Gold fund shares are primarily influenced by supply and demand factors. While demand is often the more popular aspect to focus on, supply is an important driver of gold prices as well. After all, gold's scarcity leads to its value. Thus we thought we would examine the state of gold production in the United States via the U.S. Geological Service report below. From the report we are able to make several interesting observations about the location and production of gold in America.

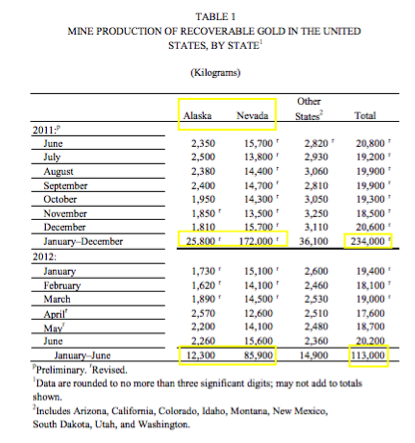

First, two states constitute the majority of the production of gold in the United States - Alaska and Nevada. While Alaskan gold opportunities are currently in the headlines due to Discovery Channel's Gold Rush reality series, it is clear the real gold rush is in Nevada. In 2011, Nevada accounted for 73.5 percent of all gold production in the country. Its next closest competitor, Alaska, only managed a 10.6 percent share of production. Even more telling is that the following states -- Arizona, California, Colorado, Idaho, Montana, New Mexico, South Dakota, Utah and Washington - combined gold production produced less than 16% of the gold taken from U.S. soil. Nevada is in both senses of the word, a gold mine for the U.S.

Second, the gold production numbers in 2012 are currently behind the pace set in 2011 by about 3.5 percent. While gold production isn't exactly an evenly paced endeavor, this downturn in production is bullish for gold fund investors. In 2011 the United States was the third-largest producer of gold behind Australia and gold production leader China. The U.S. was responsible for close to 10 percent of worldwide gold production. Below is the 2011 gold production numbers by country sourced from the USGS via Wikipedia.

Gold Fund Takeaways

Going forward, gold fund investors in products like the SPDR Gold Trust (GLD) and the iShares Gold Trust (IAU) should keep an eye on U.S. gold production rates. They have the potential to materially influence the supply side of gold prices and hence the value of gold fund shares.

Christian Magoon is the publisher of ETF Web sites GoldETFs.biz and IndiaETFs.com.