KEY TAKEAWAYS

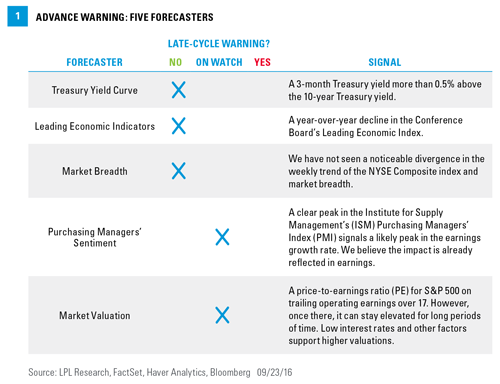

· Our Five Forecasters are collectively sending mostly mid-cycle signals.

· The Leading Economic Index, yield curve, and market breadth are all signaling the continuation of the economic expansion and bull market.

· Stock market valuations and the ISM Manufacturing Index are flashing some warning signs that are worth watching.

The Five Forecasters favor the continuation of the current economic expansion and bull market. The Five Forecasters are five indicators that, collectively, have historically signaled increasing fragility of the U.S. economy and a transition to the late stage of the economic cycle, with increased potential of an oncoming recession.

Although bear markets (defined as a 20% or more drop in the stock market) are not always accompanied by recessions, more often than not they come together. As a result, we believe these indicators can be used to give some advance warning of a bear market.

Currently, these indicators are sending mostly mid-cycle signals (similar to our Cycle Clock from our Portfolio Compass publication). Two of the five indicators are flashing yellow and suggest the cycle has moved past the midpoint, as we suspect, while three indicators are still benign [Figure 1]. Here we review these five indicators, which signal that this now seven-and-a-half-year-old bull market may continue.

Leading Economic Index: No Warning