Low volatility equity strategies have become an increasingly popular solution in the investor toolbox. This is largely the result of an increasing awareness of the low volatility anomaly, a growing use of lower volatility seeking smart-beta strategies, and a greater appreciation of the damage caused by large portfolio drawdowns.

These strategies have become an important option in smart-beta investing because they seek three key objectives: reducing the overall risk/beta of the portfolio, providing significant downside protection, and retaining meaningful upside participation.

As many investors take a closer look at low volatility strategies, an important question is whether to choose an actively managed or passive approach. To answer this question, we believe low volatility investors should focus on three criteria:

- Risk reduction

- Return generation potential

- Adaptability (or lack thereof) of the investment process

In this paper, we’ll explore these criteria and make the case for choosing an actively managed approach.

Evaluating A Low Volatility Strategy

Risk Reduction

We believe the top priority of any low volatility strategy is to deliver lower portfolio risk relative to the cap-weighted benchmark. Strong risk reduction also leads to a compounding benefit, or lower “variance drag,” which is key to low volatility’s potential outperformance in the long run.

Reducing portfolio risk requires forecasting the potential future volatility of individual equities as well as all pairwise correlations among them. Risk forecasts can be thought of along two dimensions:

- Single vs. multiple: Using one or more measures to forecast risk.

- Simple vs. sophisticated: Using estimates ranging from simple trailing volatility calculations to increasingly complex, multifactor models.

Risk Measures: Single Or Multiple?

Passive low volatility options often rely on only a single measure to assess risk. Active managers can measure risk in several ways, using different techniques; doing so provides a more robust, diversified view of risk that may result in lower realized volatility. We believe this gives managers a greater chance of identifying emerging risks in the market.

For example, a 50-stock portfolio based solely on trailing 1-year price volatility as of December 31, 2014 would include a 40% weight in Real Estate Investment Trusts (REITs). While each REIT may individually be low risk, this portfolio ends up quite concentrated, introducing an easily identifiable risk.

Risk Measures: Simple Or Sophisticated?

Sophisticated approaches often use complex, multifactor risk models that consider underlying drivers of risk. These models also use correlation estimates when determining stock weights, as adding stocks with low or negative correlation to a portfolio reduces overall risk regardless of that stock’s standalone risk.

We believe managers who use a more sophisticated approach are typically better equipped to manage correlations during portfolio construction and are better able to deliver a low risk portfolio. Going back to our 40% REIT portfolio example, we can consider two additional low volatility portfolios that use more robust risk forecasting techniques.

- Starting with the same Russell 1000 universe, we built a low volatility portfolio by minimizing total portfolio risk as measured by a fundamental multifactor risk model, which includes correlation estimates. This portfolio cuts the weight in REITs to 20% of the portfolio.

- A second, more robust portfolio could be constructed by also including a macroeconomic risk model, as REITs contain significant interest rate exposure. A portfolio that considers both the fundamental and macroeconomic risk models further reduces the weight of REITs to only 10%.

As these examples demonstrate, there are many different ways to build low volatility portfolios, and the choices made in portfolio construction can lead to significantly different portfolios.

Finally, since an investor in a low volatility strategy recognizes (implicitly at least) that market-cap-weighted benchmarks are not efficient, any portfolio construction parameter that tilts a low volatility portfolio back toward market cap weighting dilutes the low volatility nature of the portfolio and increases expected risk.

We believe less constrained low volatility strategies should deliver lower risk and more attractive diversification, and thus should be favored by investors.

Return Generation

One of the more compelling arguments for investing in an active low volatility strategy is the ability of an active manager to infuse return forecasts into the portfolio construction process. In fact, the passively managed minimum variance portfolio, which selects stocks solely based on their squared standard deviation, takes the extreme and naïve view that every stock has the same expected return. In contrast, an active manager can favor stocks with higher expected returns.

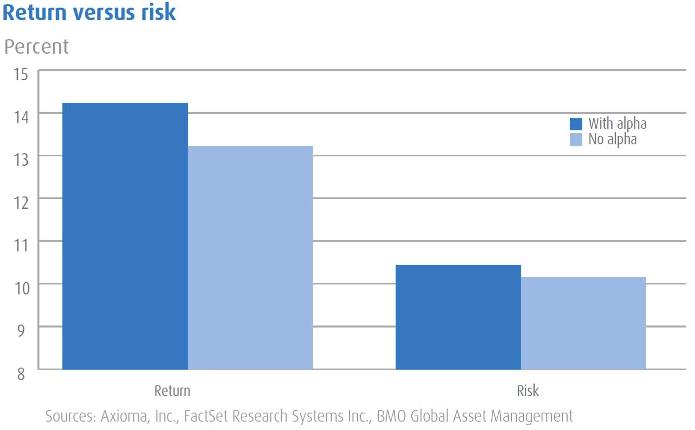

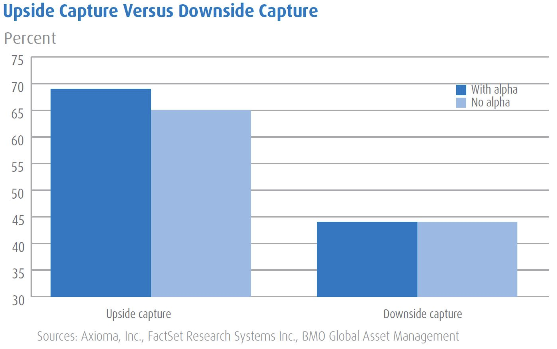

Our research suggests adding a return expectation to a low volatility strategy potentially increases returns by enhancing the upside capture with little to no impact on downside capture—and with little to no impact on overall portfolio risk.

Adaptive Process

A final consideration is whether a low volatility strategy can adapt to changing market conditions. By definition, passive low volatility strategies follow rigid and predetermined portfolio construction techniques. In contrast, an active low volatility manager has the flexibility to adapt the portfolio as market conditions warrant. For example:

- Changing market risks: An active manager has the flexibility to observe changes in the market and reprioritize to focus on the most important risks, while passive strategies rely on the same measure of risk regardless of its expected importance in the current market. Sometimes these risks will be captured by risk forecasts, but sometimes they will not. For example, in 2013 interest rate risk increased rapidly during the “taper tantrum.” Many fundamental risk models do not account for interest rates, and historical volatility did not identify this risk.

-

Rebalance frequency: An active manager has the flexibility to monitor risk and rebalance the portfolio whenever necessary, while passive strategies follow a predetermined schedule, often reassessing the portfolio’s risk only once or twice a year. This flexibility is likely to be most valuable in highly volatile markets — when the low volatility portfolio is expected to deliver the greatest benefit.

For passive strategies with regularly scheduled rebalancing, their inflexibility also means portfolios become increasingly risky as the calendar progresses, only to be rebalanced at an arbitrary point in time. - Trade off risk and return: One of the key advantages active managers have over passive low volatility indexes is the flexibility to trade off risk and return decisions over time. That is, managers can focus on risk reduction during periods of higher volatility, while offering more return generation during periods of lower volatility.

Over the long term, smart adaptability should benefit both the upside and downside capture ratios of a low volatility portfolio.

Active Fexibility Versus Passive Simplicity

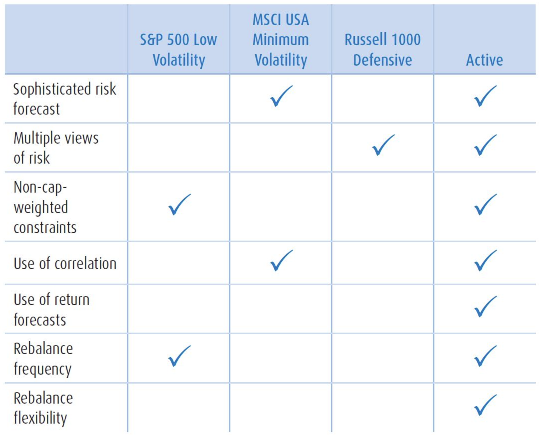

As the market for low volatility equity strategies has emerged, many of the largest index providers have constructed low volatility benchmarks. These benchmarks have increasingly been used to manage passive strategies, including exchange traded funds (ETFs) and smart-beta portfolios. The case for these approaches is to provide a cheap, transparent way to implement a low volatility portfolio.

There are three major providers of low volatility indexes, and we have included a table evaluating each of them along the dimensions discussed in the paper. The takeaway is that active management can provide far greater benefits than simple passive approaches.

Conclusion

As investor attention increasingly turns toward outcome-based solutions and smart-beta products, we expect low volatility equity strategies to continue growing in popularity. However, when choosing a low volatility provider, it’s important to remember all solutions are not created equal.

Strategies featuring more robust risk forecasts and unconstrained portfolio construction methods should provide lower realized risk and thus better downside protection. Furthermore, strategies using reliable return forecasts potentially provide higher realized returns and improved upside participation. Finally, a skillful manager should be able to adapt to emerging risks in the market, and balance the risk/return trade-off as opportunities in the market arise. Investors should evaluate all of these characteristics when determining which low volatility strategy to use. Asset Management Insights September 2015.

Ernesto Ramos, Ph.D., is Head of Equities at BMO Asset Management U.S. He leads the team responsible for portfolio management and research for all equity strategies.

Jason C. Hans, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.

Jay Kaufman, CFA, is primarily responsible for the research and development of quantitative equity investment models at BMO Asset Management U.S.

Jay Kaufman, CFA, is primarily responsible for the research and development of quantitative equity investment models at BMO Asset Management U.S.

David A. Corris, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.

David A. Corris, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.