While more and more money flows into index funds, active management’s bright spot over the past few years has been so-called smart beta funds. According to BlackRock, 25% of all new money flowing into stock funds found its way into smart beta funds in 2014. And according to a November 2015 article on ETF.com, smart beta ETFs took in around $52 billion or 30% of all flows into ETFs for 2015 to that point.

Delink Size And Portfolio Weight

Smart beta strategies are considered to sit somewhere between indexing and active management. The strategies try to beat the S&P 500 by tracking a different index that doesn’t rank funds on market capitalization or sheer size. The new indexes don’t accept the market as it presents itself, with the largest stocks occupying the highest positions of rank. Therefore, smart beta funds are passive in following an index, but active in not following a “capitalization weighted” index.

Smart beta indexes are based on historical performance back tests and studies run by academics on various “factors” or characteristics of stocks. A successful back test often leads to the creation of a new index based on the factor that appeared successful in hindsight. The factors are often related to value (low price/earnings or low price/book values), dividends, size, low volatility or price momentum.

A white paper from Research Affiliates in Newport Beach, Calif., says breaking the link between market capitalization and rank in an index or portfolio is the defining feature of smart beta strategies. Therefore, smart beta tries to exploit the defect inherent in capitalization-weighted indexing—that more popular stocks gain more prominence in the index and garner more investment dollars. Research Affiliates’ founder, Robert Arnott, is the creator of a “fundamental index” that ranks stocks on their companies’ economic footprint—sales, cash flow, dividends and book value—and has been used in the first smart beta funds such as the Pimco RAE Fundamental Plus Fund (PXTIX).

Disparity Of Short-Term Returns

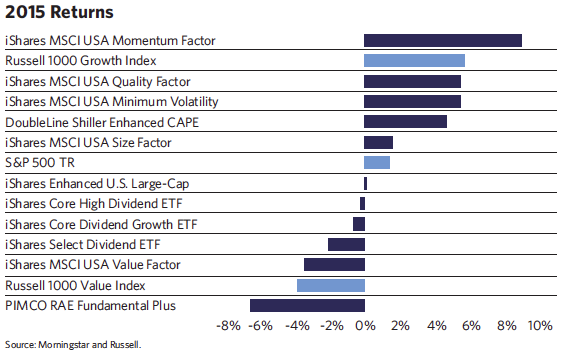

The proliferation of smart beta funds might be confusing more than helping investors, so it is important to see how they’ve behaved recently. Nobody should make an investment decision on one-year’s worth of performance, but a glance at 2015 returns shows how disparate different smart beta factors can be. A factor that has worked in a back test or even in a live fund over a long period of time isn’t guaranteed to work every year or even over every market cycle.

For example, 2015 results using the iShares suite of smart beta funds show a meaningful disparity of returns between those that are value and dividend oriented and those that are growth, momentum or quality oriented. Besides the iShares suite of ETFs, the chart also includes the S&P 500, Russell 1000 Value and Russell 1000 Growth indexes, in addition to two popular mutual funds, the aforementioned Pimco fund and the DoubleLine Shiller Enhanced CAPE fund (DSEEX).

The chart shows that three iShares dividend-focused smart beta ETFs lost between 2% and 4% in 2015. By contrast, funds organized around minimum volatility, quality and momentum factors all returned 5.5% or better for the year. It’s evident, as well, that the strategies can cluster around simple growth and value characteristics and indexes. The lagging group clustered around the Russell 1000 Value index, while the outperforming group clustered around the Russell 1000 Growth Index.

The Pimco mutual fund, which weights stocks on sales, cash flow, book value and dividends, lost more than 6% for the period. By contrast, the S&P 500 gained 1.4%. The fund weights stocks on their economic footprint rather than on an explicit value factor. That emphasis gives it a value and small size tilt relative to the S&P 500.

The DoubleLine fund is unique in that it combines an explicit value strategy with a momentum filter that has spared it the underperformance of its value-oriented brethren. (We’ll discuss this fund in greater detail later.)

Sector Risk

Investors surveying the field of smart beta funds should understand that one sector can make or break a group of funds over the short term, and that’s mostly what happened last year. One reason many dividend funds and value funds are lagging behind this year is their exposure to energy.

The iShares Select Dividend ETF (DVY) and iShares Core High Dividend ETF (HDV) have 8.6% and 20.3% of their portfolios, respectively, invested in energy. The S&P 500 index, in contrast, consists of about 6% energy.

Similarly, the Pimco fund reports an overweight in Chevron. In fact, ExxonMobil is its largest stock holding, while Chevron is No. 6. Both stocks are big dividend payers, with Exxon yielding 3.8% and Chevron 5.2%. Exxon lost nearly 13% for the year through September, while Chevron was off around 16%.

Combining Value And Momentum

However, the Pimco fund has a good 10-year record. Though its energy exposure has hurt lately, it produced an 11.7% compounded annualized return for its first decade of existence through the end of June 2015 while the annualized return for the S&P 500 was only 7.9%. The fund’s recent stumble shows that investors may have to tolerate short-term sector risk to reap the longer-term rewards of individual factors.

Another strategy for managing short-term sector risk is to invest in several funds that focus on different factors. For example, investors may want to own a momentum or quality fund together with a value or dividend fund much in the same way other asset allocations combine growth and value funds. There is no guarantee that the different factors will provide diversification, but value-factor funds often own sectors that have dropped while momentum-factor funds own sectors that are rising.

Providers such as iShares have made it easy to combine factors in a single fund with such products as the iShares FactorSelect MSCI USA ETF (LRGF), which focuses on value, quality and momentum and tilts toward smaller companies in the large-cap and mid-cap universe. It was launched last spring and returned negative 1.7% cumulatively from May through the end of 2015, while the S&P 500 gained 4.5% over the same period.

Value With A Twist

Unlike the iShares Factor Select ETF, which combines various factors, the DoubleLine fund combines a value factor with a momentum filter to achieve a steadiness arguably lacking in a one-factor strategy.

Managed by Jeffrey Sherman and bond expert Jeffrey Gundlach, the fund invests in the Barclays Shiller CAPE U.S. Sector Index, which gives it exposure to the cheapest S&P 500 sectors measured by the “cyclically adjusted P/E,” also known as CAPE or the Shiller P/E. This metric is most famous for judging the valuation of the entire S&P 500 index by comparing its price with its past 10 years’ real, average earnings.

The Barclays index applies the Shiller P/E methodology to each of the 10 sectors of the S&P 500 index, identifying the five cheapest sectors initially. Then, in a final step, the fund rejects the sector with the worst one-year price momentum.

Value purists might prefer to simply own the cheapest sectors. But by rejecting the sector tumbling the hardest—in other words, by using the momentum filter—the fund has shielded itself from energy’s continuing slide for the past year and a half (the sector, after all, scored well on valuation after its initial drop).

Another twist: Like the Pimco fund, this one uses bond investments as collateral to gain its stock exposure through derivatives. The fund pays banks a modest sum—something like the rate on a short-term loan—for the stock exposure it seeks through the Barclays derivative. The fund then invests its assets in a bond portfolio that seeks to overcome the cost of the derivative. If its bond portfolio succeeds, the fund gains an extra source of return.

The DoubleLine Enhanced Shiller CAPE fund has amassed more than $650 million in assets in the nearly 27 months of its existence, and it has done so for good reason. It has finished in the top percentile of the Morningstar large value category for each of its first two full calendar years, 2014 and 2015. Over those two years, it has produced an annualized return of 11.1% while the S&P 500’s was 7.4%.

The fund’s value filter, which has kept it out of energy, is a major part of its early success. If and when energy rebounds, the fund will likely miss some of the bounce, but that may be a modest price to pay for the momentum filter’s protection against value traps.

Active Management Makes An Entrance

Besides combining factors (or, in DoubleLine’s case, a factor and a filter), investors can also choose from an increasing array of products where active managers weigh different factors at their discretion.

For example, iShares has also issued the iShares Enhanced U.S. Large Cap ETF (IELG), which, though based on smart beta factors, relies on the judgment of its managers for portfolio construction. According to information provided by iShares, this fund screens for stocks that score best on rankings for three smart beta factors—quality, value and size. That part of the process is mechanical and rules-based.

Then, however, the portfolio managers adjust the resulting portfolio to avoid sector, industry or stock overweights and to ensure diversification. Also, an internal investment committee meets quarterly to monitor the allocations.

But does this manager discretion defeat the purpose of the rules-based approach? The managers may or may not add value, but, either way, investors are no longer making a pure bet on a back-tested model that has identified historically successful factors.

In other words, you’re arguably back to ordinary active management.