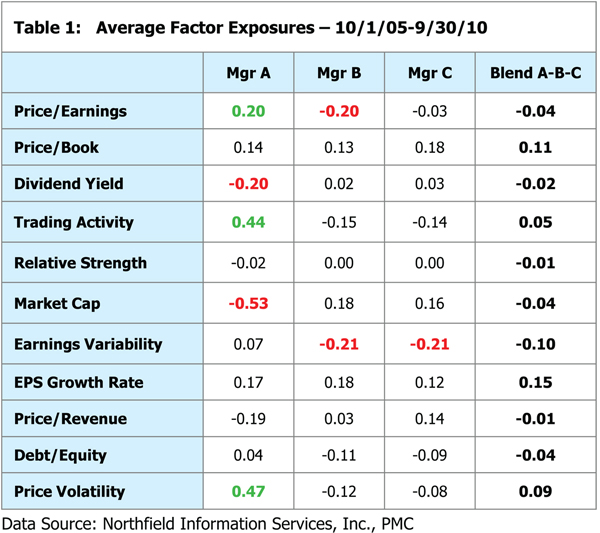

Table 1 below shows how combining managers in a portfolio can result in neutralized factor exposures. According to the Northfield risk model, there are 11 fundamental factors which are the sources of a portfolio's active return. These include such metrics as Price/Earnings, Price/Book and Dividend Yield; EPS Growth Rate; and Market Cap, to name a few. The active exposures in the table are presented relative to the underlying benchmark, in this case the Russell 1000 Value Index. A widely used rule of thumb is that relative exposures of greater than +/- 0.20 are generally considered meaningful. For example, Table 1 shows Manager A having a +0.20 relative exposure to Price/Earnings, meaning that compared to the benchmark, Manager A owns higher P/E stocks. Manager B, on the other hand, owns stocks with a lower P/E on average than the benchmark, as exhibited by its -0.20 exposure. Manager C's weighted average P/E is relatively neutral to the benchmark.

One of the benefits that accrue from combining managers also comes to light in Table 1. Even though the managers individually exhibit meaningful exposures to certain factors, when blended together, the exposures can offset each other. For the Blend A-B-C, a portfolio equally weighted between the three managers, there are no meaningful exposures, meaning that risk factors should not be a key determinant of whether the blended portfolio outperforms or underperforms the benchmark.

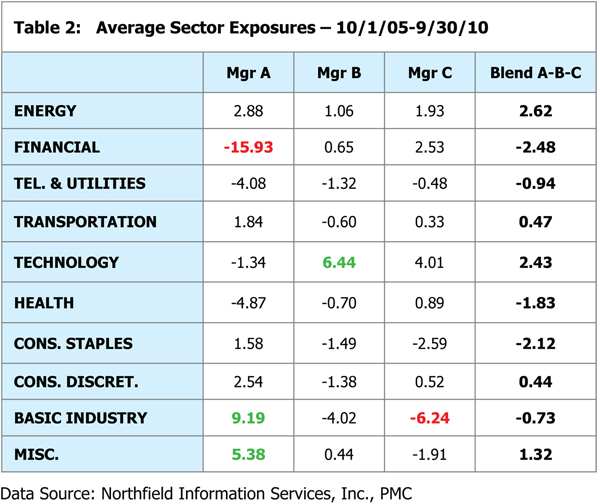

In a similar way, sector exposures can also be effectively neutralized by combining managers of the same asset class in an equal-weighted portfolio. Table 2 displays the average sector over- and underweights relative to the benchmark for a recent five-year period, with relative weights of +/- 5% highlighted. As is evident, Manager A tended to have meaningful sector exposures during this period, while Managers B and C managed sector weights somewhat closer to the benchmark. But each of the individual managers' relative sector exposures can be mitigated in a portfolio context. For example, Manager A's large underweight to Financials is offset by the neutral-to-slightly-overweight positions of Managers B and C, so that the Blend A-B-C portfolio has only a slight underweight to that particular sector. Across the board, the blend's sector weights are in line with the benchmark, meaning the portfolio's relative performance should not be driven by sector bets.

A "Free Lunch"?

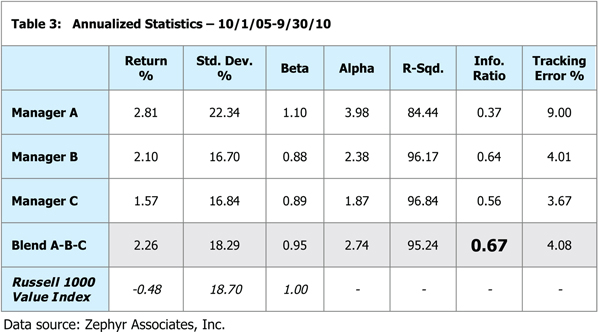

The benefit of offsetting risk exposures by combining managers is perhaps most evident when assessing a portfolio's risk-adjusted returns. Table 3 below shows portfolio characteristics for Managers A, B and C individually, as well as for Blend A-B-C and the benchmark.

During the five-year period ended 9/30/10, each of the managers outperformed the benchmark Russell 1000 Value Index, and Managers B and C did so with less volatility than the benchmark. Manager A delivered the highest return, but was more volatile than the benchmark and the other managers, and based on its tracking error of 9.0%, it is apparent that it was less concerned about tracking the benchmark, a characteristic confirmed by the factor and sector exposures in Tables 1 and 2. Managers B and C more closely adhered to the benchmark, but did not generate the same level of active returns as Manager A.

Information ratio is a widely used measure of how well a manager performs on a risk-adjusted basis, and is calculated by dividing the active return by the tracking error. The higher the ratio, the greater the active return a manager achieves for each unit of risk undertaken. All three of the managers individually generated impressive information ratios ranging from 0.37 to 0.64 during the period.

Blend A-B-C demonstrates excellent combined statistics, with solid active return and mitigated volatility. But the real power of diversification is apparent in the information ratio: Blend A-B-C's information ratio was actually higher than any of its constituent managers, meaning the blend generated a higher risk-adjusted return than the individual managers. In essence, diversification across managers within an asset class can result in a "free lunch."