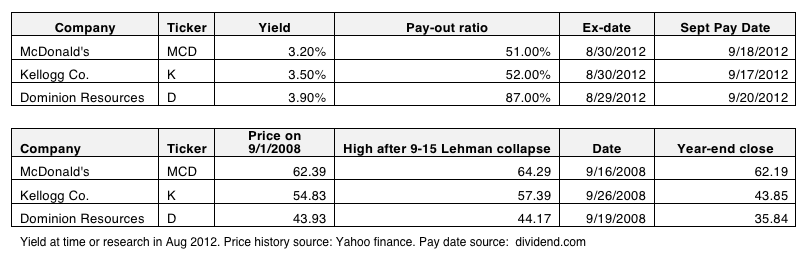

After we had our short list of stocks, we looked at how each performed after the 2008 collapse of Lehman Brothers. We wanted to find solid income-producing companies that were capable of absorbing the initial part of a major shock, giving us time to exit in case the market began to truly unravel.

As a result of this screening process, we found three companies that fit the bill. I felt clients could understand how these stocks were being used to generate income while combating the current economic headlines. Because they were popular blue chip names,I felt clients would feel comfortable employing this strategy.

Alternative Strategies Are Worthless Without Good Communication

Whether you decide to use my strategy or more complex alternative investments to drive retirement income, they won't be truly effective unless you take the time to educate clients on what to expect from them. For example, many investors don't realize that dividend payments from a company are not an expense.They represent a share of the company's profits that are awarded to shareholders.

Therefore, once a company trades without its dividend (ex-dividend date), its share price will be reduced by the amount of the dividend. I learned this the hard way when a client wondered why a stock we just bought weeks ago was already trading down almost 4%. Of course it was a large dividend payer like Annaly (NLY), and instead of starting on the right foot through education, I had to react and reason with the client over the process and strategy.

It's also important to set specific goals for alternative strategies like these. One way to do this is to establish contact points with clients, setting a performance target range wherein we will discuss the options for a specific investment or group of investments. The contact point can be a market level like Dow 13,500 or a specific return percentage such as -5% or +10%. Either way, by establishing a point when a review will take place, advisors can build trust and keep clients comfortable with alternative strategies in place as they acclimate to doing something new and different.

Overall, when it comes to retirement income, advisors and clients alike are faced with an environment in which rising correlations and near-zero interest rates are making alternative investments a necessary consideration. While true alternatives investments like private equity and long-short funds may have a place in some portfolios, I've found that by focusing on the unique aspects and measurements of more traditional investments, advisor are better positioned to add value and income without overexposing clients to market risk. By taking the time to first educate clients on how a strategy will work for them, and then following up with a performance review, advisors can set realistic expectations for alternative strategies and help clients feel more comfortable using them.

Follow Robert on Twitter @robertlaura. He is the president of SYNEGOS Financial group, co-founder of RetirementProject.org, creator of the Laddered Dividend Portfolio, and author of Naked Retirement. He can be reached at [email protected].