There are even some signs that after years of cutting interest rates and expanding bond buying programs, the era of expansive central bank policy may be reaching its limits. In recent months, many voices—including the International Monetary Fund and the Organization for Economic Coordination and Development—have pointed out that monetary policy can do only so much to boost economic growth and have called for governments to adopt more aggressive fiscal policy measures.

Pricing risk

Here again it’s not clear that the market is prepared for changing conditions. In fact, it appears investors may have become complacent about the risk of higher rates and are willing to take more credit risk in a quest for higher yields.

When interest rates rise, the prices of existing bonds tend to fall. In general, the prices of longer-maturity bonds tend to be more sensitive to rate changes than those of shorter-maturity bonds (you can measure a bond’s interest rate sensitivity by calculating its duration—the longer the duration, the more sensitive it will be to rate changes). But not all short-term bonds are equal.

Lower-credit-quality, higher-risk bonds in particular could see more price volatility in a rising rate environment. This is partly because higher-risk bonds may lose their appeal if comparable lower-risk bonds, such as Treasuries, start to offer higher yields. But lower-credit-quality bond valuations also appear to be quite high now, as yield-seeking investors have pushed prices up. That could mean they have further to fall if rates rise.

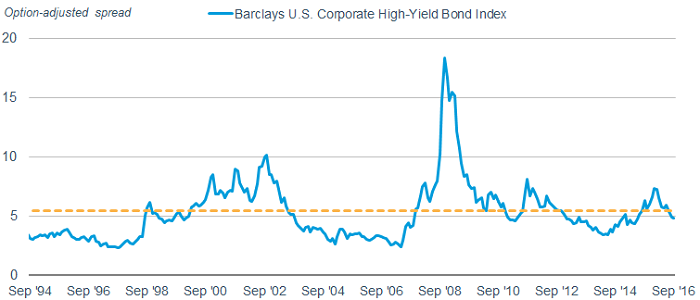

The yield spread, or credit spread, is the amount of yield potentially riskier corporate bonds offer above comparable Treasuries to compensate for the increased risk. The size of the spread is a measure of how much extra compensation investors require to invest in a potentially more risky bond. Normally, that means the higher the risk, the wider the spread. Today, the spread between high-yield bonds and Treasuries is below the long-term average, even though the underlying fundamental trends in the high-yield market are deteriorating.

High-yield spreads are now below the 20-year average

Note: Option-adjusted spreads (OAS) are quoted as a fixed spread, or differential, over U.S. Treasury issues. OAS is a method used in calculating the relative value of a fixed income security containing an embedded option, such as a borrower's option to prepay a loan. Source: Barclays, monthly data as of 9/30/16.

In other words, there is very little risk premium in the market to compensate investors, even though defaults are rising and more bonds are being downgraded than upgraded.

As we saw during the taper tantrum of 2013, high-yield bonds can be much more volatile than Treasuries when investors grow more risk averse. From May 9, 2013 through June 25, 2013, the average yield-to-worst of the Barclays U.S. Corporate High-Yield Bond Index rose more than two percentage points, from 4.95% to 6.97%. The largest trough-to-peak move for the 5-year Treasury in 2013 was only 1.2%.

A sharp rise is unlikely, but there is room for yields to move up

To be clear, while we expect some increase in bond yields over the next few months, we aren’t expecting a sharp rise or a return to yield levels seen a decade ago. Growth and inflation remain low globally and we expect the Fed to move slowly.

However, the trends appear to be higher and the markets don’t appear to be prepared for higher yields. Even a rise in 10-year Treasury yields to 2%, a level not seen since beginning of the year, could mean prices falling by as much as 3% to 4%.

So what should investors do? We suggest:

• Reduce the average duration of your fixed-income holdings. Again, short-term bonds tend to be less sensitive to rises in interest rates than long-term bonds, and we see less reward for investing in longer-term bonds today.

• Check your risk tolerance. High-yield corporate bonds have generated strong total returns this year thanks to rising prices, but are looking relatively expensive now that yields have fallen. Investment grade corporate bonds appear fairly valued today, while high-yield corporate bonds appear modestly overvalued and may be prone to more significant price declines.

• Review your fixed income portfolio. Almost all types of fixed income investments have posted positive returns in 2016, with long-term bonds and high-yield corporate bonds posting some of the largest gains. Make sure that your current allocation is still in line with your long-term goals. If price appreciation has pushed your fixed income holdings beyond your strategic allocation, it may be time to re-balance your portfolio.

• Consider an allocation to TIPS. These securities tend to outperform traditional Treasury bonds when inflation is rising. You could also consider investment grade floating rate notes, which tend to outperform when short-term interest rates are rising.

Kathy A. Jones is senior vice president and chief fixed income strategist at Schwab Center for Financial Research.