When I ask financial advisors what their long-term strategy is for growing their revenues-while at the same time keeping their marketing time and expenses under control-I often receive back answers such as:

"I attend various functions to meet prospective referral sources or clients."

"I take potential referral sources to lunch."

"I am immersed in various organizations where new business is generated."

The traditional marketing of professional services is to sell yourself to someone that has no experience working with you or your firm. When you step back and think about it, that sounds like paddling upstream against a very strong current!

Of course, it makes sense to get out and meet new people, but are you doing that at the expense of marketing to the people you already know-your existing clients? I am of the belief that the most effective time spent discussing the value and spectrum of your services is with those individuals who already know and believe in you and your firm.

So, before you run out to meet the next "prospect," you might want to take a step back and ask yourself, if you had only one hour per month to market your services, where would you spend it? Would you rather spend it convincing strangers that you are great at what you do and that they should refer people to you? Or would you rather spend it marketing yourself to existing clients, who already think you are great at what you do but who might not realize that you offer other services that they need?

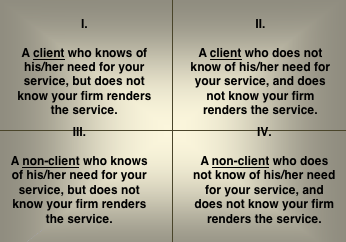

The professional service world, be it for a financial advisor, a CPA or a lawyer, is easily divided into four quadrants, as the accompanying chart indicates.

How would you feel if a client needed an advanced service that you render, but had no idea that you offer the service and used a competitor? It's so obvious that it's also very easy to overlook. The most effective hour that you could spend would be with a client in sector I-someone who needs what you do, but is unaware of your ability to satisfy their need. Isn't this a little easier than trying sell your services to someone you just met?

If this makes sense to you, your next question might be to ask how you get started marketing to existing clients. First, start by asking yourself two questions:

What advanced services are most appropriate for my client base and firm's skill set?

How do I engage my client?

If you are being held back from marketing to your existing clients because you are afraid they will be offended, don't worry. What I have found is quite the contrary. The client may have already been looking for help and is quite relieved that someone they trust has arrived to offer it. In fact, some financial advisors actually cause harm to clients by postponing planning. If you are still afraid to market new services to existing clients, consider some issues that can arise by failing to investigate their needs and offer solutions:

1. Business operating agreements are outdated and are not consistent with clients' current wishes, causing disputes upon retirement, disability or death of shareholder.

2. Employment agreements are not updated to reflect current responsibilities, salaries or benefits and are creating disagreements between partners and/or employees.

3. Asset protection plans that were established years ago are either not being followed correctly or are outdated for the current situation. Numerous individuals thought that they were protected when in reality, as time has passed, they have inadvertently not complied with their plan, leaving assets unprotected and subject to the claims of creditors.

4. Estate plans are outdated as goals, not reflecting changed family situations: children are no longer minors, have gotten married and may have children of their own. Financial situations have materially changed either for the better or for the worse. Some have even become divorced and not yet eliminated their ex-spouse from their wills.