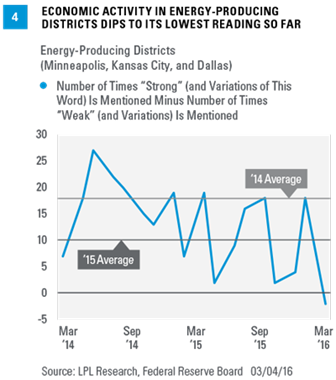

As was the case in the Beige Books released in 2015 and in the January 2016 Beige Book, the March 2016 edition provided many comments from all 12 Fed districts about how lower fuel and energy prices were benefiting multiple industries. In short, comments on the impact of falling oil prices are consistent with our view that falling oil prices may be a net plus for the U.S. economy as a whole, but economies in certain states could see a significant impact from the additional slowdown in drilling activity that is likely to occur over the next six to nine months or so.

Fading Concerns/Rising Concerns

Uncertainty around fiscal policy and the Affordable Care Act has continued to fade as a concern; however, in some cases it has been replaced by

The concerns about a stronger dollar eased substantially in the latest Beige Book, as the value of the U.S. dollar versus the currencies of its major trading partners generally moved lower over the first few months of 2016. There were only 6 mentions of “strong dollar” in the

Although strong dollar concerns over the past 18 months have mainly come from manufacturers, retailers who cater to overseas customers and tourism contacts in areas that traditionally attract overseas tourists (New York, Florida, Nevada, and California) also cited the strong dollar as a drag on business in recent Beige Books. In the March 2016 Beige Book, contacts in the farm sector cited the strong dollar for weaker than anticipated exports of agricultural products.

Of the major transitory factors that impacted the economy and the Beige Book in early 2015 (dollar, oil, port strike, bad weather), only oil and the strong dollar remain as concerns, but there has clearly been some spillover from weaker oil into other parts of the economy. However, neither the dollar nor the other headlines has dampened optimism on the economy, which has picked up strength in the past year or so.

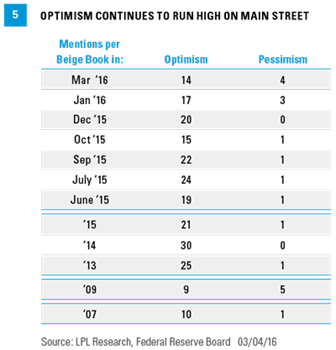

In the March 2016 Beige Book, the word “optimism” (or its related words) appeared 14 times, whereas the word “pessimism” appeared just 4 times [Figure 5]. In the 10 Beige Books released since early 2015, optimism appeared, on average, 22 times per Beige Book, while the word pessimism has appeared a total of just 12 times, with 8 of the 12 mentions coming in the Dallas and Kansas City districts, who were commenting on the outlook for the oil and gas sector.

As reassuring as it is to see that Main Street can remain optimistic despite the flow of bad news, the large number of optimistic comments in the Beige Book is not the start of a new trend: In the 8 Beige Books released in 2014, the word “optimism” appeared, on average, 30 times. In 2013, “optimism” appeared, on average, 25 times per Beige Book. In the 8 Beige Books released in 2009, during some of the worst of the financial crisis and Great Recession, the word “optimism” appeared, on average, just 9 times.

Concerns that today’s economic and market environment is similar to the onset of the Great Recession and the stock market peak in late 2007 also appear to be misplaced. In the 8 Beige Books released in 2007, the word “optimism” appeared, on average, just 10 times per edition — a far cry from the 30 times per edition in the 8 Beige Books released in all of 2014 and the 21 times per edition in 2015.