When Herb Stein, chairman of the Council of Economic Advisers in the Gerald Ford administration, was admonished by his boss not to use the word "recession" to describe a recession, he complied, reluctantly. "From now on," he told a group of economic reporters, "I won't use the word recession. I'll say 'banana.' When I say banana, think 'recession'. I think we must be wary of the risks of a banana." I revisit the word “recession” (aka banana) this morning because after speaking at two events in Sarasota last week, and then The MoneyShow in Orlando, the word recession seemed to be on everyone’s lips. At The MoneyShow, I did a Bull/Bear debate with Peter Schiff in front of a few thousand attendees. Peter began talking about: 1) a recession/depression, 2) a bankruptcy of the U.S. government, 3) worthless U.S. dollars, 4) soaring debt to GDP, to name but a few depressing topics. After he got done, I said, “Gosh, I think I better leave and provision my boat with weapons, cans of food and gold,” I responded to his points:

1) I see nothing on the immediate horizon that suggests the U.S. economy is about to tip into a “banana.”

2) The only way the government goes bankrupt is if some disingenuous politicians shut down the government and it is forced to default on the debt. The government has taxing power and the ability to print money, so the odds of a bankruptcy are de minimis.

3) If you think your U.S. dollars are worthless, then give them to me! I’ll even give you back 50 cents for each dollar (a tip of the hat to our chief economist Scott Brown, Ph.D.).

4) Yes, the U.S. debt is high when you measure it on a debt-to-GDP basis, but I think that is the wrong lens. When I was a practicing fundamental analyst, I used to analyze individual companies by comparing assets to liabilities, not liabilities to revenues. Accordingly, when analyzing the U.S. debt, you should consider the country’s assets. I have no idea how much the Grand Canyon, Yellowstone, or Yosemite are worth, but when you line up the government’s debt with the government’s assets I am pretty sure the ratio is MUCH smaller than the debt-to-GDP calculation.

Of course many participants point to the pullback in the stock market and opine a recession is surely coming. However, that does not necessarily foot with history. As often stated, since 1968 the S&P 500 has had 10 bear markets (a 20%+ decline), but four of them were not accompanied by a recession. That said, I do not think we are in a bear market. I do think a number of stocks have declined enough to place them in bear market territory. In fact, one could argue the stock market has been going through an “internal correction” for seven months while a few of the index stocks have kept the indices elevated until this year. Indeed, this year the “generals” have finally retreated, following the “troops” descent into the netherworld. That, ladies and gents, is how bottoms are made.

Speaking to “bottoms,” we got the bottom last August right and chose to ignore the concurrent Dow Theory “sell signal.” We got the “rip your face off” Santa rally dead wrong and admitted it two weeks after making that “call” on CNBC; and, before the real carnage began at the start of this year. More recently, we got the “call” for a successful test of last August’s “lows” on February 11, 2016 right thinking a double-bottom was at hand for the S&P 500 (SPX/1999.99) and said we were expecting an upside breakout above the overhead resistance at 1950. After trying three times to best the 1950 level, the SPX broke out above that level and streaked towards our next target zone of 2000 – 2040. Part of the streaky action was due to short covering, but part of it is due to the budding belief among professional investors that there will be no recession. Certainly the D-J Transports are telegraphing “no recession” after a decline of 31.2% from their intraday high into their January 20, 2016 intraday low, the Trannies have rallied some 21% (see chart 1). As our chief economist (Scott Brown Ph.D.) writes:

Whether we are headed to recession isn't the right question. It's clear that economic growth has slowed (at least in the near term) and, while the economy is widely expected to expand at a moderate pace in the quarters ahead, the risks to the outlook are weighted predominately to the downside. The data do not suggest that we are in a recession. Leading indicators are a bit mixed, with a few flashing yellow, but most still green. Fears of a possible recession, economic weakness abroad, and election-year uncertainty may continue to fuel business caution. However, the consumer fundamentals are strong and household spending should carry us through (read the report here: A Field Guide to Recessions (updated)).

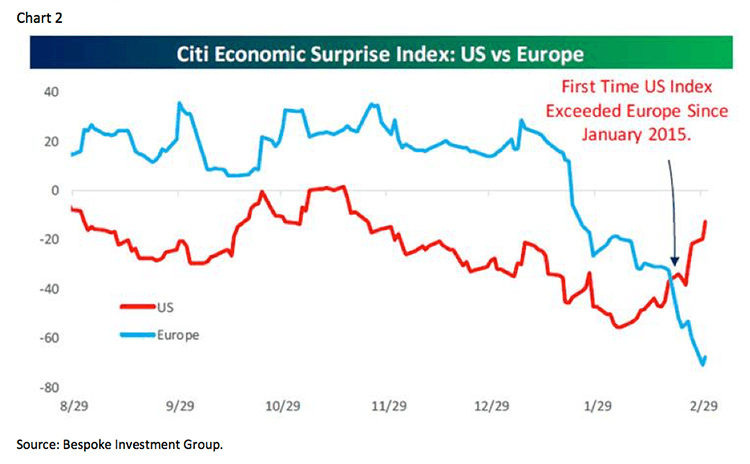

I would also point out that most of last week’s economic reports came in stronger than expected, an event that has been telegraphed by the Citi Economic Surprise Index since late January (see chart 2).

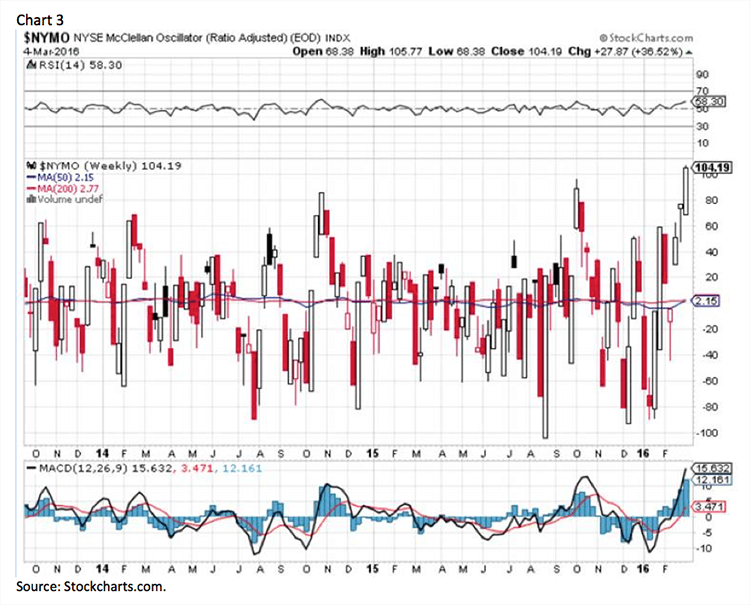

Turning to the near-term direction of the equity markets, in a statistical oddity, the SPX closed last Friday at 1999.99, which is at the lower end of our 2000 – 2040 trading target zone. The ~11% rally from the intraday low (2-11-16) to Friday’s intraday high (2009) has left the NYSE McClellan Oscillator about as overbought as it ever gets (see chart 3). And as the astute Lowry’s organization notes, “The % of OCO (Operating Companies Only) stocks above the 30-DMAs has moved to its highest level in over a year and is now well above the fully overbought level at 80%. This overbought reading could cause the market to moderate the pace of its gains in the rally from mid-February.”

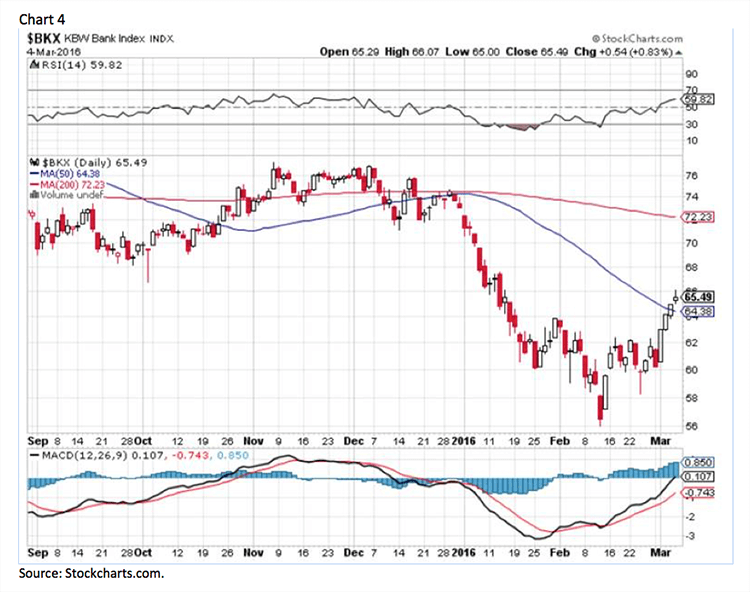

The call for this week: It’s conference week and my attention will be focused on Raymond James’ 37th Annual Institutional Investors Conference in Orlando where over 300 companies will be presenting to more than 1000 portfolio managers and analysts. The world’s investor focus, however, will likely be on this week’s ECB (European Central Bank) meeting. Many pundits expect another disappointing announcement; I am not one of them, given Europe’s worsening financial conditions since December (see chart 2). I think there will be a 10 basis point reduction in the interest deposit rate accompanied by an acceleration of the asset purchase program, as well as some other credit-easing measures. If so, it could push credit spreads down, causing the bank stocks to extend their rally (see chart 4). Indeed, one of the drivers for the overall stock market, and the financial sector, recently has been the narrowing of credit spreads (see chart 5). This morning, however, the overbought condition is coming into play, as North Korea calls up troops and threatens nuclear attacks, leaving the preopening S&P futures down about 7 points at 5:30 a.m.

.png)

Jeffrey D. Saut is chief investment strategist at Raymond James.