Earlier this year, Connor Browne, co-manager of the Thornburg Value Fund, offered a good demonstration of his investing style when he purchased the stock of Transocean Ltd.-shortly after the offshore drilling contractor's Deepwater Horizon rig burst into flames in the Gulf of Mexico, killing 11 workers and ushering in an environmental nightmare. Browne also beefed up holdings in ConocoPhillips and Marathon Oil, two energy companies without a direct connection to the incident but whose shares fell nonetheless amid concerns about a slowdown in drilling.

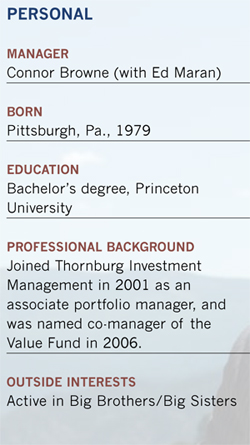

"There is no question that this was a horrible, horrible accident," says the 32-year-old Princeton graduate, who has co-managed the fund since 2006. "But that doesn't necessarily mean it's time to step away from the stock."

Browne's job as a manager is to look past the bad news, especially when he thinks it's a temporary setback, if he likes a company's long-term outlook.

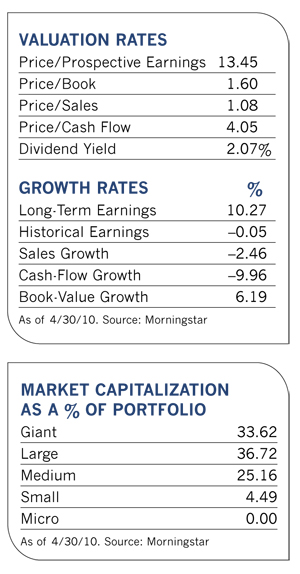

While he concedes that drilling moratoriums and higher costs from tighter safety standards may hurt Transocean in the short term, he asserts that investors are failing to recognize the value of its assets and the implications of the world's continued dependence on oil. The reduction in supply from drilling moratoriums, he believes, could eventually bring higher oil prices. "The stock became attractive when the market overreacted to the long-term impact of the spill and Transocean's valuation became extremely cheap," he says.

Most of the time, the factors that drive a stock to trade below what Browne believes it is worth are less dramatic than a rig blowup. Take health-care companies, where the fund has also beefed up its presence in recent months. These stocks may lag the market because investors are concerned about legislation, patent expirations or government cost controls. An example is Gilead Sciences, one of the fund's top holdings, a biopharmaceutical company that focuses mainly on antiviral drugs, as well as medicines for liver, cardiovascular and respiratory diseases. In recent years, the company has taken a leading role in the treatment of HIV, and an estimated two-thirds to three-quarters of all patients use its drugs.

Yet the stock is out of favor as investors mull the ramifications of patent expirations scheduled for 2018. To add to the problem, cost-cutting for health care in the U.S. and Europe threaten to decrease the use of the company's drugs.

Browne thinks such concerns should not overshadow the consistent demand for proven, life-saving medicines. He adds that Gilead also has a good strategy for replacing drugs that are going off patent, and its new products scheduled for release in the near future are going to be priced at a premium to the older ones. At a price of nine times forward earnings, the company is also attractively valued, and it's growing revenue and earnings at a brisk clip.

At other times, a hiccup in a stock's price might actually be caused by something temporary. That was the case when Browne reintroduced shares of Russian energy company Gazprom and Dutch financial services giant ING into the portfolio in the spring of this year. In early February, he sold the two stocks as the Greek sovereign debt crisis unfolded and the shares started to slip. While neither company was directly exposed to Greek sovereign debt, he believed they would be hurt by the malaise in the European Union.

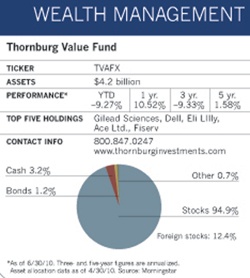

But when the stocks continued to fall after the sale, their compelling valuations, along with government actions to prop up Europe's economy, gave him the rationale he needed to delve back in just a few months after he sold them. "The market has already priced risk into these stocks," he says. "And over the next six to 12 months, austerity measures and European Central Bank efforts are going to have a positive impact on European economies." About 20% the fund's assets are in foreign stocks.

Although this is an equity fund, Browne will also dabble in bonds if he thinks they are selling for less than they're worth. In late 2008 and early 2009, at the height of the credit crisis, the fund took its first positions in several corporate bonds that were favored by Thornburg's equity research analysts and selling at what Browne considered significant discounts.

Once the crisis abated in late 2009 and early 2010, the managers sold them at a profit and slashed the fund's fixed-income position from nearly 10% of assets at the beginning of this year to less than 3% by the end of March. "The opportunity that arose during the credit crisis was unprecedented, and we do not expect to see it again," he observes.

Inexpensive valuations are only one of the flags that go up when these managers look for stocks in this focused portfolio of 40 to 55 names. There are three main components in the fund's broad range of investment strategies.

Basic Value

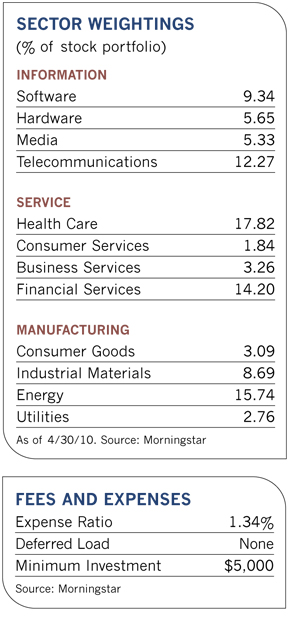

The first component, the basic value strategy, seeks out-of-favor cyclical stocks in established industries that for some reason are trading at a discount to their normal valuations. Many of these holdings are in the financial and energy sectors. They make up anywhere from 30% to 50% of the fund's equity assets and have a current allocation of 45%.

Holdings in the group include Marathon Oil, which is involved in exploration, development and refining. "The market is more interested in pure play exploration companies than those involved in refining," Browne says. "Marathon is selling at a hefty discount due to its refining operations. But that business has enormous latent earning power when oil prices increase."

Another misunderstood stock in the portfolio, Boeing, was selling at an extremely cheap valuation when Browne bought it at the beginning of 2009. At the time, investors were worried that the global economic downturn would put a severe crimp in aircraft demand. Production delays in its 787 aircraft added to concerns. "At this point, the 787 has flown and is scheduled for delivery, and demand for new aircraft is picking up," he says. The long-term nature of many of Boeing's contracts and its substantial backlog of customer orders in both the defense and commercial businesses add to the company's appeal.

The fund also owns financial companies with diversified businesses that help shield them from the impact of economic downturns or interest rate movements. One such company is U.S. Bancorp. As one of the largest financial holding companies in the U.S., it operates in the consumer banking, wholesale banking, payment services and wealth management businesses. Another financial holding, JP Morgan Chase, is a diversified company with operations in banking, wealth management, asset management and credit card operations.

Consistent Earners

Stocks of the second component, consistent earners, have higher valuations than the basic value basket. Browne is willing to pay more for these because they also have strong, consistent revenues attributable to subscription-based models, strong brands or protected patents.

Information technology and health-care companies dominate this group. "Consumer staples are usually considered consistent earners, but we don't have any holdings in that sector," says Browne. "The safety premium has already been factored into those stocks and we're not finding good values."

Comcast, the largest U.S. cable television systems operator and largest Internet provider, falls into this category as well. The company derives most of its current revenue from cable subscription fees, a feature that helps insulate it from economic downturns. "In a tough economy, people would rather keep their cable TV going than buy a $100 pair of jeans. Even if they can't pay other bills, people will still hang on to cable and Internet access," Browne observes.

Like basic value names, consistent earners can also account for 30% to 50% of assets. They currently represent 43.5% of the fund.

Emerging Franchises

The final group, emerging franchises, consists of companies that can dominate a market niche and grow faster than other companies. Though they can make up as much as 25% of the portfolio, they now account for 11% of assets. Varian Medical Systems, a member of this group, is the world's leading maker of devices and software used to treat cancer with radiation.

The basket approach with these three components produces a balanced portfolio that the fund's managers believe will hold its own under a variety of market conditions.

"The consistent earners protect us in tougher markets, while the emerging franchise and basic value groups contribute more to performance during an upturn," says Browne.

The strategy has worked well over the long term, though it fell short in 2008 when the fund plunged 41%, about 5% more than the S&P 500 index. Morningstar analyst William Samuel Rocco says Browne and Maran have succeeded in honing the strategy they learned from former manager Bill Fries, who gave up his co-manager role in late 2009 but continues to run Thornburg International Value. While Rocco gives kudos to the fund's strong long-term returns, distinctive large-blend portfolio and seasoned management, he also warns that "sector and issue concentration cause short-term pain from time to time."