Greg Levinson describes the launch of the Schooner Fund in the summer of 2008 as "both fortuitous and terrible." It's easy to understand the latter description. Within two weeks of the fund's inception, Lehman Brothers collapsed, triggering a wave of nausea among financial institutions and ushering in the Great Recession. The stock market, already on a downward path, followed suit with devastating swiftness. In the fund's first full quarter, the S&P 500 plunged 22%.

The fortuitous part was Schooner's relatively mild 7% drop during the same period. By employing an active and aggressive buy-write options strategy on individual securities and using other hedge-fund-like techniques, Schooner sailed through the worst of the worst with considerably less damage than the vast majority of its peers.

"The market downturn in 2008 was actually beneficial to us in some ways because it showed the real-life advantages of limiting downside risk," says the 38-year-old portfolio manager, who has spent most of his career in the hedge fund world. "Without a massive decline, the protection the fund offers would have been theoretical. Now, there is solid market data to prove the strategy's efficacy." The ultimate goal, he says, is to capture 80% of the market's upside but only half of its downside.

Playing It Safer

Levinson believes the current market environment is an excellent one for investors to consider hedging their stock market bets.

"The Fed's quantitative easing that began last year has provided a lot of support for the stock market," he says. "But that is coming to an end, as are the myriad of government stimulus programs that have provided a tailwind for the economy and the equity markets."

He thinks it's unlikely that additional stimulus or quantitative easing measures will continue. "Government stimulus and monetary policy produced a kind of coma that made it possible for the market to do well on life support. There's been no free market for almost two years. Now it's time to see if the patient can survive on its own."

He believes that the stock market will end the year higher than it stood at midyear, although he says there will likely be a "meaningful

hiccup" along the way. "I'm not seeing a 25% pullback," he says. "But something along the lines of 10% to 15% is certainly possible."

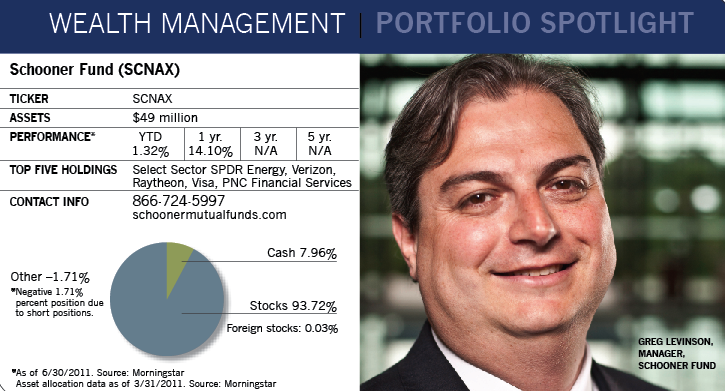

So far the fund, which is coming up on its three-year anniversary, has deftly navigated such pullbacks, and worse. Over a period that has included a devastating bear market, a long bullish stretch and lots of smaller ups and downs in between, the Schooner Fund has managed to outpace many of its stock fund competitors but also offer investors a less bumpy ride along the way.

From its inception to the end of May 2011, a $10,000 investment in the fund would have grown to $12,191, compared to $10,668 for the index. In the depths of the market collapse between August 2008 and the end of February 2009, a $10,000 investment in the S&P 500 would have fallen to $5,817, while an investment in Schooner would have kept $8,059.

In return for downside protection, though, investors must be prepared for periods of underperformance in a sharply rising market. In the first quarter of 2011, for example, the fund was up 1.10%, compared to nearly 6% for the S&P 500. In calendar year 2010, it rose 9.3%, versus 15% for the index.

The fund uses a number of hedging strategies to even out returns, and over the last three years Levinson has focused mainly on buy-write options. Also known as covered calls, these allow investors to write, or sell, a call option contract while at the same time owning an equivalent number of shares of the underlying stock. Since the investor already owns the stock, the obligation is fully collateralized. By writing options, Levinson aims to earn premium income, and that can help cushion portfolio volatility.