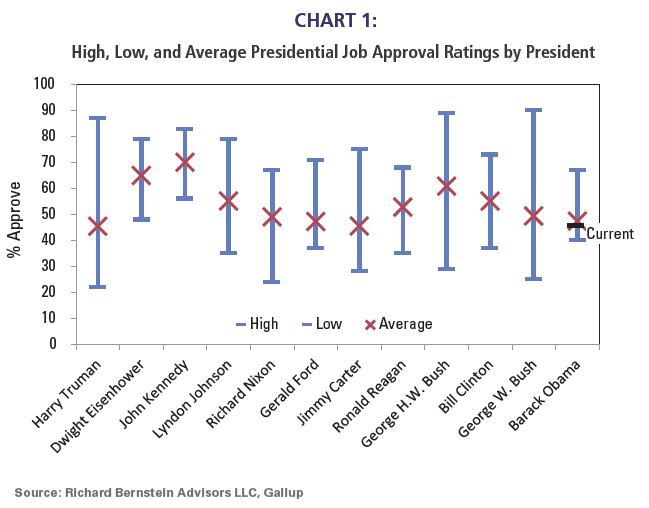

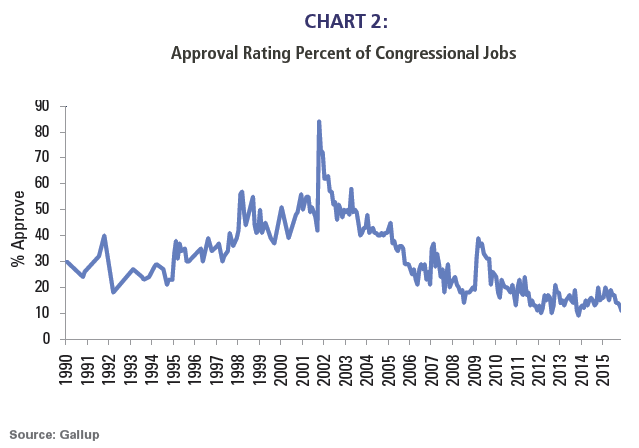

It seems certain that the eventual Republican and Democratic candidates for president will not run on status quo platforms. The current president’s approval rating remains low (see Chart 1), as does Congress’s (Chart 2), so the candidates will probably distance themselves from current policies. “Be scared, but trust me” is hardly a new or original campaign tactic, but given Washington’s historically low approval ratings, it seems certain that negative campaigning will be very loud.

Investors Must Be Dispassionate

Investors must remain dispassionate during 2016, despite the inevitable political fearmongering and consternation during the upcoming year. Taking advantage of misperceptions of U.S. fundamentals fostered by both parties’ campaigns could significantly add to 2016 portfolio performance. With that in mind, our “year ahead” report highlights some basic objective observations that show significant gaps between political perception and reality.

Could the economy be better? Of course it could. That’s not our point. Our point is simply that investors must always separate political propaganda from the true underlying fundamentals. The upcoming election could present significant investment opportunities if the campaigns (both Republican and Democratic) ignore the already improving trends of U.S. fundamentals.

The budget deficit -- better than normal. The budget deficit is much more cyclical than many investors realize. Chart 3 shows the budget deficit as a percentage of GDP (not scaling the budget deficit to the size of the economy is meaningless). During the last recession, the budget deficit expanded to 10% of GDP because spending was increasing and GDP was decreasing. Today, most investors seem unaware that the budget deficit has decreased from 10% of GDP to only about 2.5%, which is actually smaller than the long-term average. In other words, the deficit as a percentage of GDP is now better than normal.