If you are overburdened with administrative and business management issues and find that you can no longer handle both the business and client relationships, it’s time to consider hiring someone to manage the business. Such a move can provide day-to-day leadership in an operationally intensive business (adding bandwidth for the advisors), allow the firm to execute on specific strategic initiatives, provide the ability to scale the company and potentially improve profitability.

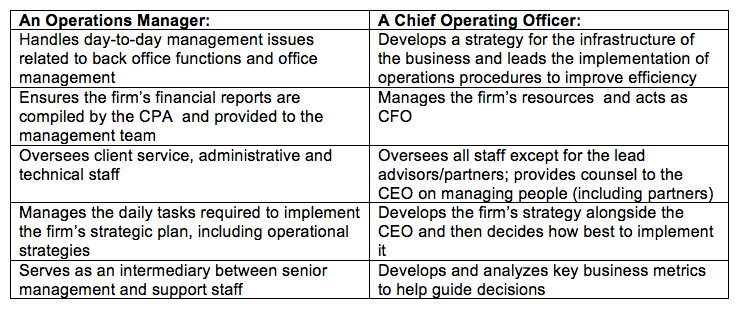

The first question to ask yourself is, are you ready to step away from managing the business and dedicate your role 100 percent to client-facing work? The second question will be whether to hire an operations manager or a more strategic chief operating officer. What’s the difference? Whereas an operations manager takes the reins of the operational activities, executes initiatives and allows partners to step away from the operational side and back office duties of the business, a COO also helps shape the strategy and culture of the company, takes on leadership and management areas the advisory partners don’t have time for/don’t want to focus on/are poorly suited for, and builds out the executive team and organizational scaffolding. Both roles help streamline a business’s operations, but in very different ways and to a different magnitude of impact.

The role of the COO is unique. Unlike other positions, the COO role does not have a universal job description or list of tasks; it can be defined differently based on the business’s and owner’s needs and often changes over time.

To decide if a COO is the best choice for your firm weigh the following:

Level Of Office Organization

If you want to hire someone to start pulling everything and everyone together and create processes for back office and client service functions, as well as management of vendor relationships, , an operations manager might be a better starting point. However, if your needs are broader and more strategic and managerial, then a COO is the clear choice.

Business Strategy

When hiring a COO, you must have a clearly defined strategy that you want the new individual to execute, or you should have the COO lead the firm through creating a strategic plan. An individual sitting in the COO’s seat is there to think bigger and guide the firm on a broader level. If you simply need someone to manage the day-to-day operational tasks and people responsible for them, an operations manager might be the better way to go.

Partner Or Employee

A senior professional who is considering accepting a COO role may expect equity in addition to compensation. It’s also important to note that although the COO will be tasked with implementing the firm’s existing strategic initiatives or helping define new ones, he or she will also have a seat at the executive table and will be involved in important decisions. Therefore, if the existing leadership wants a partner in decision making, wants a peer to help set the direction for the firm, and may be willing to offer equity ownership to another individual, then offering the COO equity could be the right choice. However, equity might not be appropriate in all cases and should be carefully considered. In the case of an operations manager, an equity position is typically not required.

Size Of Staff And Business

To justify hiring a COO, a firm should have eight staff members or more. Less than that may better benefit from an operations manager due to the lower cost and less complexity in the role. Of course, you also have to consider the overall size of your business. About 20 percent of financial advisory firms with revenue around $1.5 million have a COO, but by the $3.5 million mark, 60 percent have a COO, according to the 2011 FA Insight Study of Advisory Firms: People and Pay. However, it is worth pointing out that in many firms, the title may say COO, while the duties and level may actually be more that of an operations manager.

Bottom Line: Will Your Business Benefit?