A global opportunity set. Of the roughly $100 trillion in global bonds, the U.S. market represents only about one-third of the existing inventory and U.S. T-bills less than 2% of the total, or about $1.6 trillion. T-bills outstanding have declined by about $600 billion since the financial crisis, yet new requirements under money market reform are leading many asset managers to create government-only funds, further reducing supply of T-bills.

Alternative weightings and out-of-index securities. The largest bond index ETFs are market-capitalization weighted: They base the size of their exposure to any given security on how much is outstanding relative to other securities. Thus, index ETFs have the largest exposures to the most indebted borrowers or sectors. They also have limited ability to hold securities that are not in the index (typically 20% of the fund), which can potentially limit their diversification.

As one of the biggest and most experienced bond managers, PIMCO is positioned to take advantage of these levers. The short-term and funding desk at PIMCO manages about $300 billion in cash and short duration strategies globally, including MINT, the largest actively managed ETF, and LDUR, which represents an additional step out on the risk/return spectrum. The short-term desk draws on PIMCO’s time-tested investment process, including the firm’s top-down macroeconomic outlook and bottom-up sector and security selection from over 50 credit analysts worldwide. This is an experienced team of more than 10 portfolio managers who have managed cash and liquidity globally through many market cycles and macroeconomic environments, including the challenges of 2008. The team most recently won Morningstar’s U.S. Fixed Income Fund Manager of the Year award for 2015.

Implementing an ETF as an alternative to cash solution

Consider the holding period

When thinking about how to strategically manage cash and portfolio liquidity, the important considerations are how much cash is needed? What is the purpose of the cash holding (which drives the likely holding period and the risk tolerance)? And finally, what are the risk and return characteristics of potential cash and alternative cash solutions?

Consider, for example, a financial advisor who is helping a client and has identified three possible cash needs: a reserve to cover six months of household expenses, the purchase of a new car in one year, and the down payment for a home in two to three years. The client has a moderate risk tolerance, and the timing of the car and the home purchases could be pushed back.

How might this investor think about managing cash?

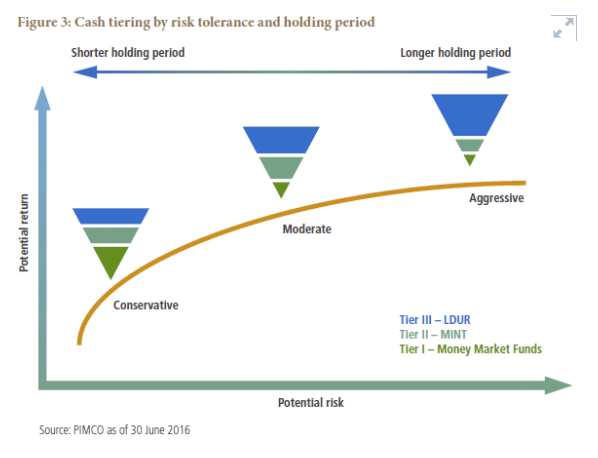

Tier cash to maximize return potential for given risk tolerance

A potential solution is to tier the allocation into cash and alternative cash investments using money market funds and active short-term ETFs such as MINT and LDUR. Money market funds* may be well suited to immediate cash needs, while cash alternatives like MINT could be considered for holding periods in excess of three months. MINT seeks to provide a stable, although not constant dollar, NAV and additional income in the form of monthly distributions and has been used extensively for liquidity management. LDUR can be added to a tiered liquidity portfolio and used to help grow portfolio balances over a longer time horizon, generally more than a year; LDUR has core bond characteristics and thus an incrementally higher risk/return profile than MINT.

In the example above, the funds needed to buy a home could be invested in LDUR while those needed for a new car as well as a portion of the reserve for household expenses could be invested in MINT. The balance of the reserve for expenses would likely need to be in a money market fund. The relative size of these three investments could be adjusted as the time approaches for purchasing the car and the home. In other words, the portfolio can be rebalanced between these three investments, bringing the overall portfolio down to a lower risk/return target as the need for cash becomes more immediate.

Figure 3 illustrates cash tiering by risk tolerance, showing the change in allocation as holding periods decrease.

Tiering cash attempts to better align the risk and return characteristics of cash and alternative cash assets with the holding period and risk tolerance of investors to preserve purchasing power and enhance risk-adjusted return.

Jerome M. Schneider is a managing director PIMCO, Newport Beach office and head of the short-term and funding desk.

Natalie Zahradnik is an executive vice president in the Newport Beach office of PIMCO, an exchange-traded fund (ETF) strategist and a member of PIMCO's global wealth management team.