Independent advisors are more successful than ever-and they can continue their strong pace of growth by increasingly focusing on strategic planning and other key drivers of success.

Schwab's 2012 RIA Benchmarking Study, with over 1,000 participants who collectively manage more than $425 billion in assets, reveals that advisors are enjoying strong growth despite significant challenges in the financial markets. In fact, many registered investment advisors (RIAs) that participated in the study last year achieved their highest levels of revenues and assets under management on record.

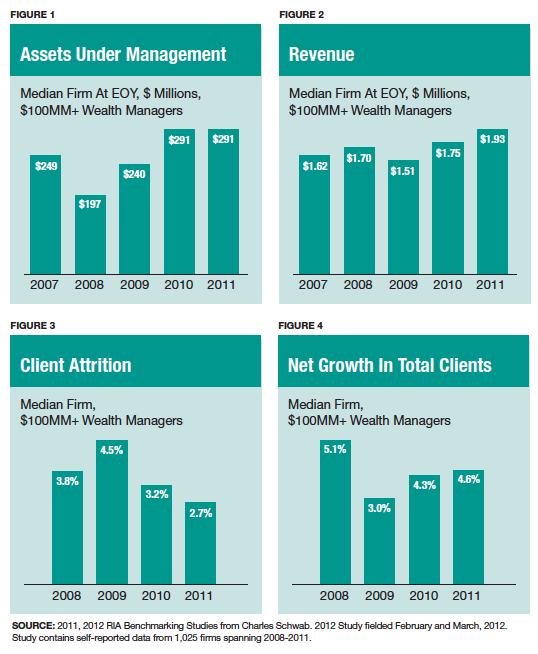

Among the key findings, advisors report that revenues at the median firm grew by 12% in 2011, while assets and clients increased by 4% and 5%, respectively. Profits increased with revenue growth rising by 14% at the median firm. Meanwhile, income per principal rose 5% to $340,000. Perhaps most impressive, client attrition was a mere 2.8% at the median firm-down from an already low 3.1% in 2010 and 4.1% in 2009. (See Figures 1-4.)

This is all great news. We see RIAs' passion for their core mission-doing what is best for their clients-as a driver of growth in the industry. As a result, the findings imply that more investors are recognizing the value of the RIA model. In 2011, RIA assets across the industry grew 3.3% while wirehouse assets fell 2.2%.1

That said advisors' businesses have become more complex in the wake of factors such as rising competition and greater expectations from their clients. To capture the opportunities of the future and overcome the biggest hurdles to growth, advisors can take a more holistic approach to managing their businesses-one that includes a focus on strategic planning-to differentiate themselves from a crowded playing field and take their businesses to even higher levels of profitability, productivity and growth.

Tackling Advisors' Biggest Concerns

Despite growth in recent years, one-third of the advisors in our 2012 study are not satisfied with their growth over the past three years. Moreover, the vast majority of firms (85%) have identified at least one barrier to their firms' growth. Addressing key challenges while managing profitable growth can be difficult, but we think advisors are well poised to tackle these three barriers.

Strategic Planning And Execution

Strategic planning has been under-utilized by advisors in the past. For example, more than half of the firms in the study don't currently have a strategic plan in place. In times of plenty, long-term strategic planning can feel like less of a necessity. However, it is increasingly becoming a hot-button issue and being recognized as a driver of success in today's environment. Strategy and planning is seen as a barrier to growth by nearly half (45%) of the advisors we surveyed-and while one in 10 advisors said that strategic planning and succession planning were their top strategic initiatives for the firm last year, this year that figure was one in seven. When we look at the best-managed firms, we see that nearly twice as many of those firms use a longer time horizon for their plans and rely on twice as many sources of research to build their plans as do less successful firms.2

This growing focus on high-level planning is being driven largely by the challenges of the marketplace, including fierce competition for investors' assets and continued uncertainty in the financial markets. What's more, the great success that advisors are enjoying has created many more "moving parts" in their businesses that require coordination.

A strategic plan can serve as the air traffic controller for RIAs' entire operations by helping them to organize their businesses and prioritize their goals and initiatives in areas from client service and internal operations to prospecting and even corporate governance. Advisors who have conducted strategic planning tell us that having a final plan helps them with decision-making, targeting the right opportunities and steering clear of distractions.

The majority of the largest, most successful firms have a strategic plan in place-for example, 64% of wealth managers with more than $1 billion in assets have a formal, written plan. For all firms of all sizes, setting priorities and gaining focus is critical whether or not there is a written plan in place. Accountability for implementation also becomes increasingly important. But, as firms grow and reach higher levels of complexity that demand more careful choices, strategic planning becomes a best practice and key driver of success.