Barclays Plc just upended one of the most common narratives for why hedge funds are struggling to repeat the glory years: they found it's not the number of funds that's causing returns to languish. It's their size. That calls into question a piece of wisdom so well received that even the industry itself has started to repeat it. Barclays polled 340 investors with about $8 trillion in assets under management, and 74 percent of them said the primary reason for meager returns is that the industry itself has become too big. In fact, Barclays found, the malaise is much more likely to be a function of the fact that funds themselves are growing larger, and can't take the nimble gambles that generated high returns in the past.

The issue is likely not the growth in size of the overall HF industry, as there appears to be an ample supply of assets. The issue may be, however, the growth in size of many individual HFs, which are pursuing similar strategies leading to crowding.

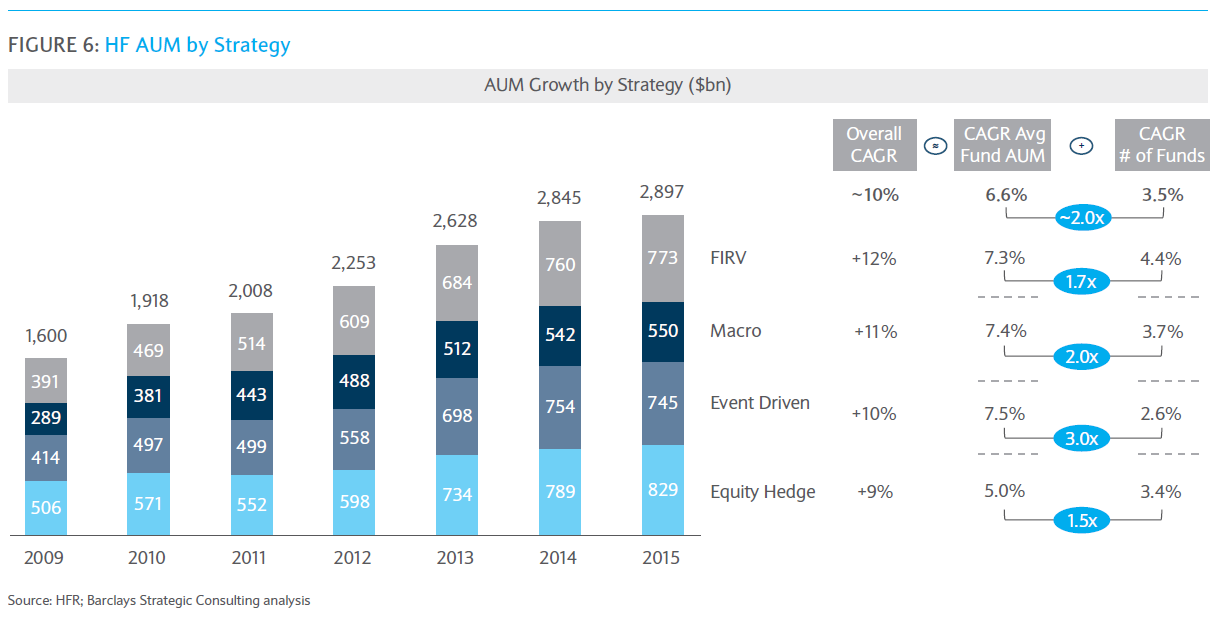

Fund managers were right about one thing: a poor macroeconomic backdrop is exacerbating the picture. "Historically, investing in crowded names has generated positive returns, particularly in stable, rising markets. However, when the reverse happens, it tends to be sharp and painful," Barclays said. Macroeconomic factors were blamed by more than half of the respondents, making that the second-most popular theory for the performance of the industry. Over the last four years hedge funds haven't just lagged earlier successes but even the relevant benchmarks, according to the research.Barclays found ample reason to be suspicious of the size-of-the-industry thesis. While the compound growth rate for hedge-fund assets from 2009 to 2015 was an annual 10 percent, growth within individual funds accounted for two-thirds of that, while new funds made up the remaining portion.

The bank's analysts point out that even with the considerable growth in hedge-fund assets, at $2.9 trillion they still only account for around 1 percent of the total pool worldwide.

The dominant view in the bank's survey echoes the perspective voiced by Oaktree Capital Group LLC’s Howard Marks, who said last month that investor appetite for hedge funds has waned after too many managers started up new vehicles in the past decade. Yet Barclays said there's even an advantage to all these new funds — at least for the funds themselves.

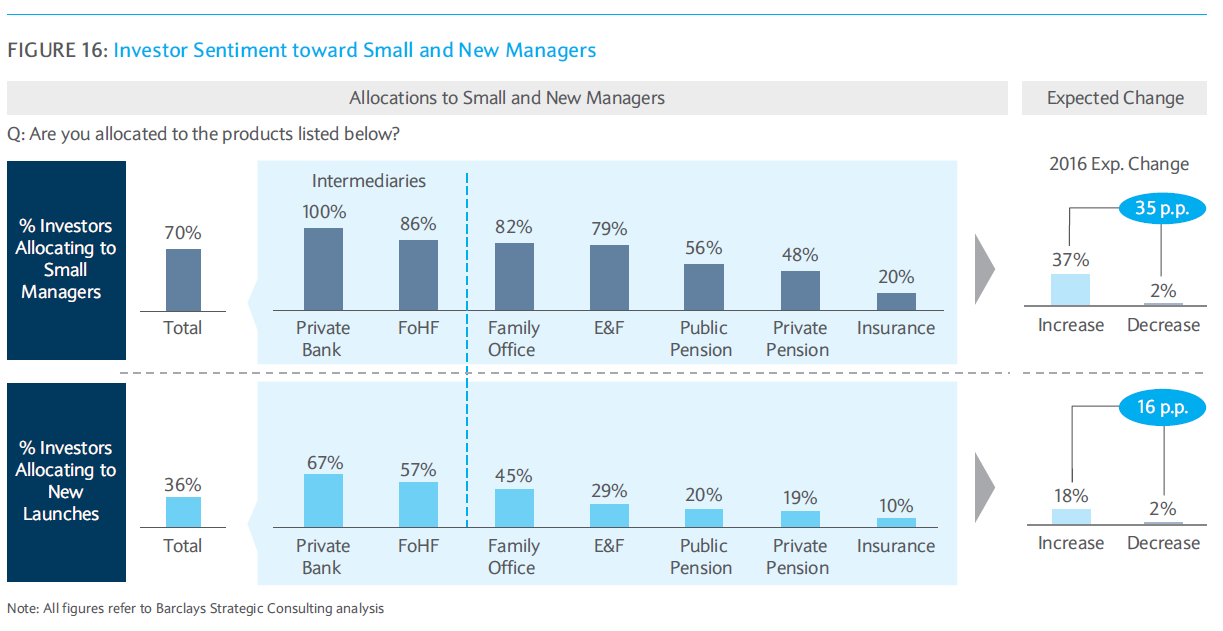

Investors have been increasing their allocations in small and new managers, "in search of better returns and more flexibility on fees and terms", according to Barclays.