As I’ve said many times lately, I do not believe we’re heading for a repeat of 2008–2009.

A number of factors—a stronger U.S. economy, a less leveraged financial system and consumer, and an absence of imbalances like we saw with housing—suggest that we’re not in for a 2008-style collapse. Although the economy may be entering a slowdown, growth is likely to continue.

But, even as the real economy chugs along, risks in the stock market are rising. A bear market—that is, a loss of more than 20 percent from the peak—is becoming increasingly likely. I wrote about bear market risk factors last October, outlining several indicators that have provided warning in the past. Let’s take a look at what those indicators are telling us now.

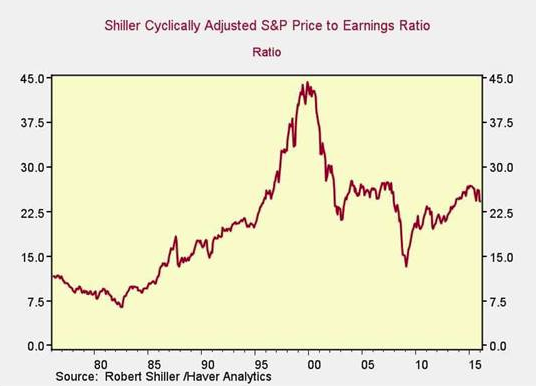

Risk factor #1: Valuation levels

As you can see, valuations are close to the bottom of the range of the past 20 years, which makes them seem reasonable. At the same time, they’re above any of the levels before 1996.

You can draw one of two conflicting conclusions here: that the past 20 years are the best indicator (and valuations are reasonable), or that the past 20 years are an aberration (and valuations are very high). With rates low and stimulus continuing, I think the past 20 years are probably the better indicator. That conclusion, however, is based on recent history and an absence of evidence for a regime change. Call this one neutral, or even slightly positive, for markets.

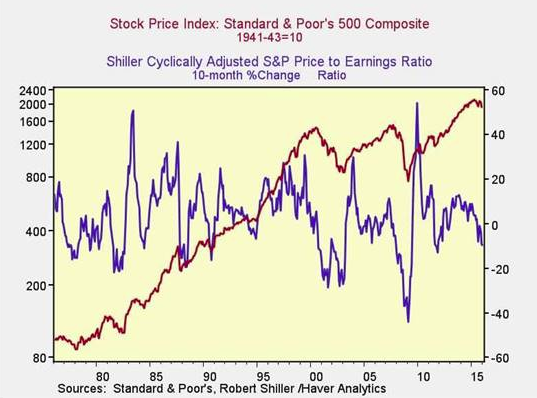

Risk factor #2: Changes in valuation levels

Another way to use this data is to look at changes in valuation levels over time as an indicator of trouble ahead.