Cash holdings in investment portfolios are at record highs, and the rationales for these allocations are remarkably diverse. Some investors seek to wait out market volatility, while others have strategically increased cash allocations to reduce portfolio risk. Many are “barbelling” higher-yielding, volatile core assets with lower-volatility, income-producing short-term fixed income strategies. Still others are seeking to optimize returns on cash before U.S. money market reform takes effect later this year.

At the same time, two profound market dynamics are at play: First, 2a-7 money market funds continue to yield next to nothing due to a multitude of influences, including supply constraints, more demand and the forthcoming regulatory reforms; second, investors ‒ ranging from individuals to large institutions ‒ are increasingly deploying ETFs in their investment portfolios due to their transparency and operational ease of use.

The question many investors are asking now is how can ETFs be used for liquidity and volatility management given these evolutionary market changes? Here are some of the important considerations and why PIMCO’s actively managed short-term ETFs, MINT and LDUR, may be superior tools for liquidity management.

‘Capital preservation’ does not necessarily maintain purchasing power

In today’s environment, many investors are seeking “safety” by allocating to money market funds, which are expected to return capital because of their stable net asset value (NAV). Similarly, many ETF investors have chosen U.S. Treasury-bill funds both for their low total expense ratios and the perceived safety of index T-bill exposure.

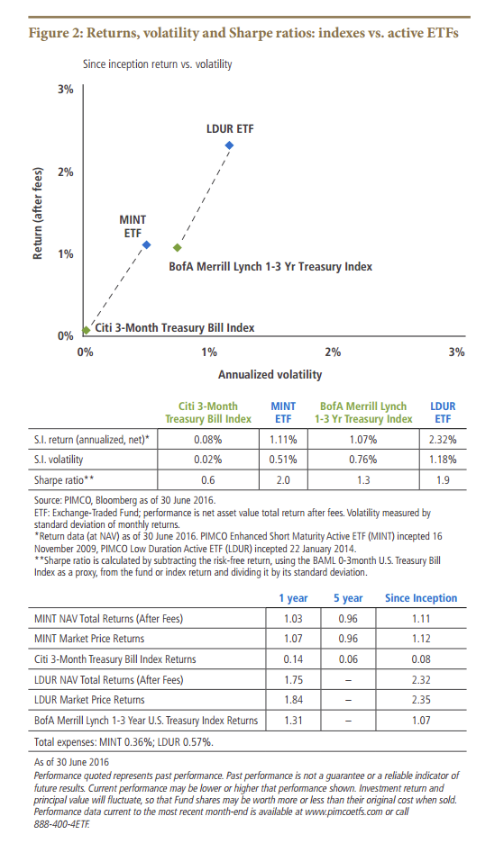

Figure 2 shows the returns, volatility and Sharpe ratios of the PIMCO Enhanced Short-Maturity Active ETF (ticker: MINT) and the PIMCO Low Duration Active ETF (ticker: LDUR), along with those of the Citi 3-Month Treasury Bill Index and the Bank of America Merrill Lynch 1-3 year U.S. Treasury Index.

Getting active, going global and diversifying to reduce volatility and improve liquidity

Short maturity active ETFs can employ several levers for helping reduce risks and enhance returns. Active management generally increases an ETF manager’s freedom to navigate volatile markets. Namely, active managers can utilize a wide opportunity set:

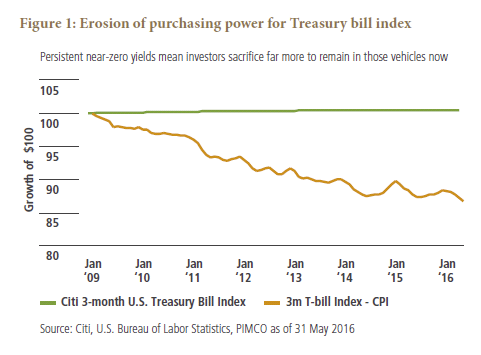

However, preserving capital does not equal preserving purchasing power ‒ essentially, returns after inflation. Figure 1 looks at the decline in purchasing power of T-bill index returns in the low inflation environment since the financial crisis of 2008. The same holds for money market funds: For much of the past 40 years, traditional money market funds have provided investors with positive inflation-adjusted returns, but in today’s low yield environment, that is no longer the case. In more normalized, higher-inflation environments, the erosion of purchasing power could be even greater.

Active short-term management strategies can potentially remedy this deficit because they seek not only return of nominal capital but also additional income, which can help protect purchasing power. When considering cash strategy alternatives, liquidity and capital preservation are important, but they are not the only considerations. It is also important to look at the risk, or volatility, for a given level of return. One measure of this is the Sharpe ratio, which is calculated by taking the average return earned in excess of the “risk-free” rate, typically represented by T-bill returns. The greater the Sharpe ratio, the more attractive the risk-adjusted return.

The data in Figure 2 illustrate important issues. First, for investors seeking capital preservation, ETFs that track T-bill and even short maturity indexes may not adequately compensate investors for the risks they take, even though they may be low-cost. Second, the after-fee, risk-adjusted returns of active ETFs may better protect purchasing power.

Multiple sectors, and the ability to adjust exposures as market conditions and manager views change, offer key advantages. Most index ETFs used for liquidity management provide exposure to one or two sectors of the market, such as Treasuries or investment grade credit, and usually only the U.S. bond market. They maintain a static, structural exposure to interest rates (duration), which can potentially result in lower performance as rate expectations adjust. Unlike active ETFs, index funds only adjust exposures when the index changes. This leads to forced “buying and holding,” as well as forced selling when market conditions might warrant just the opposite.