Investors place far too much emphasis on the GDP figures. However, digging into the components suggests a less optimistic (not pessimistic) outlook for growth in the near term.

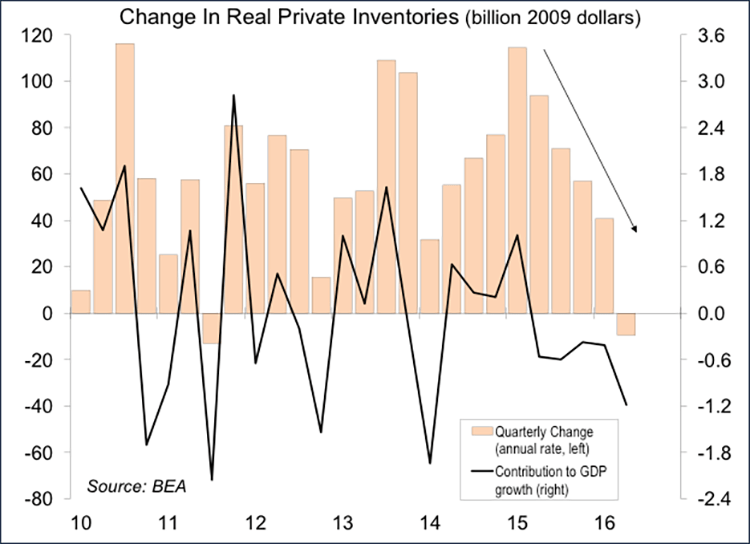

Real GDP rose at a 1.4% annual rate in the 3rd estimate for 2Q16, held back by a slower pace of inventory growth. Recall that GDP is a flow ($/time), while inventories are a stock ($). The change in inventories ($/time) contributes to the level of GDP, which means that the change in the change in inventories contributes to GDP growth. In other words, a slowdown in inventory growth subtracts from GDP growth. That was the case in each of the last four quarters. Real GDP rose 1.3% in the four quarters ending 2Q16, but would have risen 2.6% -- twice as fast – if not for the inventory slowdown. When inventories slow, it’s often unclear why. Firms may be more cautious about future sales or demand may have exceed expectations. Lean inventories (relative to sales) normally bode well for future production as inventories are rebuilt. A large inventory rebuild was expected to propel 3Q16 GDP growth to 3% or more. We now have two months of sketchy inventory figures for the third quarter. Price changes make it difficult to estimate what has happened in real terms, but it looks as if the inventory rebuild will be more moderate than anticipated. Perhaps the inventory rebuild will be shifted into the fourth quarter or into early 2017, but it seems likely that the level of inventories has adjusted to an expected slower long-term trend in overall growth, and will not add as much to GDP as was expected.

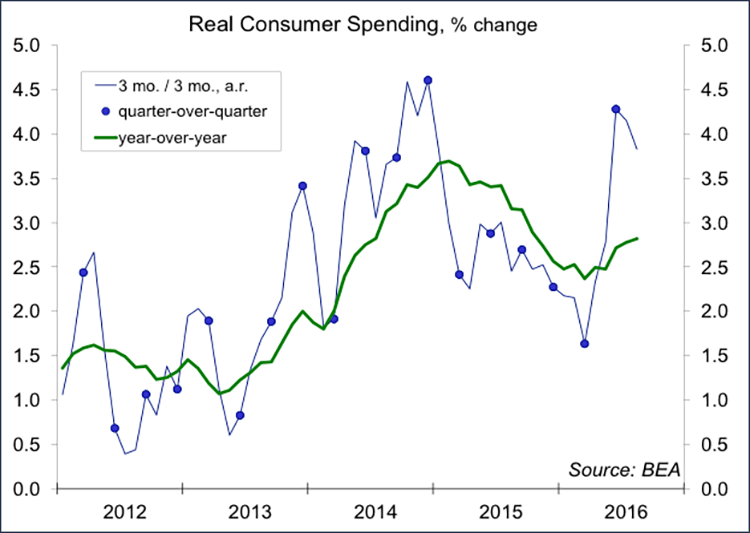

Consumer spending accounts for about 69% of GDP. We now have figures for July and August, which suggest some loss of momentum. The household sector fundamentals remain sound. Job growth has remained strong (not quite as robust as in the last two years, but that’s to be expected as labor market slack is taken up). The Conference Board’s Consumer Confidence Index has broken out of its recent range and is back to pre-recession levels. While consumers don’t spend confidence, surveys show that people are more optimistic about current job availability (although they remain generally a bit pessimistic about future jobs). Spending on autos and other consumer durables softened in August and anecdotal reports suggest further weakness in September. Big-ticket purchases are sensitive to expectations. Election-year uncertainty may be a restraining factor. The budgets of middle-class households may be strained by higher rents and healthcare costs. However, spending is normally lumpy, bunching up and slowing down around a longer-term trend. Spending numbers through August suggest a softer quarter than was anticipated earlier. More importantly, the trend appears likely to carry though to 4Q16 (that’s simply the way the monthly-to-quarterly arithmetic works). That doesn’t mean that we are in danger of falling into a recession, but it does imply an adjustment to expectations.

Other GDP components have appeared mixed. Business fixed investment was revised higher in the 3rd estimate for 3Q16, but that largely reflected strength in intellectual property products. Spending on structures and equipment continued to weaken. Shipments of capital goods were weak in the first two months of 3Q16, but orders have been improving (there’s hope). The contraction in energy exploration has ended. We don’t anticipate a sharp rebound in oil and gas well drilling, but an end of the decline should be enough (that is, energy is no longer a subtraction from GDP growth).

Putting the components together suggests that GDP growth is likely to be in the 2.0-2.5% range, lower than the 3+% expectations of a few weeks ago. The outlook for 4Q16 has come down as well, to about a 1.5-2.0% annual rate. That’s not terrible, but it is consistent with a lower trend rate of growth in the near term (slower labor force growth combined with a sluggish rate of productivity growth).

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.