Q: The performance turn since late January has been dramatic. Is this a bounce, or the beginning of a sustained move?

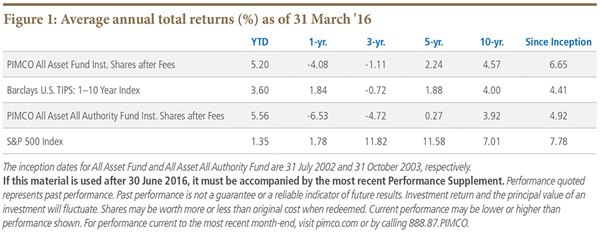

Arnott: Probably the latter. Since January’s lows through April 30th, our All Asset strategies returned over 14.5%, outpacing U.S. 60/40 (60% S&P 500 Index, 40% Barclays U.S. Aggregate Index) by more than 650 basis points. Is this a “dead cat’s bounce” or the start of a multi-year bull market? While it’s entirely possible that we will see a test of the lows, it’s also entirely possible that we will not test these lows. As we said in April’s Insights, we have neither the clairvoyant ability to time market turns, nor the skill to predict the catalysts for a bull market top or a bear market bottom. Instead of pointing to whether we’ve seen the bottom for the Third Pillar or the top for mainstream 60/40, we prefer to focus on long-term future rates of return.

While the last several weeks’ performance of the Third Pillar has been encouraging, it’s human nature to use the recent past as an anchor to form our expectations.1 Whether we are using the recent bounce to shape our optimism, or the grinding three-year bear market in Third Pillar assets to shape our pessimism, extrapolating from the past is profoundly unwise. It’s the single greatest source of investor error. For decades investors have made a mistake by setting unrealistic expectations based on inflated historical returns. So, when assessing the Third Pillar’s forward-looking prospects after a short-but-impressive run, we ask ourselves: Is the Third Pillar still trading at cheap levels relative to history? Or, has the recent strong performance put a dent on its forward-looking return prospects? Both are true.

The good news is even after the recent rebound, the Third Pillar is still trading at attractive levels relative to its history. It’s gone from cheap to a bit less cheap. The latest run doesn’t make Third Pillar markets expensive or vulnerable. Case in point: our models for long-term (10-year) real returns suggest that the recent outperformance in Third Pillar markets clipped their collective real return prospects by less than 0.2% since December.2 This is hardly a blow. We believe that Third Pillar asset classes today, especially relative to expensive mainstream U.S. stock and bond markets, are still bargains boasting attractive multi-year return prospects.

We’ve been on the record saying that we believe starting yields are a reliable predictor of future long-term returns. Over the last twenty years,3 the correlation between the starting yield premium of the Third Pillar over U.S. 60/40, and its corresponding 10-year excess return, is a remarkable 86%. Twenty years is a relatively short period of time in the history of capital markets, but results can be indicative. Given the short 20-year span, is this statistically significant? No. Is it economically powerful? Yes! Based on historical norms, the current yield premium suggests an excess potential return of 3% to 4% per annum, for Third Pillar relative to 60/40, compounding handily over the next ten years.4

Based on a casual glance at Figure 2, the current yield premium – while albeit lower than the start of this year – is far more robust than the levels seen since the start of a Third Pillar bear market three years ago, which was when we suggested these asset classes were not cheap and generally cautioned investors to tamp down their return expectations. Over the full span, outside of the Global Financial Crisis and the 1998 Asian Flu,5 the current yield premium remains in its highest historical quartile. Unsurprisingly, the rebound in the last two months relieved some of the tension in the proverbial “rubber band” of stored alpha from stretched spreads. But the rubber band is still taut.

If history is any guide, much of this performance will be front-end-loaded, delivering 5% to 8% annual excess returns, for the Third Pillar relative to U.S. 60/40 investing, over the coming three to five years. History suggests that the yield spread has a 93% likelihood of tightening (providing alpha larger than the yield spread) over the next five years.6 So, the five-year prospect of a continued rebound in the Third Pillar’s excess return over 60/40 remains compelling.

Naturally, most of us chase past performance. So, we saw immense inflows during the first half of 2013, and we’ve seen outflows in the face of recent bargains.

Arnott On All Asset, May 2016

May 26, 2016

« Previous Article

| Next Article »

Login in order to post a comment