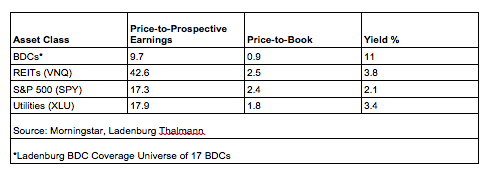

As the table below shows, BDCs currently offer the lowest valuations compared to REITs, the S&P 500 and utilities while paying the highest dividend yield. BDCs are trading at about 10 times earnings and barely one times book value while yielding an average of 11 percent annually. All other assets classes in this table are twice as expensive if not more.

Investment Risks

There are only 49 publicly traded BDCs and most have small balance sheets and don’t have the ability to serve as the sole lender to privately held companies. Small BDCs oftentimes cannot access the investment-grade debt markets, limiting their sources of funding. BDCs make loans to privately held businesses, which may default on their loans or go out of business for various reasons.

Grier Eliasek is the president and chief operating officer at Prospect Capital Corp., a firm that provides private debt and equity capital, in New York.

Business Development Companies Poised To Outperform

March 11, 2015

« Previous Article

| Next Article »

Login in order to post a comment