Independent advisors are more successful than ever-and they can continue their strong pace of growth by increasingly focusing on strategic planning and other key drivers of success.

Schwab's 2012 RIA Benchmarking Study, with over 1,000 participants who collectively manage more than $425 billion in assets, reveals that advisors are enjoying strong growth despite significant challenges in the financial markets. In fact, many registered investment advisors (RIAs) that participated in the study last year achieved their highest levels of revenues and assets under management on record.

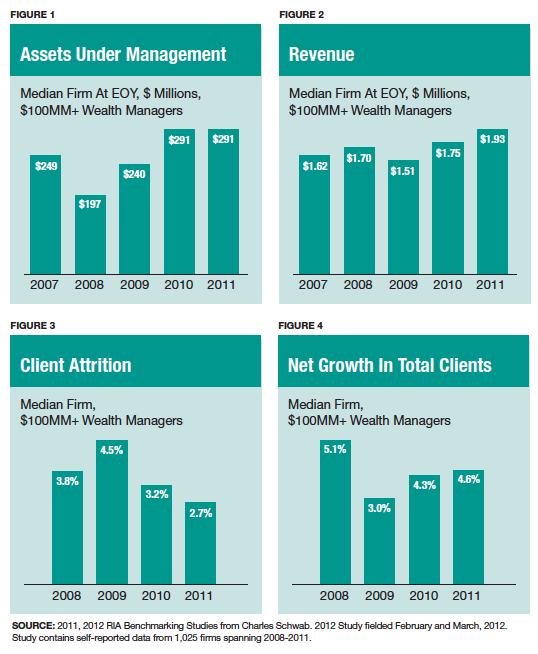

Among the key findings, advisors report that revenues at the median firm grew by 12% in 2011, while assets and clients increased by 4% and 5%, respectively. Profits increased with revenue growth rising by 14% at the median firm. Meanwhile, income per principal rose 5% to $340,000. Perhaps most impressive, client attrition was a mere 2.8% at the median firm-down from an already low 3.1% in 2010 and 4.1% in 2009. (See Figures 1-4.)

This is all great news. We see RIAs' passion for their core mission-doing what is best for their clients-as a driver of growth in the industry. As a result, the findings imply that more investors are recognizing the value of the RIA model. In 2011, RIA assets across the industry grew 3.3% while wirehouse assets fell 2.2%.1

That said advisors' businesses have become more complex in the wake of factors such as rising competition and greater expectations from their clients. To capture the opportunities of the future and overcome the biggest hurdles to growth, advisors can take a more holistic approach to managing their businesses-one that includes a focus on strategic planning-to differentiate themselves from a crowded playing field and take their businesses to even higher levels of profitability, productivity and growth.

Tackling Advisors' Biggest Concerns

Despite growth in recent years, one-third of the advisors in our 2012 study are not satisfied with their growth over the past three years. Moreover, the vast majority of firms (85%) have identified at least one barrier to their firms' growth. Addressing key challenges while managing profitable growth can be difficult, but we think advisors are well poised to tackle these three barriers.

Strategic Planning And Execution

Strategic planning has been under-utilized by advisors in the past. For example, more than half of the firms in the study don't currently have a strategic plan in place. In times of plenty, long-term strategic planning can feel like less of a necessity. However, it is increasingly becoming a hot-button issue and being recognized as a driver of success in today's environment. Strategy and planning is seen as a barrier to growth by nearly half (45%) of the advisors we surveyed-and while one in 10 advisors said that strategic planning and succession planning were their top strategic initiatives for the firm last year, this year that figure was one in seven. When we look at the best-managed firms, we see that nearly twice as many of those firms use a longer time horizon for their plans and rely on twice as many sources of research to build their plans as do less successful firms.2

This growing focus on high-level planning is being driven largely by the challenges of the marketplace, including fierce competition for investors' assets and continued uncertainty in the financial markets. What's more, the great success that advisors are enjoying has created many more "moving parts" in their businesses that require coordination.

A strategic plan can serve as the air traffic controller for RIAs' entire operations by helping them to organize their businesses and prioritize their goals and initiatives in areas from client service and internal operations to prospecting and even corporate governance. Advisors who have conducted strategic planning tell us that having a final plan helps them with decision-making, targeting the right opportunities and steering clear of distractions.

The majority of the largest, most successful firms have a strategic plan in place-for example, 64% of wealth managers with more than $1 billion in assets have a formal, written plan. For all firms of all sizes, setting priorities and gaining focus is critical whether or not there is a written plan in place. Accountability for implementation also becomes increasingly important. But, as firms grow and reach higher levels of complexity that demand more careful choices, strategic planning becomes a best practice and key driver of success.

Additionally, it has been shown that strategic planning helps firms define a roadmap to achieve long-term value in their firm, focuses firms on profitable growth, ensures consistency and alignment between firms' initiatives and staff, and helps direct decisions on investments and resources.

Bringing In New Business

A full 72% of advisors surveyed identified at least one barrier to growth related to marketing and business development-making it the biggest area of concern for advisors today. Indeed, advisors' report that their top strategic initiatives for the year ahead focus on getting referrals from clients (25%) and strategic partners (16%).

Many advisors, even the largest and most successful, typically want to keep growing their businesses at a steady pace. In the current environment, generating that growth requires more time and effort. Another striking finding from the study was that advisors' median cost of gathering $1 million in new assets rose to $4,450 in 2011, up from $3,730 in 2010. Essentially, the cost of acquiring new clients increased by nearly 20%.

One reason for the higher costs in bringing in new clients is that the sales cycle has lengthened. Clients are taking their time to select their advisors and invest their assets-requiring advisors to spend more time and effort to land new business. Additionally, as firms grow, they often must navigate the transition from having a single rainmaker at the center of the firm to sharing the role among others on the team.

A solution to develop more profitable clients could be to make client segmentation part of a firm's strategic plan. Using client segmentation (the right support for each client) and a well-defined value proposition (what a firm has to offer) can help advisors identify and target ideal clients. Segmenting also helps firms analyze and optimize client profitability and cost to serve, allocate resources more effectively, evaluate pricing models, find the right people and staff to hire to grow profitably and focus on targeted growth, and create a strong career path for employees. Currently, 42% of advisors report that they have a client segmentation plan in place-a significant percentage, but also evidence that there are many advisors who still could be leveraging this key best practice. Again, in this environment, a higher level of precision can be rewarded.

Improving Firm Productivity

Nearly half (47%) of advisors see client service and operations as a barrier to their growth. As part of their efforts, 23% of firms said that "investing in technology to support firm productivity" was one of their top three strategic initiatives. Meanwhile, the percentage of firms utilizing productivity-enhancing technologies continued to increase across the industry. The average RIA firm now uses 5.4 technologies out of 8 included in the study, up from 4.4 technologies three years ago.

That said, simply adding more technology doesn't automatically generate big benefits. One key to successfully gaining efficiencies through technology is to fully leverage the technology that's currently in place and maximize its value. RIAs often find that they can achieve important productivity goals by making better use of their existing systems, and many top firms focus largely on how they can get more out of what they have. For example, they might align internal procedures and workflow with their technologies, and integrate their various systems (client relationship management "CRM," portfolio management, document management) to achieve significant productivity gains that in turn can help boost profit margins.

Advisors also continue to look to outsourcing to operate efficiently and focus on core competencies such as client service. The 2012 study shows that outsourcing data management has increased from 19% to 30% of firms over the past two years. Outsourcing client reporting increased from 15% to 20% over that same time frame, and outsourcing client invoicing increased from 8% to 13% of firms.

Here again, strategic planning can help guide decisions regarding effective technology spending and usage as well as which operational functions may be good candidates for outsourcing and how to best prioritize these choices.

Plan Now For The Road Ahead

While there are numerous growth opportunities in the RIA space, capturing that growth in an increasingly competitive, ever-changing environment will not be easy. The advisors who will best position themselves for the future will be those who identify the specific barriers to growth and opportunities within their own firms and begin addressing them right away.

For a growing number of RIAs, this process can include holistic, strategic planning that can guide multiple business initiatives across the enterprise. The complexities of the marketplace will require more advisors to think strategically and craft long-term plans to capture emerging growth markets, achieve key productivity gains by investing in business operations and continue to provide the type of exceptional client service that has been the foundation of their huge success to date. Advisors who create plans that reflect where they stand today and where they wish to go can give themselves a clear and visible guide that can keep them on point to their goals.

Advisors' future success will depend on how well they navigate the challenges and opportunities of an increasingly complex world. Of course, advisors for decades have consistently proved their ability to do just that extraordinarily well-and generate meaningful success for their clients, their teams and themselves along the way.

The road ahead looks just as promising.

Jon Beatty is senior vice president of Schwab Advisor Services, a leading provider of custodial, operational and trading support for nearly 7,000 investment advisory firms.

1 New Realities in Wealth Management: Firms at a Standstill, Investors in Flux, Aite, May 012.

2 Best-Managed Firms are the top 20% of firms in the study as defined by profitability, productivity and organizational leverage.