How do financial advisors rank their clients' investment goals and how do they perceive REITs' role in reaching those goals? A survey of 150 financial advisors commissioned by the National Association of Real Estate Investment Trusts (NAREIT) shows that a majority of them recommend REITs to their clients. Perceptions among financial advisors suggest that REITs can help individual investors meet key investment goals by providing portfolio diversification, long-term growth in portfolio value, inflation hedging benefits and a consistent stream of income.

Advisors' attitudes about REITs generally match up with REIT investment attributes that are supported by extensive analysis of market performance data. Recent research on portfolio optimization by Wilshire Associates sheds new light on how REITs may help investors improve long-term returns and diversify their portfolios to reduce risk. Wilshire Funds Management's head of investment research, Cleo Chang, actually described REITs as "a triple play asset class, providing income, capital appreciation and inflation protection."

Top Personal Finance Priorities

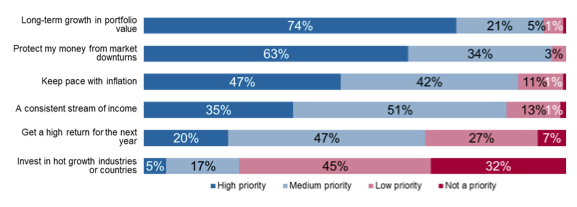

The first thing we wanted to know was what financial advisors said were their individual investor clients' most important investment goals. While every client situation is different, majorities of financial advisors say long-term growth in portfolio value (74%) and protecting money from market downturns (63%) are among their clients' highest priorities in terms of personal finance goals. Keeping pace with inflation is also a high priority for many (47%). Maintaining a consistent stream of income or a high return for the next year was ranked as a medium priority (35%).

Also not surprising given the above data and market volatility of recent years, financial advisors said that investing in hot growth industries or countries falls to the bottom of clients' personal finance goals. They indicated this goal is a low priority (45%) or not a priority at all (32%) for their clients.

Majority Of Advisors Recommend REITs

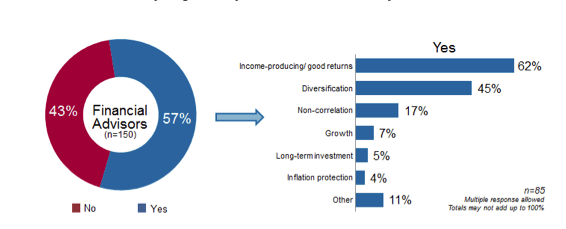

Most advisors are aware of real estate investment through REITs. Some 63% said they had a somewhat or very positive view of REITs, and a majority (57%) said they generally recommend REITs to their clients. Among those recommending REITs, the most common reasons included: income-producing/good returns (62%); diversification (45%); and non-correlation with other investments (17%).

For those that do not recommend REITs, they largely state that REITs are too risky (34%) or that an investment in REITs does not align with their clients' needs and priorities at the moment (29%).

Delving Deeper Into Advisor Perceptions About REITs' Role In Investment Goals

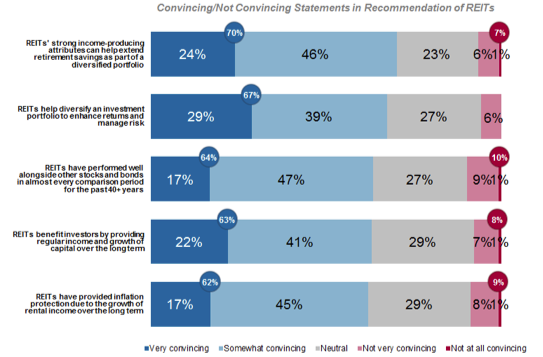

To delve deeper into the question of why some advisors recommend REITs to their clients, the survey asked advisors to rate different statements of factual attributes about REITs in terms of how convincing they are in the eyes of their clients. The key takeaway here is that four REIT attributes rise to the top in terms of their relevance to individual investor priorities:

1. Diversification: 70% of advisors agreed that the statement "REITs' strong income-producing attributes can help extend retirement savings as part of a diversified portfolio" would be very convincing or somewhat convincing for their clients. And 67% agreed that the statement "REITs help diversify an investment portfolio to enhance returns and manage risk" would be very convincing or somewhat convincing.

2. Performance: 64% thought the statement that "REITs have performed well alongside other stocks and bonds in almost every comparison period for the past 40-plus years" would be a very convincing or somewhat convincing argument for recommending REITs.

3. Income: 63% agreed that the statement "REITs benefit investors by providing regular income and growth of capital over the long term" would be convincing.

4. Inflation protection: 62% also found the inflation protection provided by REITs due to the growth of rental income over the long term to be a convincing factor.

As indicated by the graph below, 10% or fewer of the financial advisors surveyed did not find these statements of fact to be at all convincing as reasons to recommend REITs to their clients. Slightly more than a quarter said they were neutral with regard to these points.

Financial advisors' perceptions of REITs are generally supported by the facts. Diversification clearly makes sense for reducing risk: REITs have shown low to moderate correlation with large cap, small cap and international stocks as well as U.S. and international bonds over long investment periods. REITs have also outperformed the S&P 500 index over the past one-, three-, 10-, 15-, 20-, 25-, 30-, 35- and 40-year periods ending July 31, 2012, and have also consistently outpaced corporate bonds.

Dividends also make a difference: What drives REIT total return performance is both the requirement that REITs pay out to their shareholders every year at least 90% of taxable income as dividends, plus the effective management of property assets that can support increases in REIT share prices over time. And REIT dividends have historically increased with inflation. In fact, REIT dividend growth has outpaced consumer price inflation in 18 of the past 20 years.

Interestingly, we found that advisors who recommend REITs to their clients are significantly more likely to consider long-term growth in portfolio value a high priority. Given how financial advisors ranked their clients' personal finance goals, there are good reasons for them to consider a role for real estate investment through REITs as a basic building block for a long-term retirement plan.

Michael R. Grupe is NAREIT's executive vice president of Research and Investor Outreach.