Key Points

The Fed kept rates unchanged but the statement had a notably more positive tone.

The labor market has strengthened, inflation is up, global uncertainty has eased, and financial conditions have loosened.

The September FOMC meeting should be considered on the table for a rate hike.

The Federal Open Market Committee (FOMC) held rates steady but noted diminished risks in the U.S. economy and a tighter labor market, highlighting in the accompanying statement “that the labor market strengthened and that economic activity has been expanding at a moderate rate.” This was in contrast to the mention of “weak growth in May”—in reference to the extremely weak May jobs report which helped push the Fed to the sidelines. The Fed also reiterated that it expects inflation to reach its 2% target in the medium term.

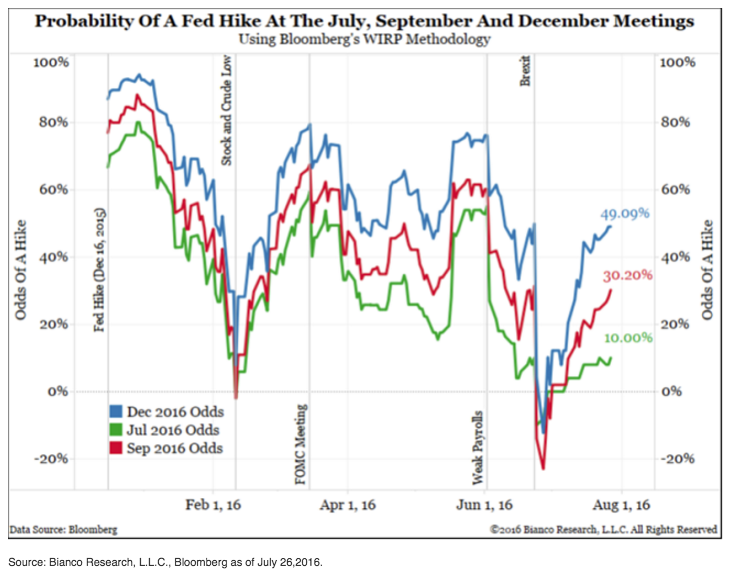

There was one dissenter—Kansas City Fed President Esther George, a noted FOMC hawk. After flying into the doves’ den by not dissenting at the June FOMC meeting, she reestablished her penchant for raising rates. Heading into the meeting today, and as you can see in the chart below, there was only a 10% chance of a rate hike at the July meeting. But the likelihood of a rate hike in either September or December has spiked since the Brexit-related plunge.

So, September is on the table, but we’ve been down this road before. Fed Chair Janet Yellen and other FOMC members were telegraphing rate hikes heading into the June FOMC meeting until a temporary dip in job growth, market volatility and the surprise of Brexit put the brake on those plans. It’s clear the FOMC would like to continue to normalize rates, albeit gradually. Although no specific timing was mentioned, the FOMC repeated that it expects “economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate.”

Ultimately the decision will be a function of incoming economic data as well as the health of financial conditions. Financial conditions—both here in the United States and globally—have eased significantly, even post-Brexit. The volatility in these conditions has been at the heart of the FOMC’s movements between dovish and hawkish so far this year. Although there was nothing manifest in the statement pointing to September as the meeting at which they’ll likely move, we believe it’s on the table as long as economic data behaves and financial conditions remain relatively loose.

Liz Ann Sonders is senior vice president, chief investment strategist at Charles Schwab & Co., Inc.