They should also be prepared for times when a “hot” sector that the fund is not invested in moves ahead and the fund falls behind.

Macauley says some financial advisors use his fund as “an alpha generating satellite around passive core holdings.” Others use it in conjunction with a handful of other focus funds run by skilled managers with strong track records. Since holdings among these types of funds rarely overlap, using several is a way to replace a highly diversified core equity fund, he says.

Making The Cut

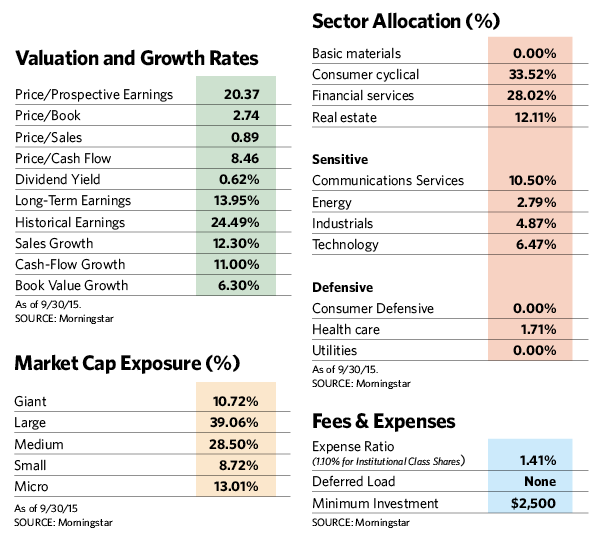

In the Hennessy Focus Fund, the managers look for small and mid-cap growth businesses that are likely to grow earnings per share and cash flow at a rate at least in the mid-teen percentage area and that are selling at attractive valuations. The companies must also have a strong competitive niche, offer compensation incentives that benefit both their managements and shareholders and operate in industries with growth potential.

“We are also thoughtful about avoiding disasters,” says Macauley. “That means avoiding companies with too much leverage, that depend on some fad or fashion, that are hard to understand, or that carry regulation or litigation risk.”

Unlike many funds, this one doesn’t “trade around” positions by selling portfolio stocks when their price is high and buying them back in the future at a lower cost. Macauley says that strategy, which generates trading costs and tax liabilities, “isn’t worth the possibility of picking up a few extra basis points. The majority of our returns have come from a handful of businesses we’ve held for a long time.”

But the managers will sell when the original premise for investing is fading. That happened in late 2014 when it exited a long-held position in T. Rowe Price as the migration from active to passive investing began taking a toll on the company’s business. “This is an outstanding, well-run organization with great management,” he says. “But the headwinds from the move to passive investing aren’t going to dissipate.”

Stocks in the fund often start out with a small weighting of 3% of assets. The managers might do this because they want to move in slowly or because a company is very small and the fund cannot accommodate a larger allocation. A stock might have a medium-level weighting of 3% to 6% if the fund has a high level of confidence in the company’s long-term business prospects and the stock is reasonably priced. The largest weightings, 6% or more of fund assets, are reserved for the highest conviction picks in terms of price and prospects. These large weightings typically compose more than half of portfolio assets.

Sector weightings also deviate substantially from those of the benchmark. Right now, the fund is heavily skewed toward the financial sector (which represents 44.7% of assets) and consumer discretionary (which represents 26.5%). Macauley says the fund’s seemingly narrow focus is somewhat misleading because of the way the industry wedges companies with divergent characteristics into the same sector classification. He cites fund holding American Tower. Because the company leases cell phone towers, the stock falls into the financial REIT classification, which puts it in the same sector bucket as asset managers, brokerages and insurance companies. Yet all these companies have very different characteristics and risk profiles.

Brookfield Asset Management, a holding in the financial sector category, was added to the portfolio in early 2014 and is now a top holding. The firm owns and manages “real” assets such as office buildings, power lines and toll roads for pension plans and other institutional investors. Macauley says its business is growing as these investors continue to move more assets to this increasingly popular real asset category. “Brookfield is a global business with tens of thousands of employees and an expertise in this type of investing,” he says. “It’s hard to replicate what they do.”

One of the fund’s newer additions, Hexcel Corp., became part of the portfolio in early 2015. A leading producer of carbon fiber for high-performance aerospace and industrial applications, the company has become a global powerhouse in an industry with high barriers to entry, requiring the companies within it to meet federal aircraft quality specifications and boast formidable intellectual property rights. With Boeing and Airbus competing to make lighter, more durable and more fuel-efficient aircraft, and other aerospace customers increasingly using carbon fiber and other advanced materials instead of aluminum, Hexcel should see a midteens rate of earnings growth over the next five years.

Among the Hennessy Focus Fund’s longtime holdings is O’Reilly Automotive, the third-largest auto parts retailer in the U.S. As of September 30, the stock, which has been in the portfolio for over a decade, accounted for 11% of fund assets. Earnings per share at the company have grown at an annualized rate of 20% since O’Reilly Automotive became part of the portfolio, and the stock has appreciated at a similar pace.

The company has 4,400 stores, up from 1,300 stores 10 years ago, and Macauley believes that the number could increase to between 6,000 and 7,000. The company has stronger buying power than many of its smaller competitors and a highly efficient distribution system, and these advantages continue to give it a leg up. The company’s strong management should continue to find ways to uncover value.

Another long-timer, kitchen cabinet manufacturer American Woodmark, made its debut in the portfolio in 2003. One of the top three kitchen cabinetmakers in the U.S., the company is benefiting from an uptick in demand for its products as new home construction and remodeling projects rebound. Unlike many of its more leveraged competitors, American Woodmark has a strong cash position and is building market share.

CarMax has been in the portfolio since 2004. The company, which has 150 used car stores around the country, provides a better, no hassle car-buying experience because its prices are fixed and it has a wider selection than a typical dealer selling trade-ins. Its market share has grown from 1% 15 years ago to 4% today, and Macauley thinks it’s well on the road to doubling its store base.