An important debate has emerged about one of the biggest mega trends of this century: Does the explosive growth of the aging population present an opportunity or risk for investors with a medium to long-term investment horizon?

We are talking about seismic shifts that will play out over several decades, and leading companies and investors are positioning themselves for 21st century longevity opportunities with the potential to create new markets and economic growth. For the first time in history, 65-year- olds outnumber 15-year-olds; the elderly population in several developed countries will double in 20 years. This is also a wealthy population. Nearly 70 percent of disposable income will soon be in the hands of Americans over 60.

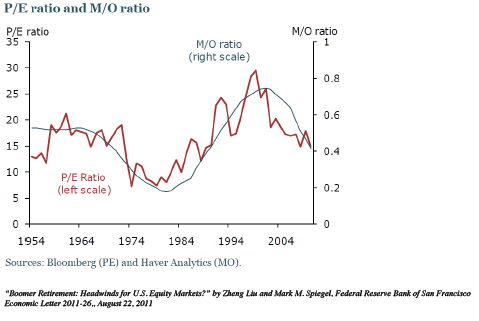

Less discussed are the investment risks posed by aging. For the bear case, consider the United States Federal Reserve Bank of San Francisco’s analysis, "Boomer Retirement: Headwinds for U.S. Equity Markets?" To examine the relationship between demographics and stock prices, Fed economists compared equity price / earnings (P/E) ratios with the so-called M/O ratio, which measures Middle-age population cohort aged 40-49, relative to the Older cohort aged 60-69. Between 1981 and 2000, when baby boomers were at their peak working and saving years, the M/O ratio quadrupled and P/E ratios for the S&P 500 tripled to 24x. Since the early 2000s, M/O and P/E ratios have declined, and the model predicts a downward trend until 2025 when demographics are more supportive of stock valuations.

Chart 1: U.S. Equity Values Closely Related To Population Age Distribution

Likewise, the Bank for International Settlements’ Aging and Asset Prices paper predicts that as older investors sell their homes and financial assets to fund their retirement years, and there are fewer younger workers to take their place, asset prices will face a much tougher environment.

A convincing counterargument is made by fixed income giant PIMCO. PIMCO cares profoundly about the direction of interest rates and bond yields, and it doubts the global savings glut is going to end any time soon—arguing that aging demographics in the United States will provide a tailwind for bonds and keep interest rates low for at least another decade.

The reason? The better off you are, the more likely you are to work longer and save more. In 1998, of the top 20 percent of U.S. earners aged 65-74, two out of five were in the labor force; now three out of five are still working. The percentage of working 75-year-olds has more than doubled. PIMCO finds that U.S. households accounting for the vast majority of personal income do not reduce their savings until their 70s, and they will drive continued demand for fixed income assets. The conclusion: “Combine a low global neutral interest rate and strong domestic demand for bonds, and what do you get? Lower rates for longer in the U.S.”

Prudential’s investment unit PGIM is also skeptical of an asset “meltdown” caused by boomers drawing down their savings, noting there is no strong empirical support for a correlation between asset prices and age structure. Its report, "A Silver Lining: The Investment Implications of an Aging World," is a must-read for the bull scenario.

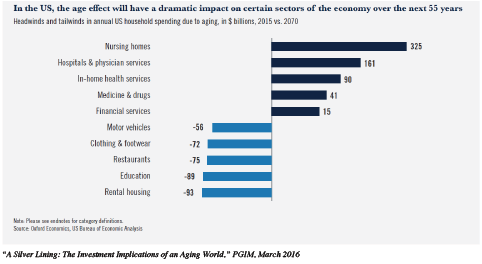

PGIM’s analysis of long-range consumer trends is striking. Spending by older consumers on senior care, health and financial services could increase by hundreds of billions of dollars per year, while cars, apparel and even education, face long-term headwinds.

Chart 2: Headwinds And Tailwinds In Annual U.S. Household Spending Due To Aging

PGIM identifies two investment themes around aging: real estate and health care. Real estate represents 40 percent of gross assets for older households. As boomers seek to live active senior lifestyles, demand for residential properties in urban areas is growing. As they enter their 70s and 80s, growing demand for independent and assisted living units will accelerate.

Health-care costs also increase with age: “People over the age of 85 spend twice as much as those aged 65 to 84—who, in turn, spend double the amount of 45- to 64-year-olds.” PGIM believes pharma, biotech and “silvertech” innovations that personalize and improve care for seniors will benefit.

As with any trend, the aging population will produce winners and losers. Patience and pragmatic understanding of demographic and health care trends is required, but long-term investors will be rewarded for identifying structural market drivers for key industries and businesses to maintain and create wealth.

Shankh Mitra, a former portfolio manager of a major hedge fund, is senior vice president of finance and investments at Welltower Inc.