Few would dispute that the 12-year (and still counting) bull market in gold has been the opportunity of this investment lifetime. Even fewer have participated. From its 20-year bear-market low in August 1999, bullion has appreciated more than seven fold. That works out to a $US compound return of 18.0% compared to 0.7% for the S&P 500. There is a paltry $2 trillion of investment gold, approximately 1% of global financial assets. It is not mainstream. It is not widely held. The rationale for investing is antithetical to mainstream thinking. The opportunity has been missed by almost every conceivable category of investor including pension funds, endowments, mutual funds, and central banks, all of whom could be safely described as underweight the metal, overweight dicey financial assets. Despite the headlines, gold remains under owned.

To regard the lengthy bull market in gold as an isolated fact would be simplistic and superficial. The media and most of the financial community are captivated by daily price action, but see nothing more. To most, it is a speculation, probably an overcrowded trade, and maybe a bubble. It is seen in the narrowest of terms, as an odd curiosity that will at some point just go away.

Gold's advance is but one aspect of a much bigger picture. The collapse of the dotcom and housing bubbles, the 2008 credit collapse, the 11-year bear market in stocks, sovereign debt woes in Europe, zero interest rates, intractable sovereign fiscal deficits, and, yes, the steady rise of gold in all currencies are rooted in the breakdown of confidence in paper currencies linked only to political agendas.

Since the demotion of gold to non-monetary status by the Nixon administration in 1970, fiat money and credit based upon it have been a fundamental source of global wealth generation. What is the value in real terms of the $200 trillion of wealth denominated in currency if nobody wants the paper?

In golf parlance, a "mulligan" is a second chance to make good on a bad tee shot. Mulligans are routinely granted and gratefully accepted by every golfer at the beginning of a friendly match, after a bad first shot. In the world of investing, second chances, or "do overs" are not routine. Sideline huggers who have missed the bull market of a lifetime must "pay up" if they wish to participate in a long-established trend. Late to the party entry points are inherently more risky, as the sharp correction in bullion during the last week of August in bullion illustrates.

What follows is a table thumping, categorical, endorsement of gold and precious metal mining stocks. It is addressed not only to impatient and possibly dispirited holders of precious metals mining equities, but also to the bystanders and spectators of the past 12 years. Gold mining equities represent the closest thing to an investment mulligan as we have seen-a rational way to participate in what appears to be the end game for paper currencies on an attractive risk-adjusted basis. Gold bullion is popular. Gold stocks are not. Gold bullion has become volatile. Gold stocks remain somnolent. The two have diverged widely over the past eight months, with gold rising 29.2% while the stocks (basis XAU) have declined 2.7%. Since the 1999 bear market low in bullion, the XAU has underperformed the metal by 331% or 13% per year. Based on Lipper data, precious metals mutual fund outflows during the first half of 2011 were the largest in five years:

Reasons For Underperformance

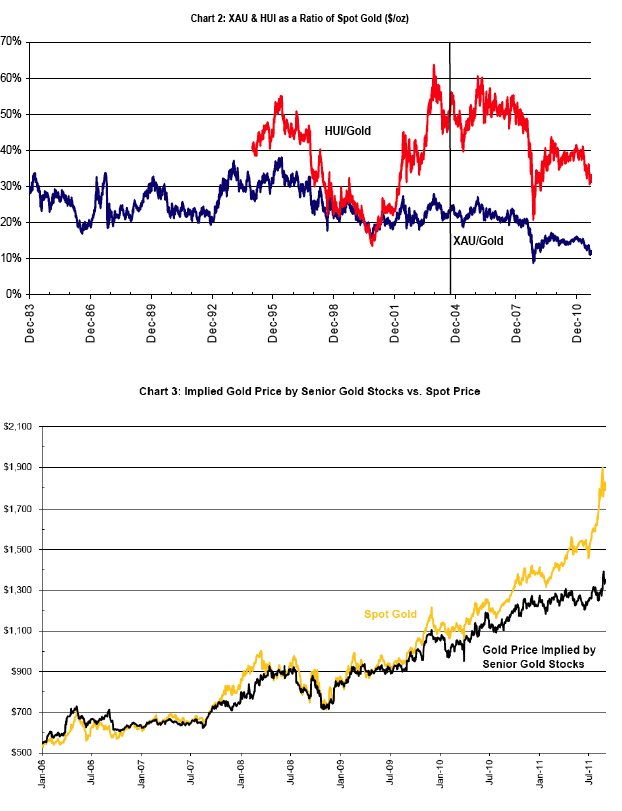

Over the past ten years, the miners, as measured by the XAU, have barely kept pace with the metal itself. Since early December 2010, gold stocks have lagged the metal substantially. The ratio of the XAU (Philadelphia Stock Exchange index of Gold and Silver stocks) to the metal price stands near an all-time low (see Chart 2). The same can be said of the shorter lived HUI. The basket of senior mining equities monitored by our research team to the NPV (net present value) shows a similar result. This universe implies a gold price of $1372/oz, a discount of 27% to spot (as of 9/6/11), vs. a five year average of -4%.

The chart below, another measure of the unpopularity of gold stocks, tracks the discount to spot prices implied by the trading level of our index of senior gold mining equities:

There are four possible explanations for the recent underperformance of the mining stocks:

Gold ETFs

In November 2004, the World Gold Council launched a gold ETF (GLD) which now has a market cap of $72 billion. GLD is backed by physical gold and has tracked the gold price accurately. Other gold ETFs have been launched and today the aggregate market cap is $130 billion, compared to an estimated market cap for gold mining equities of $500 billion. Chart 2 shows that the valuation of the XAU relative to the bullion price began to trend lower in the years following the launch of GLD and other gold ETFs.

It appears that the gold ETFs have been a mixed blessing for gold mining stocks. On the one hand, by making gold more user friendly, ETFs facilitated capital flows into the metal. By making gold available to mainstream investors, they democratized what was previously an obscure asset known only to central bankers, commodity traders, and coin dealers. The ETFs have had a positive, but difficult to measure, impact on the gold price. In all likelihood, and with 20-20 hindsight, this impact was probably marginal. Who is to say that given the macroeconomic tail winds for gold, that the price would be any different today in the absence of the gold ETFs? On the other hand, gold ETFs have created competition for gold mining stocks, and this seems to be reflected in Chart 2. Prior to 2004, the miners held a monopoly for equity market investors wishing to bet on a decline in the value of paper currency. This monopoly translated into an extremely low cost of capital for the gold mining industry. Unfortunately this advantage was dissipated by industry management during the 1990's and through 2007 by way of excessive share issuance, unwise capital allocations, and risky hedging practices which ultimately resulted in the destruction of shareholder capital.

Relative to gold mining equities, investment in the metal is straightforward and clear cut. There is no business risk. Investing in the business of mining gold demands more complex and specialized analysis. Given the flight to safety in capital markets, it is not surprising that investors flock first to bullion.

Doubts On Gold Price

The hesitancy in gold stocks year to date reflects the reluctance of investors to incorporate higher gold prices into earnings and dividend expectations. The steep acceleration in the slope of gold prices over the past 90 days and related volatility is a near-term negative because the natural expectation is for the metal price to correct. A correction in the metal price might give equity investors the confidence to project and normalize new and previously unexpected fundamentals. The steep discount to the current spot price of $1872 (-27%) (Chart 4) indicates a level of skepticism not seen since 2008.