The iShares Select Dividend ETF (DVY) and iShares Core High Dividend ETF (HDV) have 8.6% and 20.3% of their portfolios, respectively, invested in energy. The S&P 500 index, in contrast, consists of about 6% energy.

Similarly, the Pimco fund reports an overweight in Chevron. In fact, ExxonMobil is its largest stock holding, while Chevron is No. 6. Both stocks are big dividend payers, with Exxon yielding 3.8% and Chevron 5.2%. Exxon lost nearly 13% for the year through September, while Chevron was off around 16%.

Combining Value And Momentum

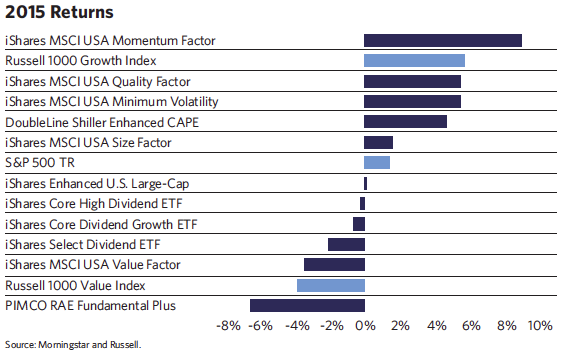

However, the Pimco fund has a good 10-year record. Though its energy exposure has hurt lately, it produced an 11.7% compounded annualized return for its first decade of existence through the end of June 2015 while the annualized return for the S&P 500 was only 7.9%. The fund’s recent stumble shows that investors may have to tolerate short-term sector risk to reap the longer-term rewards of individual factors.

Another strategy for managing short-term sector risk is to invest in several funds that focus on different factors. For example, investors may want to own a momentum or quality fund together with a value or dividend fund much in the same way other asset allocations combine growth and value funds. There is no guarantee that the different factors will provide diversification, but value-factor funds often own sectors that have dropped while momentum-factor funds own sectors that are rising.

Providers such as iShares have made it easy to combine factors in a single fund with such products as the iShares FactorSelect MSCI USA ETF (LRGF), which focuses on value, quality and momentum and tilts toward smaller companies in the large-cap and mid-cap universe. It was launched last spring and returned negative 1.7% cumulatively from May through the end of 2015, while the S&P 500 gained 4.5% over the same period.

Value With A Twist

Unlike the iShares Factor Select ETF, which combines various factors, the DoubleLine fund combines a value factor with a momentum filter to achieve a steadiness arguably lacking in a one-factor strategy.

Managed by Jeffrey Sherman and bond expert Jeffrey Gundlach, the fund invests in the Barclays Shiller CAPE U.S. Sector Index, which gives it exposure to the cheapest S&P 500 sectors measured by the “cyclically adjusted P/E,” also known as CAPE or the Shiller P/E. This metric is most famous for judging the valuation of the entire S&P 500 index by comparing its price with its past 10 years’ real, average earnings.

The Barclays index applies the Shiller P/E methodology to each of the 10 sectors of the S&P 500 index, identifying the five cheapest sectors initially. Then, in a final step, the fund rejects the sector with the worst one-year price momentum.

Value purists might prefer to simply own the cheapest sectors. But by rejecting the sector tumbling the hardest—in other words, by using the momentum filter—the fund has shielded itself from energy’s continuing slide for the past year and a half (the sector, after all, scored well on valuation after its initial drop).

Another twist: Like the Pimco fund, this one uses bond investments as collateral to gain its stock exposure through derivatives. The fund pays banks a modest sum—something like the rate on a short-term loan—for the stock exposure it seeks through the Barclays derivative. The fund then invests its assets in a bond portfolio that seeks to overcome the cost of the derivative. If its bond portfolio succeeds, the fund gains an extra source of return.

The DoubleLine Enhanced Shiller CAPE fund has amassed more than $650 million in assets in the nearly 27 months of its existence, and it has done so for good reason. It has finished in the top percentile of the Morningstar large value category for each of its first two full calendar years, 2014 and 2015. Over those two years, it has produced an annualized return of 11.1% while the S&P 500’s was 7.4%.

The fund’s value filter, which has kept it out of energy, is a major part of its early success. If and when energy rebounds, the fund will likely miss some of the bounce, but that may be a modest price to pay for the momentum filter’s protection against value traps.

Active Management Makes An Entrance

Besides combining factors (or, in DoubleLine’s case, a factor and a filter), investors can also choose from an increasing array of products where active managers weigh different factors at their discretion.

For example, iShares has also issued the iShares Enhanced U.S. Large Cap ETF (IELG), which, though based on smart beta factors, relies on the judgment of its managers for portfolio construction. According to information provided by iShares, this fund screens for stocks that score best on rankings for three smart beta factors—quality, value and size. That part of the process is mechanical and rules-based.

Then, however, the portfolio managers adjust the resulting portfolio to avoid sector, industry or stock overweights and to ensure diversification. Also, an internal investment committee meets quarterly to monitor the allocations.

But does this manager discretion defeat the purpose of the rules-based approach? The managers may or may not add value, but, either way, investors are no longer making a pure bet on a back-tested model that has identified historically successful factors.

In other words, you’re arguably back to ordinary active management.