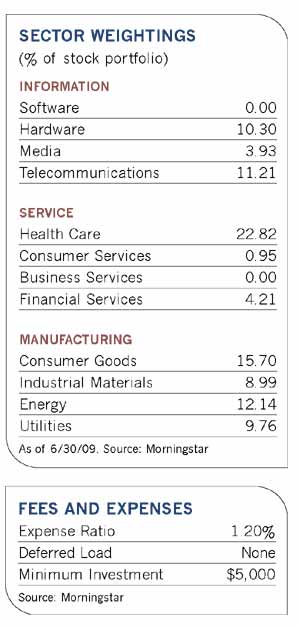

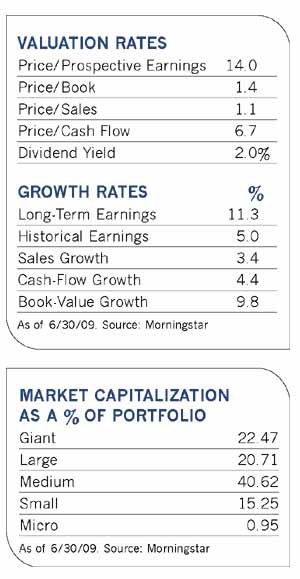

Meanwhile, companies with above-average, growing dividends from industries such as health care, utilities and technology are playing an increasingly important role in the portfolio. "Dividends have historically accounted for half of stock market returns, and in a sluggish or uncertain market they become more appealing to investors," he says. "People living off of investment income get some psychological as well as financial assurance from stable and rising dividends that can help them meet expenses."

With a dividend yield of about 4%, American Water Works is typical of the kinds of high-payout stocks Osterweis has purchased this year. The largest investor-owned wastewater and utility company in the U.S., its water and wastewater utilities serve some 15 million customers in the U.S. and Canada. It works in the company's favor that there's a critical need for improvement in water infrastructure. And as municipal budgets continue to tighten, localities may turn to investor-owned companies such as this one to help shore up facilities.

Like any regulated utility, American Water Works' biggest challenge is state and local rate regulation, which caps profit growth. U.S. rate regulation may be one reason that a German conglomerate that acquired the company in 2003 now owns only about one-quarter of its shares. But the company has been aggressively pursuing rate increases with some success, and municipalities are slowly loosening the budget strings.

Two other Osterweis utility holdings, NV Energy in Nevada and Sempra Energy in California, operate in relatively favorable regulatory environments. NV Energy has more than doubled its electric generating capacity since 2006, and it is expanding its renewable resource efforts for wind and solar, though growth has slowed more recently with the downturn in the Nevada housing market. Based in San Diego, Sempra was formed in 1998 through the merger of two utilities. Its California utilities, San Diego Gas & Electric Co. and Southern California Gas Co., serve more than 20 million consumers. Osterweis bought the stocks last fall when they were "dirt cheap," and says they remain attractive because of their rising earnings and stable dividends. Both recently had dividend yields of slightly more than 3%.

Health-care companies make up the largest sector in the portfolio. While some of those stocks could be hurt by the health-care reforms working their way through Congress, Osterweis believes the spotty support for such legislation has slowed momentum. "Republicans are not on board with most of the proposals, and Democrats are split," he says. "States are also divided. I think that something will be done on health care, but the outcome is not likely to involve a huge amount of change."

The stocks within the group are diverse and would be affected in varying degrees by any sort of reform. Diagnostics companies, pharmaceuticals and rehabilitation facilities could actually benefit from consumers' greater access to health care and their increased use of such companies' products and facilities, he says. Fund holding Laboratory Corporation of America, an independent diagnostic services company, is one of two competitors controlling over half the market, and it stands to benefit from an aging population and increased demand for testing. And German pharmaceutical company Bayer AG "has a strong pipeline and the least exposure to patent expiration of any of the major pharmaceutical companies." The drugmaker also has divisions that produce agricultural products and industrial materials, which provide a diverse business base.

Most of aluminum and steel container manufacturer Crown Holdings' revenue, meanwhile, comes from beverage packaging, a business that Osterweis believes will do well as budget-conscious consumers bypass restaurants in favor of eating at home. "It's an interesting countercyclical play that works well in a recessionary environment," he says.