This week’s commentary features content from LPL Research’s Outlook 2016: Embrace the Routine.

Our view is that the U.S. economy—as measured by real gross domestic product (GDP)—is likely to post growth of 2.5–3.0% in 2016. This rate is below its post-World War II average of 3.2%, but above the 2–2.5% average growth rate seen in the first six-and-a-half years of this expansion, based on the factors discussed below. Despite the length of the current expansion (already the fourth longest on record), it has not followed what would be considered a routine path. Supportive monetary policy from the Federal Reserve (Fed) has remained in place throughout the expansion; economic growth, while steady, has been below trend; and inflation, which often picks up near the middle of the cycle, remains near cycle lows. While we believe we are likely in the second half of the economic cycle, 2016 may be the first typical mid-cycle year of the expansion, and investors may need to figure out what it means to get back to that routine.

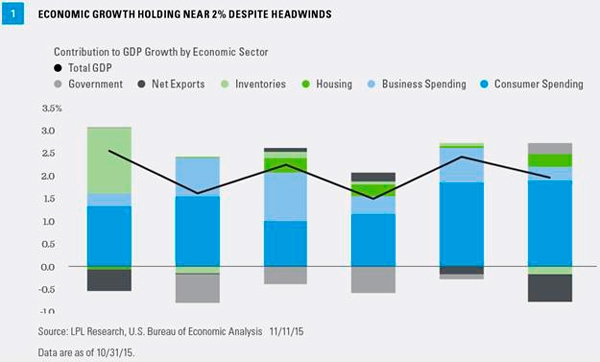

Returning to Our Typical Sources for Growth

As we plan ahead for 2016, the mix of economic growth may look a bit different than in 2015, with manufacturing, business capital spending, and net exports potentially taking larger roles. The manufacturing economy is stabilizing after a difficult 18-month period (mid-2014 to late 2015) and may accelerate further. The housing sector is expected to contribute to growth for the sixth consecutive year, and the consumer sector may continue adding to growth, benefiting from low energy prices, record levels of household net worth, and still low consumer interest rates. Business capital spending struggled in late 2014 and throughout 2015 amid the collapse in oil prices and stronger U.S. dollar. We believe oil prices may move modestly higher as demand remains strong and, as we’ve started to see in 2015, supply comes down. Business capital spending may add to growth in 2016 as commodity prices stabilize.

The hallmark of this current economic expansion has been underinvesting, especially in research and development, and while we do not expect a boom in 2016, there is potential for some catch-up spending. Net exports, which were a sizable drag on growth in both 2014 and in the first three quarters of 2015, may stabilize as the dollar consolidates after the 20%+ gain between mid-2014 and mid-2015—matching the largest 12-month increase in the value of the dollar versus its major trading partners since the dollar went off the gold standard in the early 1970s [Figure 2]. We expect the dollar will begin to stabilize as central bank policies and the outcomes of those policies become clearer. A stabilizing dollar should help to boost exports and remove a key headwind for manufacturing and profits of U.S. corporations.

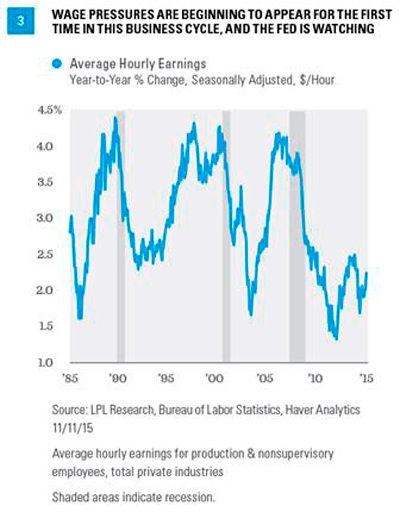

Continued Progress for Employment & Wages

We expect continued progress in the U.S. labor market in 2016, with the economy generating enough jobs to nudge the unemployment rate ever closer to the elusive “full employment” range, the level at which, in the past, businesses need to raise wages to attract and retain skilled employees. Wage growth has been limited but should continue to accelerate in 2016 [Figure 3]. This acceleration in wages—if not accompanied by better economic growth—may cause headaches for the Fed as it begins to normalize policy in 2016. We expect the Fed to begin raising rates in late 2015 or early 2016, with our focus on the pace of hikes throughout 2016 and beyond.

Checking Off Inflation

Inflation remains in check, but commodity/goods inflation may be poised to make a comeback, which would help keep the Fed on schedule to begin raising rates. Since the middle of 2009, prices of services in the economy (as measured by the Consumer Price Index [CPI] for services) accelerated from under 1.0% to as high as 2.8% in early 2014, and then settled into a range of 2–2.5%. Prices of services (medical services, rents, etc.) account for over two-thirds of overall CPI, and history suggests that as the business cycle ages, and as the housing and labor markets tighten, service inflation may continue to accelerate. The Fed has to watch this closely.

However, the CPI for goods (prices of oil and other commodities purchased by consumers) sank along with oil prices from mid-2014 through late 2015. This kept the U.S. economy flirting with deflation (a prolonged period of falling wages and prices). Overall CPI posted a 2.1% year-over-year gain in mid-2014, and by the end of October 2015, the overall CPI was just 0.2%. Looking ahead to 2016, if oil prices move up as we expect, the goods portion of CPI may increase by 2–3%; and if the pace of service sector inflation remains between 2% and 2.5%, overall CPI will accelerate quickly and may be well over 2.0% by year-end. By then, the Fed will have already begun raising rates.