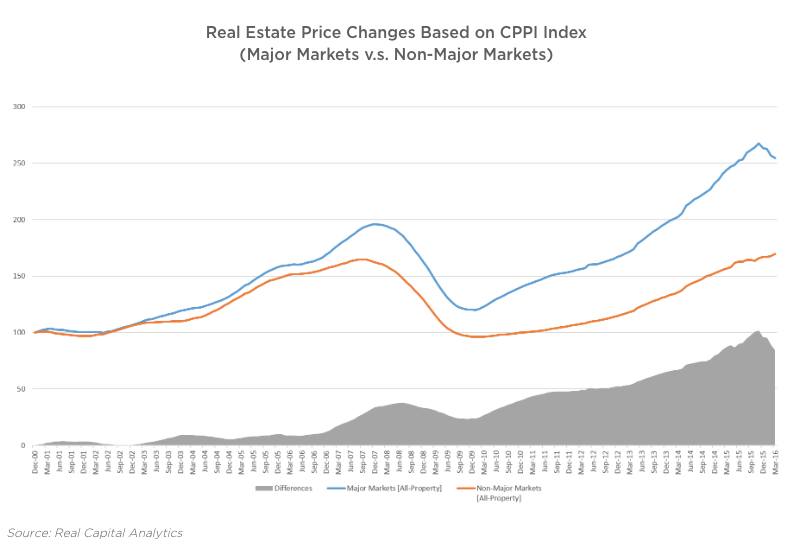

There is a perception that major markets — large urban centers with international appeal — are more stable and produce higher returns than real estate investment in smaller cities. Over the past 6 years, this has been a self-fulfilling prophecy. International capital has flowed into major markets, driving price appreciation of 112 percent since the market bottom in December of 2009. Over the same time period, secondary (non-major) markets have appreciated by 76 percent. But in Q1 of 2016, the trend began to reverse, with major markets declining while secondary markets continued to appreciate at an annualized rate of 6.4 percent.

Here's why we think investing in real estate in mid-sized cities will outperform investing in their larger siblings over the coming years.

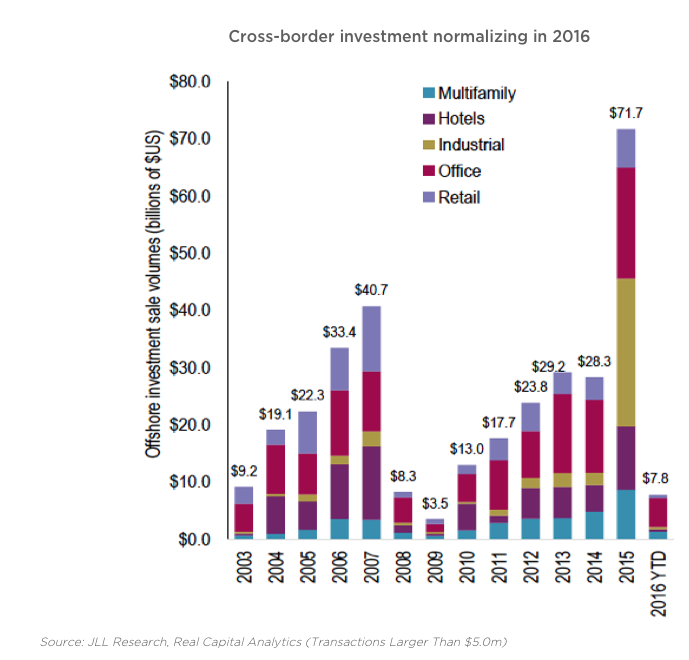

1. Foreign real estate investment in the US is retrenching to normalized levels. Following a record inflow of $71.7 billion of foreign capital into US real estate in 2015, foreign capital investment in Q1 2016 retrenched to $7.8 billion. This is comparable to the more normalized levels of foreign capital flows in 2013 and 2014, on an annualized basis, and it’s unlikely that 2015’s record inflow will be repeated.

Foreign investment is heavily focused on gateway cities like New York, San Francisco, Los Angeles, Boston and Washington DC, so gyrations in the level of foreign investment are contributing to volatility and reduced demand for property in these markets.

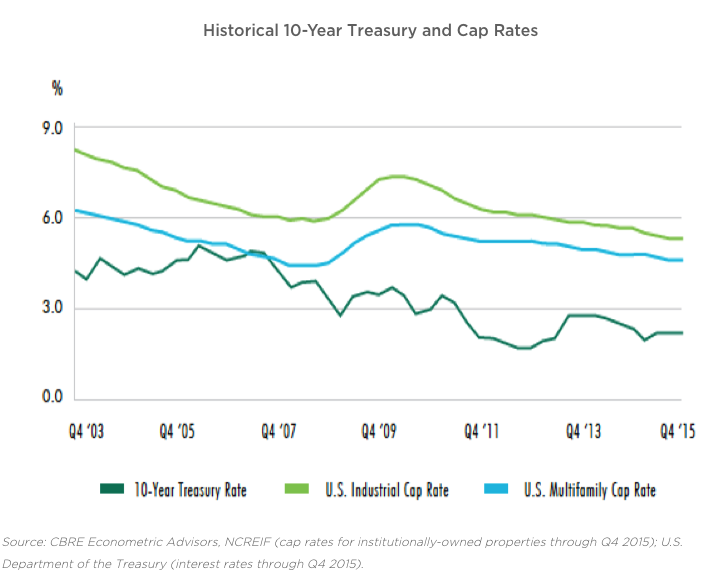

2. As cap rates fall, investors broaden their target markets to search for yield. Class A office and industrial cap rates have dropped below 6.0 percent, and multifamily cap rates are below 5.0 percent. Investors who had been focused exclusively on major markets now need to consider secondary markets in order to achieve their targeted returns.

3. New construction has focused on major markets, while mid-sized cities have seen limited increases in supply. Property values in many secondary markets are still below the cost of new construction. As a result, development activity in these markets has been limited, leading to lower vacancy rates and rising rents. Markets like Oakland, Nashville, and Salt Lake City now have lower office vacancy rates than Manhattan and San Francisco. Primary markets account for 56 percent of the office development pipeline, according to JLL, even though they account for well under half of total office inventory. This means that mid-sized cities with limited construction should continue to benefit relative to primary markets with increasing supply.

Mitch Wasterlain is the founder, co-CEO and CFO of CAPFUNDR, a curated marketplace for real estate funds specializing in providing institutional style investment funds to individual investors.