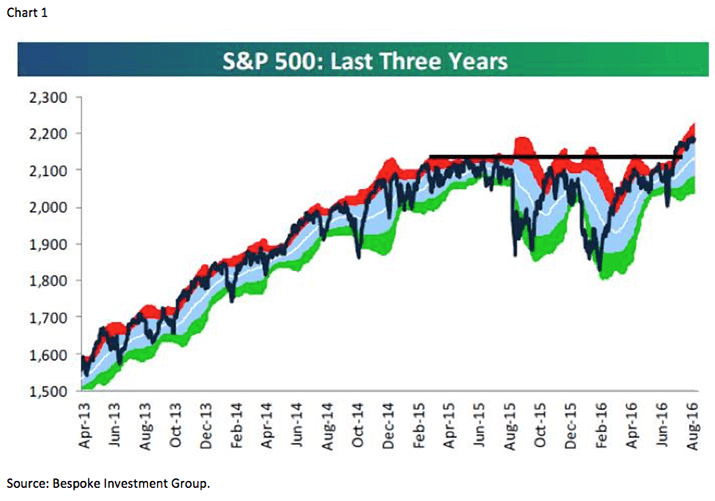

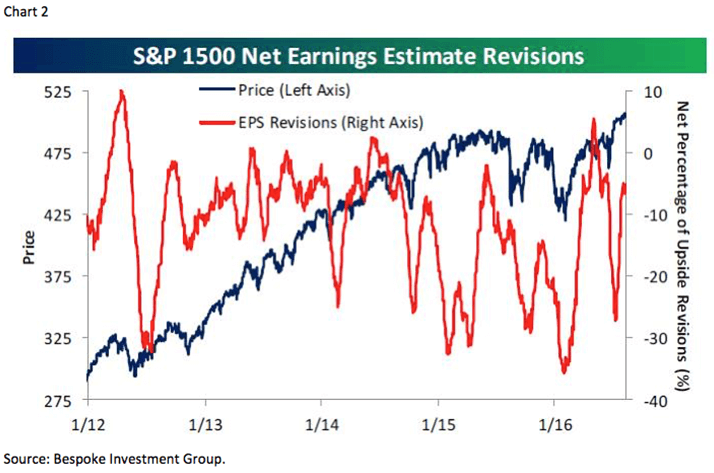

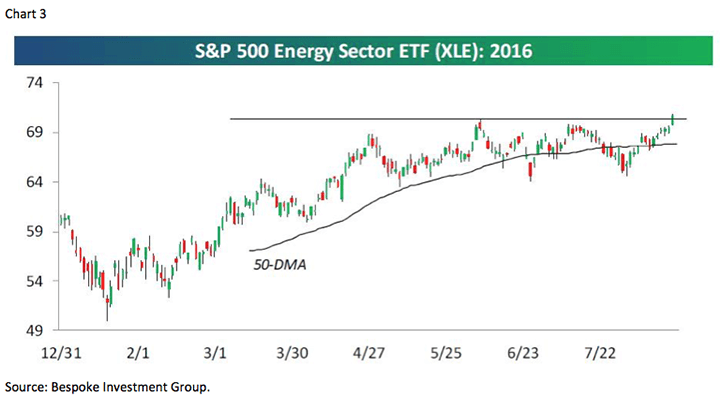

The call for this week: While there are numerous economic releases this week, by far the key event for the week is Janet Yellen’s speech this Friday (10:00 a.m.) at the Kansas City Fed’s annual Jackson Hole Forum. Her topic will be “The Federal Reserve’s Monetary Policy Toolkit.” Certainly the various markets will put on “rabbit ears” for clues as to what it means for interest rates and consequently stocks. As often expressed in these missives, “Nobody can consistently ‘time’ the markets, but if one ‘listens’ to the message of the market you can certainly decide if you should be playing hard or not so hard.” Since our model targeted the February lows, we have been playing pretty hard. Last week, however, we began playing less hard as our model was calling for a short-term trading top into Friday’s option expiration. We further opined that if the SPX breaks below 2175, more selling should ensue. The quid pro quo is that if the recent intraday high of 2193.81 is taken out to the upside, all downside bets are off. Of course this is merely a finesse “trading call” because our model shows the first point of any real vulnerability comes in mid-/late-September as the equity markets transition from an interest rate-driven bull market to an earnings-driven bull market (chart 2). And don’t look now, but the energy sector is breaking out to the upside (chart 3).

Jeffrey D. Saut is chief investment strategist at Raymond James.