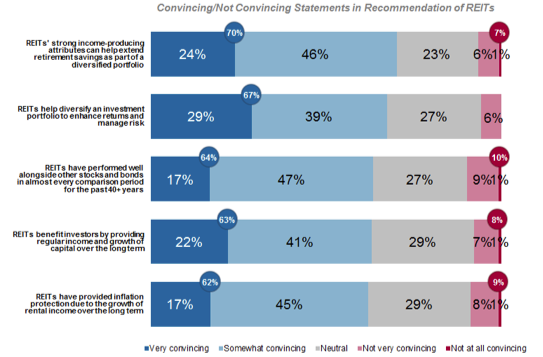

2. Performance: 64% thought the statement that "REITs have performed well alongside other stocks and bonds in almost every comparison period for the past 40-plus years" would be a very convincing or somewhat convincing argument for recommending REITs.

3. Income: 63% agreed that the statement "REITs benefit investors by providing regular income and growth of capital over the long term" would be convincing.

4. Inflation protection: 62% also found the inflation protection provided by REITs due to the growth of rental income over the long term to be a convincing factor.

As indicated by the graph below, 10% or fewer of the financial advisors surveyed did not find these statements of fact to be at all convincing as reasons to recommend REITs to their clients. Slightly more than a quarter said they were neutral with regard to these points.

Financial advisors' perceptions of REITs are generally supported by the facts. Diversification clearly makes sense for reducing risk: REITs have shown low to moderate correlation with large cap, small cap and international stocks as well as U.S. and international bonds over long investment periods. REITs have also outperformed the S&P 500 index over the past one-, three-, 10-, 15-, 20-, 25-, 30-, 35- and 40-year periods ending July 31, 2012, and have also consistently outpaced corporate bonds.

Dividends also make a difference: What drives REIT total return performance is both the requirement that REITs pay out to their shareholders every year at least 90% of taxable income as dividends, plus the effective management of property assets that can support increases in REIT share prices over time. And REIT dividends have historically increased with inflation. In fact, REIT dividend growth has outpaced consumer price inflation in 18 of the past 20 years.

Interestingly, we found that advisors who recommend REITs to their clients are significantly more likely to consider long-term growth in portfolio value a high priority. Given how financial advisors ranked their clients' personal finance goals, there are good reasons for them to consider a role for real estate investment through REITs as a basic building block for a long-term retirement plan.

Michael R. Grupe is NAREIT's executive vice president of Research and Investor Outreach.