In our inaugural issue of Private Wealth, I discussed the size of the ultra-affluent population and the aggregate assets they controlled to provide a context for the opportunity facing our readers (see "The $62 Trillion Opportunity," PW June/July 2007). Given the upheaval that's transpired since then, including but certainly not limited to the recent credit crisis, a host of investment scams and a decrease in the world's economic growth rate, it seems an appropriate time to revisit this topic to get a feel for how our target market has been impacted.

Over the past 18 months, nearly everyone has suffered financial losses, so it should be no surprise to learn that the wealthiest among us have also seen their wealth shrink. Last year's World Wealth Report from Merrill Lynch/Cap Gemini stated that the number of households with at least $1 million in investable assets at the end of 2008 had dropped 15% from the previous year and their wealth had decreased by 20%. But how did their wealthier counterparts fare under the same circumstances? Larger pools of assets clearly have the potential to sustain bigger losses in dollar terms; but did the ultra-affluent lose a greater percentage of their overall portfolios as well?

Roll Call For The Financial Elite

The ultra-affluent can be measured and defined in many ways-and flexibility is key when it comes to segmentation. My first article focused on individuals or families with a total net worth of at least $10 million, because above that threshold our research findings show a psychological shift in attitudes about money-a shift significant enough to warrant the attention of advisors and tailored approaches to communications and service. For the purposes of this article, and to isolate the group of individuals that are most likely to work with a wealth manager or multi-family office, I've chosen to move upmarket and focus on individuals and families with a net worth of $20 million or more.

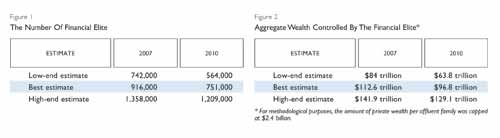

As before, a best estimate was calculated for each statistic along with both high and low scenarios. The data is updated regularly and on the following page I've included 2007 and 2009 figures to illustrate the change in this coveted population in recent years. Figure 1 shows that the number of super-wealthy in the world decreased from 2007 to 2009 by 165,000, or 18%, though we project the range of losses to fall between 11% and 24% depending on certain sensitivities. At the same time, the aggregate wealth controlled by these individuals also decreased by $15.8 trillion, or 14%, with a projected loss range of between 9% and 24% (Figure 2). Notably, this is the first time in nearly a decade that the high-net-worth ranks have gotten smaller rather than larger year over year.

By any measure, $16 trillion is a staggering loss and has undoubtedly spurred feelings of dismay, anger and resolve. An unscientific comparison of the World Wealth Report numbers cited above and our numbers seem to indicate that the percentage decrease among different segments of wealth is fairly consistent-people with $50 million lost the same percentage of their wealth as those with just $5 million, for example-but the dissipation of investable assets may be higher than that of net worth since net-worth figures often include illiquid and hard-to-value assets such as businesses, collectibles and real estate, whereas most invested assets are priced in real time.

The Bottom Line

The bad news is that there are fewer affluent prospects with less wealth to manage, which means competition for their business will intensify. Those who remain are surely still coping with the aftereffects of the losses and seeking ways to recapture their wealth. The good news is that it's still a sizable target market whose members both want and need the guidance of wealth managers and professional advisors-and may be more open to new ideas, new approaches and new professionals than ever before.

While change is afoot, many aspects of working with the super-rich remain constant and that will make it easier for conscientious advisors to respond effectively. Generally speaking, these financial elites value privacy and confidentiality in their social and professional relationships. The form and structure of their assets typically require complex, multi-part solutions and the input of third-party specialists. They are sensitive to taxes but haven't yet done all they can to mitigate their tax obligations. The same is true with estate planning, as ultra-affluent individuals cite the future financial security of their family and loved ones as a priority but do not regularly update their estate plans.

I'll offer you a final reminder: Although these estimates are well-constructed and thoughtful, they are subject to the effects of changing asset values, the state of the economy and the entrepreneurial drive of the wealthy-three things that have exhibited recent signs of improvement.

A Note About Analytical Modeling

Prince & Associates Inc. constructed the first analytic model to estimate the size and aggregate wealth of various segments of the high-net-worth universe in 2002. The model incorporates data from 68 different sources, all of which are focused on some aspect of working with or serving the exceedingly wealthy. These sources include think tanks, financial institutions, industry consultants, academics and government organizations. The model accounts for the role of the "underground economy" on private wealth creation and excludes wealth generated by illegal activities. The model was revised in 2009 to account for the actual and perceived differential in selected assets, such as business interests, real property and collectibles, and the change in status of specific tax havens.