Greg Levinson describes the launch of the Schooner Fund in the summer of 2008 as "both fortuitous and terrible." It's easy to understand the latter description. Within two weeks of the fund's inception, Lehman Brothers collapsed, triggering a wave of nausea among financial institutions and ushering in the Great Recession. The stock market, already on a downward path, followed suit with devastating swiftness. In the fund's first full quarter, the S&P 500 plunged 22%.

The fortuitous part was Schooner's relatively mild 7% drop during the same period. By employing an active and aggressive buy-write options strategy on individual securities and using other hedge-fund-like techniques, Schooner sailed through the worst of the worst with considerably less damage than the vast majority of its peers.

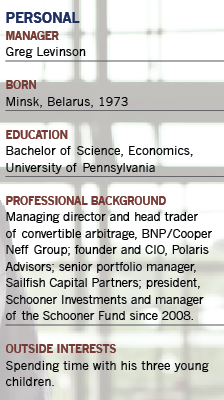

"The market downturn in 2008 was actually beneficial to us in some ways because it showed the real-life advantages of limiting downside risk," says the 38-year-old portfolio manager, who has spent most of his career in the hedge fund world. "Without a massive decline, the protection the fund offers would have been theoretical. Now, there is solid market data to prove the strategy's efficacy." The ultimate goal, he says, is to capture 80% of the market's upside but only half of its downside.

Playing It Safer

Levinson believes the current market environment is an excellent one for investors to consider hedging their stock market bets.

"The Fed's quantitative easing that began last year has provided a lot of support for the stock market," he says. "But that is coming to an end, as are the myriad of government stimulus programs that have provided a tailwind for the economy and the equity markets."

He thinks it's unlikely that additional stimulus or quantitative easing measures will continue. "Government stimulus and monetary policy produced a kind of coma that made it possible for the market to do well on life support. There's been no free market for almost two years. Now it's time to see if the patient can survive on its own."

He believes that the stock market will end the year higher than it stood at midyear, although he says there will likely be a "meaningful

hiccup" along the way. "I'm not seeing a 25% pullback," he says. "But something along the lines of 10% to 15% is certainly possible."

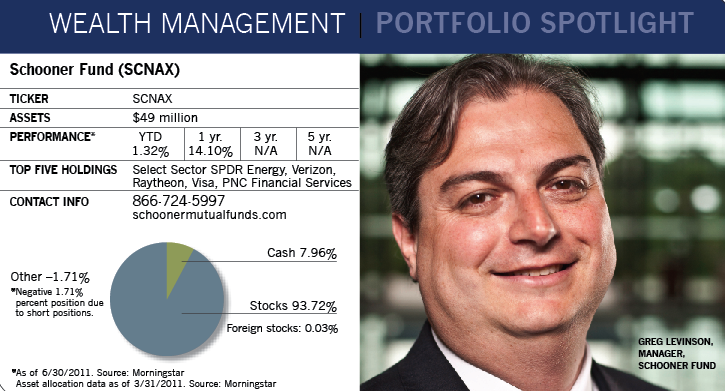

So far the fund, which is coming up on its three-year anniversary, has deftly navigated such pullbacks, and worse. Over a period that has included a devastating bear market, a long bullish stretch and lots of smaller ups and downs in between, the Schooner Fund has managed to outpace many of its stock fund competitors but also offer investors a less bumpy ride along the way.

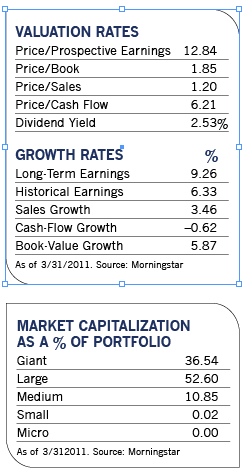

From its inception to the end of May 2011, a $10,000 investment in the fund would have grown to $12,191, compared to $10,668 for the index. In the depths of the market collapse between August 2008 and the end of February 2009, a $10,000 investment in the S&P 500 would have fallen to $5,817, while an investment in Schooner would have kept $8,059.

In return for downside protection, though, investors must be prepared for periods of underperformance in a sharply rising market. In the first quarter of 2011, for example, the fund was up 1.10%, compared to nearly 6% for the S&P 500. In calendar year 2010, it rose 9.3%, versus 15% for the index.

The fund uses a number of hedging strategies to even out returns, and over the last three years Levinson has focused mainly on buy-write options. Also known as covered calls, these allow investors to write, or sell, a call option contract while at the same time owning an equivalent number of shares of the underlying stock. Since the investor already owns the stock, the obligation is fully collateralized. By writing options, Levinson aims to earn premium income, and that can help cushion portfolio volatility.

During times of high market volatility, such as 2008 and 2009, the fund may have close to 100% of its portfolio under a buy-write strategy. Now that section of the portfolio constitutes about 58% of its assets. Based on the value of the stocks in that sleeve, the call options generate monthly premium income of over 3%.

To maximize premium income, Levinson looks for options on volatile stocks that he believes are priced too cheaply. An actively managed options "roll" strategy helps ensure that a stock won't get yanked out of the portfolio too quickly in an up market or fall too far in a decline.

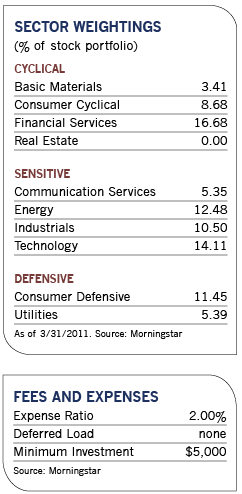

Stocks that make good candidates for a buy-write strategy include those in jumpier sectors such as technology and energy, which allow the fund to generate maximum premium income. Companies recently included in the buy-write section include Noble Energy and Yahoo.

There's no magic formula or bold strokes of genius for stock picking here. "The filtering and selection process here is pretty methodical and is based more on quantitative factors versus any insight into a company's business model," says Levinson.

About 38% of the portfolio is in long positions that aren't covered by an options writing strategy. Levinson, who doesn't make any outsize stock or sector bets and typically stays within close range of S&P 500 sector weightings, says the fund is slightly overweight in more defensive areas such as health care, consu mer staples

mer staples , utilities and telecommunications.

, utilities and telecommunications.

Because he feels the market is range-bound at this point, he is zeroing in on stocks that can generate a decent amount of dividend income such as Bristol-Myers Squibb, Eli Lilly, AT&T, Verizon and Duke Energy. The focus generates a healthy 3.6% yield on the long-only portion of the portfolio.

In addition to buy-writes, the fund can also employ other strategies, although Levinson uses them sparingly at this point. It has about 8% of its assets in convertible preferred stocks in financial firms such as The Hartford and MetLife, which yield north of 5%. Levinson says that while he sometimes has a higher allocation to convertible bonds, a lack of new issuance and low yields relative to investment-grade securities make them less attractive at this point.

The fund can also invest up to 30% of its assets in high-yield, below-investment-grade securities or move up to 100% of its assets into cash for temporary defensive purposes. Other potential investment tools include zero coupon bonds, put options or futures contracts.

Advisors Warm Up Slowly

With just $100 million in firm assets under management and $49 million in the fund, Levinson admits the unorthodox strategy hasn't been an easy sell to financial advisors used to strict adherence to style boxes and long-only equity investing. But he hopes that as the fund hits its three-year anniversary it will show up on more radar screens, and he believes that both retail investors and financial advisors are ready for a fund that combines the transparency and convenience of mutual funds with the risk-moderating strategies of a hedge fund.

"There's been a pushback from hedge fund investors over illiquidity, lack of transparency and structural inefficiencies, and they are ready for something different," he says. "I believe we are in the early stages of melding the hedge fund world with the mutual fund world."

One barrier that may be difficult to get around is the fund's above-average expenses. With an expense ratio of 2%, plus high trading costs that eat into returns, the Schooner portfolio doesn't come cheap. Although Levinson tries to moderate the tax bite from frequent trading and the high portfolio income with tax loss harvesting, he admits that the shares are preferable in a tax-deferred account.

"Our costs may be higher, but the value proposition is there," says Levinson. "This is not an index-based or index-hugging strategy but one that requires specific trading and investment management expertise. And that is naturally going to be more expensive."

But he thinks investors will subscribe to the idea that paying a bit more for substantially lower risk and less volatility is worth it. "No fund is cheap if it's losing lots of money," he observes. "This fund is a great alternative to the multiyear lockups and illiquidity of a hedge fund, and it's much cheaper. And, its lower volatility helps investors avoid emotional responses to sharp market declines."

So far, he says, advisors seem to be using the fund in one of three ways. "Some use it as part of their alternative sleeve because it has a lower correlation to the stock market than most funds. Others use it for the large-cap domestic equity allocation for risk-sensitive clients, such as retirees or high-net-worth individuals, who want S&P 500-type returns without all the volatility. And some are using it as a bond surrogate because it has similar volatility characteristics to bonds without the interest rate risk of fixed-income investments."