Residential mortgage investments have always been a component of diversified investment portfolios. Typically they have been hidden within bond allocations, whether through a Ginnie Mae fund, an investment grade fund or a money-market fund. Rarely have they been considered a stand-alone asset class.

But that has all changed since the financial collapse of 2008. Residential mortgage securities are no longer the safe and sleepy assets favored by banks and insurance companies. Orphaned from their prior owners, they now trade at distressed prices, and that spells opportunity for many investors. All told, the changed nature of residential mortgage securities could be viewed as the arrival of a new asset class.

It's also important to note this isn't a market hiccup. Home price depreciation and mortgage defaults continue, and by some indicators, it could take years before the housing and mortgage markets normalize. It makes for an environment that skillful managers-particularly those managing hedge funds, which are more nimble and flexible than traditional investments-can navigate to their advantage.

In summary, today's residential mortgage market represents a stark change from the way things were just a few years ago, according to investment managers.

"I think probably most high-net-worth investors didn't even know it existed as an asset class" before the financial collapse, says Warren Paddock, director of investments at Bluffview Wealth Management.

Home Price Decline

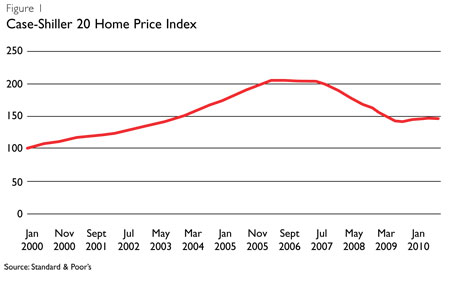

Fundamental housing metrics predominantly explain how residential mortgages went from being stable to distressed investments. The primary cause is the dramatic decline in nationwide home prices, illustrated by the S&P/Case-Shiller 20 Home Price Index. This index peaked in summer 2006 and has since fallen about 30% (Figure 1), triggering record default levels.

Quarterly foreclosure filings have increased from about 300,000 in 2006 to over 900,000 in 2010, according to RealtyTrac. "We're setting new records almost every day in terms of foreclosure activity," says Rick Sharga, senior vice president of RealtyTrac.

Declining home prices are also responsible for negative home equity, which has limited home sale and refinancing activity. A recent study by Moody's Mark Zandi and Yale University's Robert Shiller reports that 31% of mortgages were under water in 2010, compared with 5% in 2006.

While home prices have stabilized and in some cases improved in 2010, the gains may be temporary. In a recent survey by Macromarkets LLC, over 60% of economists, real estate experts and investment and market strategists expected home prices to decline in 2010. As a result of deteriorating fundamentals and continued pessimism, the residential mortgage market remains in distress.

The Best Offense: A Good Defense

These conditions may cause some to steer clear of residential mortgage securities, but for a growing number of investors, such pervasive market pessimism signals opportunity. "We get to assume that the U.S. real estate market in the short run continues to go down, just like the numbers reported in the press are indicating," says Marc Rosenthal, co-portfolio manager of FrontPoint Strategic Credit Strategy. Because the market expects that homeowners will continue to default, the price of non-agency residential mortgage backed securities (RMBS) already factors in continued home price depreciation. This cushion against continued economic weakness is further bolstered by structural credit enhancement, which Rosenthal calls "embedded protection" and a yield that often exceeds 10%. Rosenthal adds that RMBS offers attractive relative value. "In other fixed-income markets, like the corporate bond market and the high-yield market, it feels to us that the pricing is assuming that housing has bottomed," he says. "Even if home prices go down 10% from here, our product still offers the yield in excess of other fixed income products as well as cash flow."