Investors have preferred growth stocks for some years, but value stocks have enjoyed a nice bump higher year-to-date. Is this mean reversion a simple bounce or will the first quarter of 2016 mark the bottom for value stocks?

Over the past few years, some reliable themes have dominated equity markets. The financial crisis and sluggish global economic growth made defensive stocks naturally attractive to investors, who embraced characteristics such as quality, low volatility and growth. And recently, concerns about China and the sell-off in commodities exacerbated these themes as cyclicals sold off and growth’s outperformance of value widened to historically significant levels.

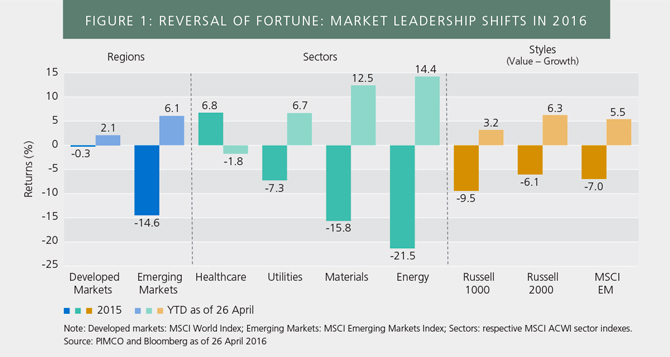

But in 2016 we’ve seen a complete reversal in market leadership across regions, sectors and styles. Emerging market equities, a long-time laggard, are well ahead of developed markets; last year’s top-performing sector, healthcare, is this year’s worst whereas utilities, materials and energy have rebounded sharply (See Figure 1). And value, so dominated by growth in recent years, is leading year-to-date, meaningfully so in small caps and emerging markets.

It is always difficult to identify the specific catalysts that drive a change in market leadership, but it appears that expectations of fundamentals are now more positive. Continued central bank actions from China, Europe and Japan, along with the U.S.’s patience on raising rates (thus reducing U.S. dollar strength), have helped macro sentiment. In addition, optimism that supply cuts in commodities will help pricing and rising PMIs (Purchasing Managers’ Indexes) will support cyclicals has contributed to this rotation away from defensive stocks. Hedge fund positioning also drove the sharpness of this reversal, as seen most clearly in March’s short squeeze of energy and materials.

Whether value stocks are back is a question that can only be answered over a longer period of time. But the market action of 2016 reinforces something important: Stock prices routinely overshoot fundamentals, with investors extrapolating recent data points (both positive and negative) into the future. Ultimately, mispricings are revealed and valuations normalize, so mean reversion can be a source of long-term excess returns.

Whatever the rest of 2016 holds, contrarian, value investors are off to a good start.

Andrew Pyne is an executive vice president and product manager in the PIMCO's Newport Beach, Calif., office, focusing on equity strategies.