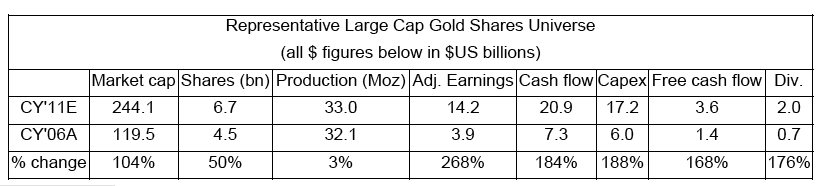

The higher gold price, in our opinion, has transformed our representative universe (see appendix for detail) of large cap gold mining equities from fantasies on the future course of the gold price (2006) to solid value propositions (2011) providing compelling valuations, attractive current returns and a virtually free ride on future gains in the gold price. Our sample universe consists of eleven companies accounting for approximately 40% of global gold production in 2010:

The $14.2 billion of aggregate earnings is based on the 2011 run rate at $1450 gold/oz, which is slightly below the average gold price received year to date by the industry. The incremental leverage for earnings, cash flow, and EPS for each $100/ increase in the gold price is 16%, or 68% at the current gold price of $1872. The gold price has advanced sharply in 2011, and has averaged $1514 year to date vs. $1227 in 2010.

The robust level of profitability means that capital structures are healthy and that the threat of chronic share issuance is reduced. Over the past five years, share issuance increased 50% and the economic gains were decisively accretive on a per share basis.

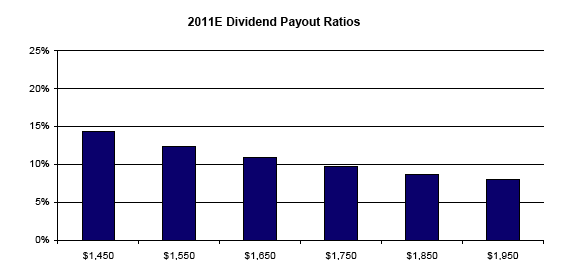

Although dividends have nearly tripled over the past five years, dividend payout ratios are still on the miserly side at 14%, based on $1450 gold. Should gold prices stabilize at $1750/ oz, 5% below the current spot price, those payout ratios (as of 6/30/2011) could drop to 10%. The chart below shows the prospective payout ratios for the group at different gold prices:

Newmont Mining has linked its dividend to the gold price (as of 4/7/11), when gold was trading at $1458. For each $100 increase or decrease in the gold price, the dividend increases or decreases $0.20 per share, or $99 million. While other leading companies have yet to follow suit, we expect similar announcements to follow once industry management becomes comfortable with gold prices at $1500 or above. Gold is not a growth business. Annual gold production of 2,698 tonnes has not changed significantly since 1999 despite the strong increase in gold prices. Grades have dropped steadily over the past decade from 0.15 oz/ton to the 0.05 oz/ton (est) in 2010. We believe the larger companies will have limited choices in deploying their free cash flow, other than to increase dividends or to diversify away from gold mining at the risk of losing the premium equity valuations still enjoyed by precious metal producers.

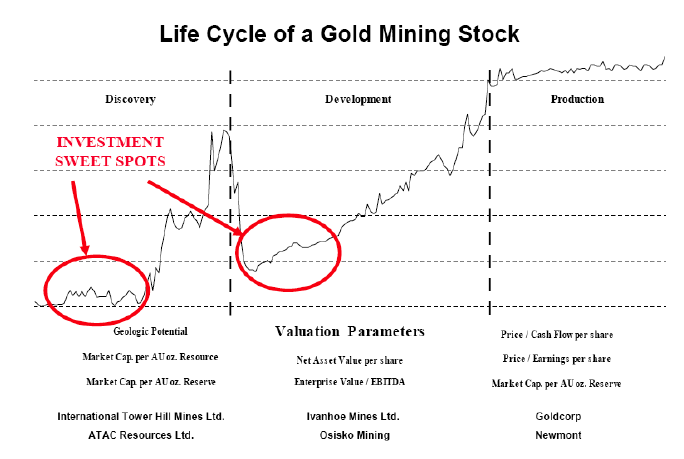

Although gold is not a growth industry, smaller companies routinely grow into larger companies through discovery, mine development, or acquisition. Returns generated through corporate development accretive on a per share basis are incremental to the effect of rising gold prices. The most efficient exposure to such returns is to invest in early stage or small cap companies where entrepreneurial success in discovering new, economically significant precious metals deposits, or in developing new deposits into cash flow producing mines can yield quantum increments in per share valuation. Larger cap producers also make significant discoveries and are constantly upgrading their asset mix, but the net impact on overall corporate valuation is typically more muted:

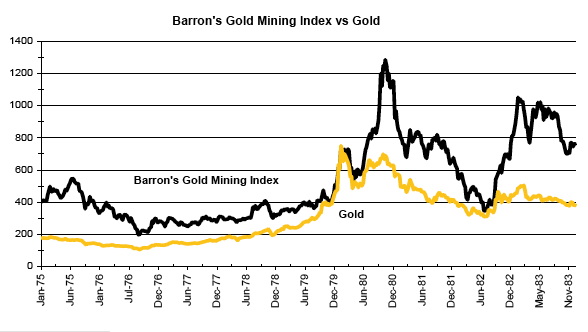

The disconnect between gold bullion and gold equities works both ways. When the metal is rising rapidly, it is not uncommon for the equities to lag. Following peaks in the metal, performance of the equities has often been positive. Gold peaked in 1980, but gold equities peaked nearly a year later. There was a second peak in gold equities, lower than the first peak, but still higher than trading levels in 1980 when the metal itself peaked. Based on this history, we find that the fear that returns from gold equities are circumscribed by peak gold prices is unsubstantiated.

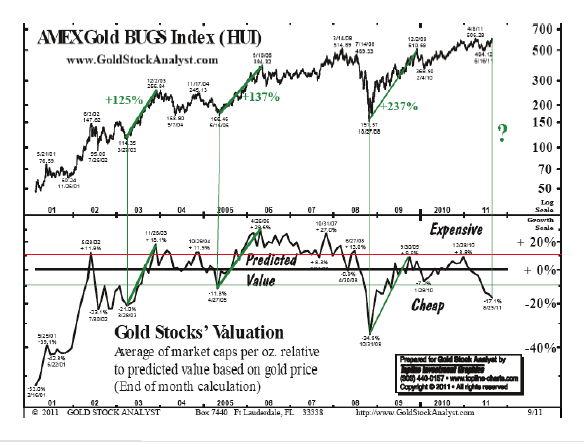

The Gold Stock Analyst chart (9/1/11) shows that returns from investing in gold mining equities are greatest when the stocks trade at a discount to the metal: