David Shepherd Jr. Typically relies on exchange-traded funds when he's investing in equities. But when it comes to fixed income, Shepherd, a financial advisor with Retirement Financial Services in Tucson, Ariz., often splits the pie between mutual funds and ETFs.

He gives bond mutual funds the nod for his core positions because they offer more diversity than ETFs, which typically track narrower indexes. "A number of multi-sector mutual funds provide government, corporate high-yield and foreign exposure," he says. "There's really nothing like that in the ETF world."

At the same time, he views ETFs as a good way to capture returns from specific slices of the market such as high-yield corporate or foreign bonds at a much lower cost than they would be with mutual funds. "I also like the ability to place stop orders, which I can't do with mutual funds," he says.

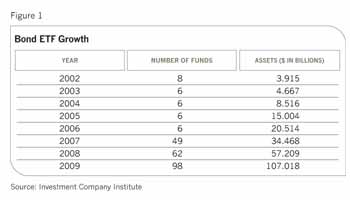

A growing number of advisors like Shepherd believe that even though bond mutual funds and ETFs differ in a number of key ways, they can complement each other well in client portfolios. And with the expanding roster of bond ETFs, there are more ways than ever to add them to the mix. By the beginning of 2010, there were 98 bond exchange-traded funds worth $107 billion on the market, up from 62 ETFs worth $57 billion the previous year, according to the Investment Company Institute.

While that's a fraction of the assets held by bond mutual funds, the new product launches by marquee names in the last year suggest that ETFs are emerging as formidable competition. In June, Pacific Investment Management Company (PIMCO) launched its first ETF and quickly followed up with nine others. In November, Vanguard expanded its stable of fixed-income ETFs from seven to 12. Barclays, State Street Global Advisors and PowerShares are among the other sponsors tapping into the growing investor appetite for bond investments.

As bond ETFs become increasingly popular, investors are learning about features that make them very different from either mutual funds or individual securities. On the plus side, they offer more variety for index investors by covering virtually every corner of the bond universe. Vanguard, a name that's synonymous with indexing, has only four bond index funds, while its equity index offerings number 24.

The handful of funds from other sponsors all use broad-based indexes. By contrast, the more expansive ETF universe spans nearly 100 offerings that follow myriad indexes, either those already in existence or new ones devised by the companies. Diversified portfolios, Treasurys, municipals, inflation-protected securities, high-yield securities and international bonds are all available as investment options.

Active management is an up-and-coming area, and the last five active ETFs to hit the market have been fixed-income offerings from Grail Advisors and PIMCO. The largest of the three PIMCO entrants, the PIMCO Enhanced Short Maturity Strategy Fund, has $122 million in assets and an expense ratio of 0.35%, well below the 1.07% charged by the average actively managed bond mutual fund.

Still, despite the exchange-traded fund's enticements, mutual funds have an overwhelming advantage in the breadth of their actively managed offerings. That's why they are typically more expensive than passive index ETFs, whose annual expense ratios range from 0.09% to 0.50% for more exotic investments such as high-yield bonds. The keenest competition on the expense front comes from Vanguard's no-load bond index mutual funds, which have expense ratios similar to those of bond ETFs. Mutual funds also allow investors to dollar cost average without paying brokerage commissions, which makes them a better deal for those clients with smaller amounts to invest over a longer period.

On the other hand, ETFs can be cheaper to buy and sell through discount brokerage platforms. At Schwab, it will cost $49.95 to buy or sell shares in a Vanguard bond index fund, while it costs only $8.95 for online stock trades. At Fidelity, investors can trade 25 iShares ETFs, including five fixed-income offerings, for free.

The most unusual and controversial aspect of bond ETFs are the pricing aberrations that sometimes unexpectedly pop up in them. Unlike mutual fund shares, which simply trade in line with net asset values after adjustments for expenses, bond ETFs have a price at which they trade-their market price, which changes throughout the day. Their net asset values, which reflect the reported value of all the securities in the ETF, are updated daily.

The difference between the price and NAV is usually only a few basis points in popular stock ETFs, and it's generally less than 20 basis points in the bond ETFs tracking more liquid markets, such as government securities. But because the market for more illiquid corporate and municipal offerings can be unpredictable, the gap between the market value of the ETF and the reported value of the underlying securities widens as you move up the credit risk ladder.

Market volatility, for instance, can sometimes widen the market price discounts and premiums to net asset value. During the market meltdown in October 2008, even broad-based, diversified bond ETFs traded at steep discounts to their net asset values as investors abandoned them in droves. Then by year's end, some of those ETFs had swung to significant premiums as investors seeking safety piled back in.

Another area of confusion is the sampling techniques that managers use to assemble a group of bonds that replicate an index. In the year that ended in mid-February, for example, three ETFs following the Barclays Capital U.S. Aggregate Bond Index posted returns ranging from 5.42% to 6.67%, while the index itself returned 7.38%. (The Vanguard Total Bond Market Index tracked most efficiently, with a 7.42% return.) At other times, discrepancies occur because several ETFs in a particular bond sector may use different proprietary indexes, making it difficult to compare one with the other.

Last year's volatile conditions widened tracking errors among certain bond ETFs covering more illiquid areas of the market. According to a study by Morgan Stanley, the SPDR Barclays Capital High Yield Bond Fund missed its benchmark by nearly 13% in 2009, while the PowerShares High Yield Corporate Bond portfolio fell short by 11%.

Some see pricing inefficiencies, however, as an entry point to profits. In late 2008, the chief investment strategist at Members Trust Company in Tampa, Fla., John Largent, bought a corporate bond ETF that was selling at a steep discount to net asset value. A few months later, after the bond market had started to recover and demand for the ETF picked up, he sold it at a substantial premium. "If you know how to do things right, you can take some of the negative issues, such as tracking error or volatility, and use them to your advantage," he says.

Largent also uses the ETFs to emphasize particular areas of the yield curve or credit quality spectrum. In line with his belief that interest rates are likely to rise in the near future, he is mixing a core position in the iShares Barclays Aggregate Bond Fund with positions in two short-term bond ETFs. Overall, he prefers bond ETFs over mutual funds and individual securities because "you can tailor strategies more precisely and take advantage of opportunities more efficiently."

Others prefer the more predictable nature of mutual funds. Richard Ferri, the president of Portfolio Solutions in Troy, Mich., tried bond ETFs a few years ago but has since abandoned them in favor of bond index mutual funds. He noticed that when stocks were volatile and prices dropped suddenly, the underlying corporate bond market lost liquidity as well, leading to wide discounts to net asset value among the ETFs that owned them. "These are the same periods we are rebalancing portfolios by selling bonds and buying stocks," he says. "If we used bond ETFs, we would be selling into these discounted prices." By using open-end funds, he gets closing-day net asset values, which he says fetch a better price for his clients during volatile periods like those from November 2008 to March 2009.

William Sowell, president of Sowell Management Services in Little Rock, Ark., will use mutual funds if a manager adds enough value to justify the added expense, or when the expense ratio is lower than that of a comparable exchange-traded fund. At the same time, the low cost structure of the ETF makes it "particularly useful for squeezing out returns in lower-yielding areas of the market such as short-term bonds or Treasurys," he says. To help ensure liquidity, he sticks with ETFs that have an average daily trading volume of at least a few hundred thousand shares from the larger sponsors. Buying ETFs that follow more liquid securities such as Treasurys is another option for those seeking a tamer entry point into the market.

Bond ETFs can also augment individual bond holdings, according to Morningstar analyst John Gabriel. "We think that, in many cases, bond ETFs are most suitable as complementary players in an investor's bond allocation, perhaps between 10% and 30%," notes Gabriel in a recent report. "The remaining fixed-income allocation, for instance, could be a laddered portfolio of individual bonds with specifically tailored maturities designed to offset a given individual's future liabilities."