The price-to-earnings ratio is one of the most popular valuation metrics in the investing world. It is calculated by dividing a security’s current price by its earnings. As a general rule, a P/E of around 15 for broad stocks is the norm, though that figure can vary greatly by industry and depending on market conditions.

Many investors look to identify exchange-traded funds with P/E ratios below the industry norm, as those funds can be deemed “undervalued” relative to the market. It is a strategy that has been used for quite some time and remains one of the must frequently quoted fundamental metrics.

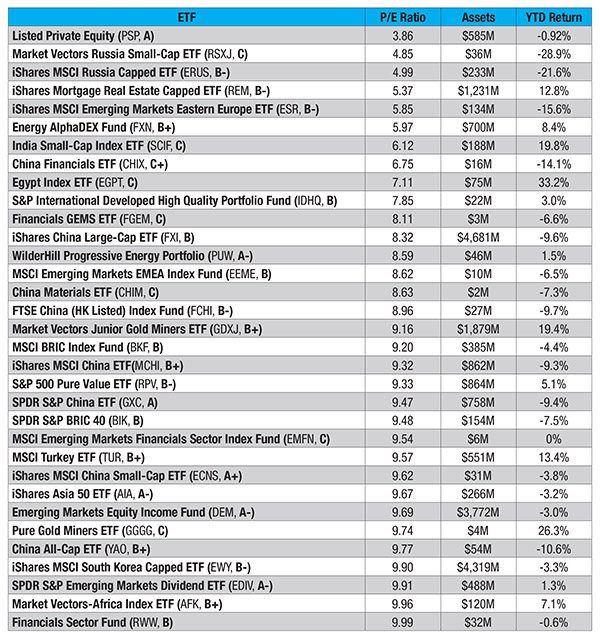

The SPDR S&P 500 ETF (SPY) has a P/E ratio of 15.24, setting the mark for a “standard” measure for other ETFs. We found 33 ETFs that not only have P/Es lower than that of SPY, but their price-to-earning multiples fall below 10 (includes ETFdb's letter grade for each fund):

The Bottom Line A low P/E ratio is not a “buy” indicator on its own, but rather a metric to help identify securities that may be undervalued.

Remember that a fund’s sector or industry must always be taken into account as well. There are some sectors––such as technology––that are known for having high P/Es, and some industries known for the opposite.

Finding a fund whose multiple is below the benchmark for its investment objective is a good jumping off point to find a prospective undervalued investment. Remember to always do your homework and use this multiple as one of many metrics and tools when it comes time for you to choose your allocation.

Jared Cummans writes for ETFdb, which offers a comprehensive and original ETF database and analytical consulting services for advisors and investors, as well as a free newsletter. Learn more about their services by visiting ETFdb.com. Disclosure: the author had no positions in the securities named in this article at the time of writing.