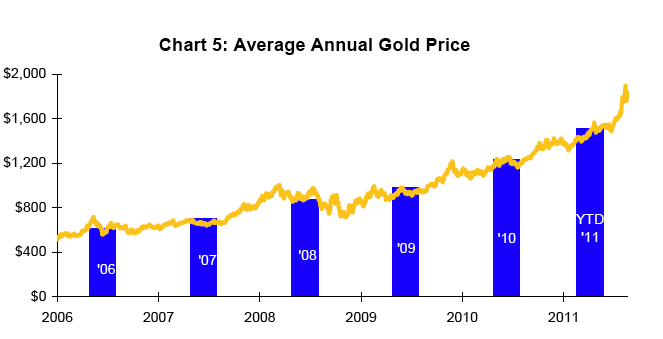

The rationale for investing in mining stocks is purely and simply a bullish view of the gold price. However, the fundamental that drives earnings is not the spot price but the average price over a period of time. As the chart below shows, the average annual gold price is in a steadily rising and bullish trend. This trend is a more reliable gauge of industry profitability than spot prices. Since the average price received is well below (-26%) the spot price, and the moving average is still climbing, we expect the best is yet to come for gold mining earnings.

We also expect the price behavior of gold to become ever more astonishing. As long as favorable macroeconomic conditions prevail, especially negative real interest rates, marginal capital flows into the metal will have an outsized impact on the metal price. The reason is that the available supply of investment gold increases slowly while the quantity of paper currencies and sovereign debt proliferates at comparative warp speed. The addition to the above-ground gold stock of 170,000 metric tonnes from annual mine production is only 2,698 metric tonnes or 2%. $100 swings in the daily price are likely to become routine. Those who view the metal's price as a vehicle for trading profits will in all likelihood fail to capture the full return from the substantial and permanent devaluation of paper currencies against it. The record of the high-profile pundits in calling short-term tops and lows in the price action is abysmal. We graciously do not reproduce any of their inaccurate calls as evidence. It raises the question of why anyone would want to trade in the midst of a tectonic shift in global monetary arrangements.

The basis for expecting sustained high gold prices is the erosion of confidence in central banking and fiscal and monetary policy in Western democracies. Low esteem for paper currencies has the appearance of permanence. Reclaiming confidence in paper currency will be no easy task. The challenge was discussed in our previous web site article: Another Volcker Moment At Hand? Until confidence is restored, there will be no substitute for gold. Once the point of no return for confidence in fiat money has passed, there is no self-correcting market mechanism to drive down the price of gold. Gold is unique in this respect. Unlike the price of oil, base metals, grains and other economically sensitive commodities, its price is not restricted by conventional market forces.

Margin Pressure

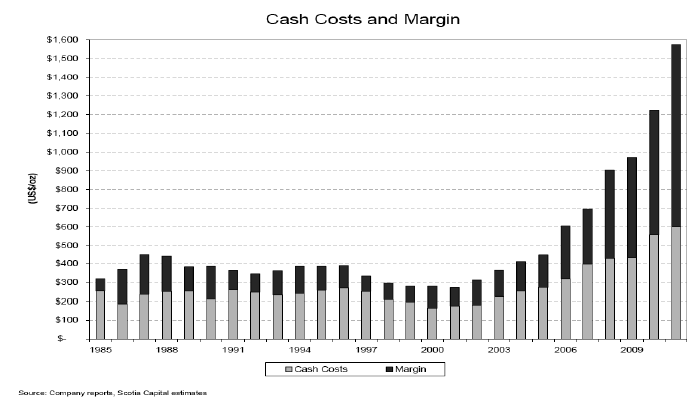

Pressure on gold mining margins is often mentioned as a reason for lackluster stock performance. However, the facts do not support the argument. In 2007, oil prices approached $150/bbl, and today are hovering in the mid $80's. Energy, one of the key variable cost components of producing gold, has not kept pace with the gold price. Almost all of the others that one could name, including steel, chemicals, rolling stock, and labor have not kept pace either. Given a world economy that seems to be stuck in perma-mud, we do not see input costs becoming problematic. Should inflation accelerate due to monetary laxity, we would expect the gold price to continue to outpace variable costs. The chart below shows that the spread between the global cash cost of producing gold has widened significantly since the watershed of 2008:

Prior to 2008, margin pressure was a legitimate concern. The costs of producing were outrunning the gold price. Skinny margins translated into high potential shareholder dilution if the industry was to reinvest sufficient capital to maintain production and reserves. Following the credit implosion of 2008, profit margins on existing mines have steadily expanded.

If there is a legitimate margin/return on capital issue, it relates to mines of the future. The steady decline in head grades requires disproportionate and possibly geometric increases in capital to produce the same volume of gold. More capital translates into heightened project risk. Companies that choose to avert dilution in favor of cash distributions on highly profitable existing assets are more likely to find favor with investors and will be rewarded in terms of equity valuation, in our opinion. Those that choose to pursue growth strategies that require capital intensive new projects in risky political jurisdictions may well fail to achieve the privileged equity valuations that we envision for those that don't.

Resource nationalism directly impacts the economics of existing and future mines. The term is new but the practice of nickel and diming the profitability of successful business in the commodity sector is time honored. Host countries, especially those in the developing economies of the world, have honed this practice to a fine art. The issue is most relevant for large, highly visible new mine projects and indisputably adds risk in terms of capital, time, and project economics. However, the predisposition of governments to penalize success, especially when soaring commodity prices produce "undeserved" profits cannot be used as an explanation for the recent underperformance of gold mining stocks since it has always been part of the landscape for extractive industries .

Hangover From 2008

It goes without saying that mining stocks are riskier than the metal itself. Periods of sustained equity market weakness create drag for gold mining equities, even if the gold price itself is strong or holding steady. The weak equity market in 2011 and 2008 are two recent examples. Bear markets inevitably raise concerns over the viability of a strategy of investing in gold mining stocks. Investors in gold bullion are for the most part risk averse, while investors in gold mining equities are opportunistic or risk takers.

The dreadful performance of gold mining stocks in 2008 in our opinion remains an important negative weighing on the group and an important explanation for their recent sluggishness. Gold bullion rose 5.8% in $US and proved to be the only safe haven other than cash in the instance of asset deflation. Gold mining equities (XAU) declined 27.8% in 2008.

Investors in gold mining stocks during 2008 quite possibly celebrated the unfolding collapse of the credit markets. The premise of their investment was the expectation of the very events that took place. However, despite their foresight, the gold and precious metal share investor lived the same nightmare experienced by all equity market investors. At that time, equity investors meeting margin calls had no time to consider the distinctions between gold mining and other equities. Within the confines of 2008, gold stocks did not insulate against the implosion of credit. For this reason, in our opinion, they are still viewed with skepticism.

The Case For Gold Stocks

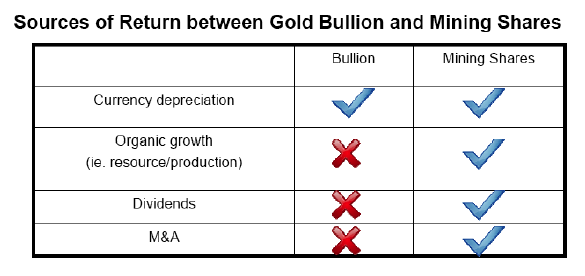

Gold bullion and gold stocks are completely different, similar only in their attraction to investors who distrust paper currencies. Gold is inert. Gold stocks are claims on the enterprise of finding and extracting gold from the core of this planet. Think of them as long term, deep in the money, long duration income producing options on the gold price. Perhaps their suitability is limited to a range of investors narrower than bullion itself. However, for that narrower slice of the investment universe seeking a more dynamic exposure to currency debasement than the metal itself can provide, they are the only game in town.

In terms of potential return, gold stocks have inherent advantages over the metal itself: income, growth, and takeover potential. These three possible sources of return are beyond the scope of physical gold. As obvious as these attributes may seem, they have been periodically over looked. One possible reason is that the bid for gold is global. It emanates from China, India, South East Asia, and other diverse global locations where gold mining stocks are all but unknown. Aside from speculators in Western capital markets, gold is purchased not for its return potential but rather for its traditional attributes as a safe haven and a store of value. The demand for gold stocks comes mainly from a much narrower base of investors. In the primal scramble for safety, the nuanced advantages of gold mining equities have been heavily discounted. To our thinking, the discount is sufficiently excessive to spell extraordinary opportunity.